Last updated on Feb 17, 2026

Get the free Investor Suitability Questionnaire template

Show details

