Get the free Like Kind Exchange Clauses: Contract for Real Property template

Show details

A clause dictates the conditions under which the contract is legally enforceable and determines the terms of the contract. Contracts often contain boilerplate clauses or standard clauses found across

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

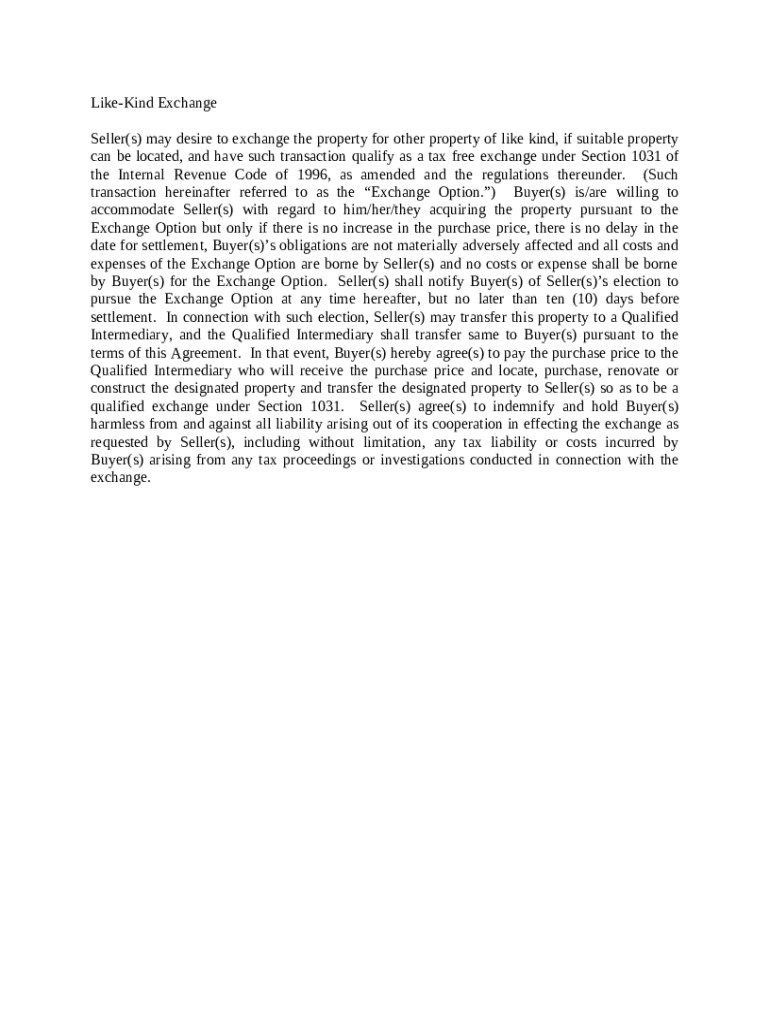

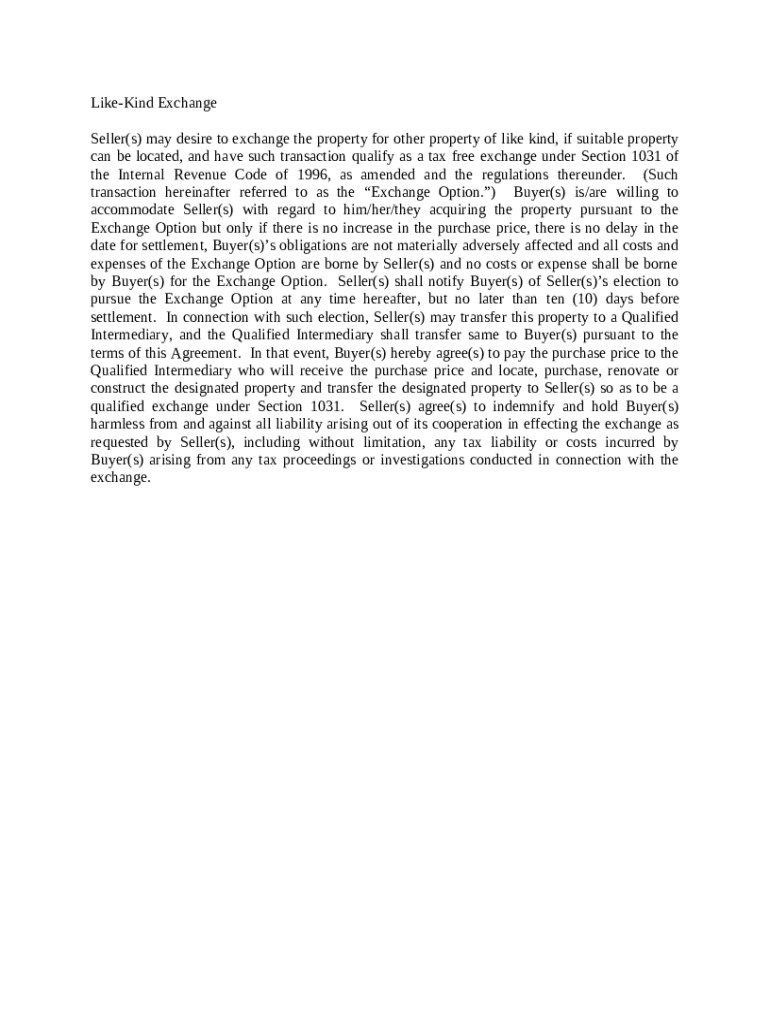

What is like kind exchange clauses

Like kind exchange clauses are provisions in real estate transactions that allow for the deferral of capital gains taxes when exchanging similar properties.

pdfFiller scores top ratings on review platforms

It works really good

was good, worked well... however your price point is higher than what Arobat offers (they have full Docusign built in)

I'm new to PDFFILLER

Great , easy to use design.

Love it Very easy to use and navigate through thank you

great experience!

Who needs like kind exchange clauses?

Explore how professionals across industries use pdfFiller.

Your comprehensive guide to like-kind exchange clauses

How does a like-kind exchange work?

A like-kind exchange allows taxpayers to defer capital gains taxes on the sale of a property by reinvesting the proceeds into a similar property. This is specifically defined under Section 1031 of the Internal Revenue Code, which provides significant tax advantages for investors looking to swap real estate.

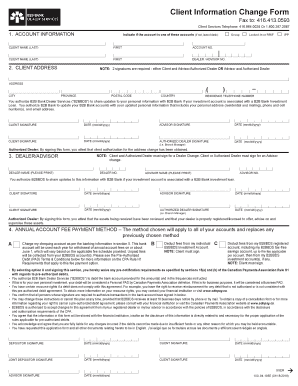

To fill out a like-kind exchange form correctly, ensure you qualify under IRS guidelines, notify involved parties, and engage with a qualified intermediary to facilitate the process. Tools like pdfFiller can further streamline this, helping you manage necessary documents.

What are the eligibility criteria for like-kind exchanges?

-

Only investment or business properties qualify. Personal residences don't meet the criteria under Section 1031.

-

Both parties need to be identified as investors, rather than individuals conducting a primary residence sale.

-

Certain properties and transactions, like stocks or bonds, are excluded from this exchange.

What steps should be taken to initiate a like-kind exchange?

-

This involves informing sellers of your intention to engage in a like-kind exchange, enabling a smooth transition.

-

This third-party entity will hold the funds during the exchange process, ensuring compliance with IRS rules.

-

Track all important dates for identifying and closing on replacement properties within 180 days.

What responsibilities do buyers and sellers have?

-

Buyers must ensure that transactions align with IRS guidelines, managing documentation and timelines appropriately.

-

Sellers should provide accurate valuations and comply with due diligence requirements to ensure smooth exchanges.

-

These clauses protect both parties against potential misunderstandings and liabilities during the transaction.

What are the potential risks and liabilities?

-

Preparing for the potential tax liabilities that could arise if the exchange does not comply with IRS regulations is crucial.

-

Buyers can face risks such as losing their investment if the seller fails to uphold their end of the agreement.

-

Transactions may be subject to scrutiny by tax authorities, necessitating thorough documentation throughout the exchange process.

How can interactive tools aid in managing like-kind exchanges?

Platforms like pdfFiller empower users to efficiently edit and manage like-kind exchange documents. They offer eSigning capabilities and collaboration features that facilitate smooth communication among parties involved.

As you track the status of your exchange, these tools simplify complex processes, helping you maintain an organized approach while complying with Section 1031 requirements.

Where can you find related resources and further reading?

-

Explore a variety of guides that provide deeper insights into managing real estate transactions.

-

Find essential forms and templates specifically tailored for like-kind exchanges for efficient documentation.

-

Dive into comprehensive content that clarifies the complexities surrounding real estate exchanges.

How to fill out the like kind exchange clauses

-

1.Access your document on pdfFiller by logging into your account.

-

2.Locate the 'Like Kind Exchange Clauses' template or upload your own document.

-

3.Review the introductory information to understand the purpose of the clauses.

-

4.Fill in the names and contact information of the parties involved in the exchange.

-

5.Describe the properties being exchanged, including addresses and current market values.

-

6.Indicate the investment timelines for the like kind exchange.

-

7.Specify any additional terms or agreements pertinent to the exchange.

-

8.Preview the document for accuracy and completeness before submission.

-

9.Save the changes and download the document or share it directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.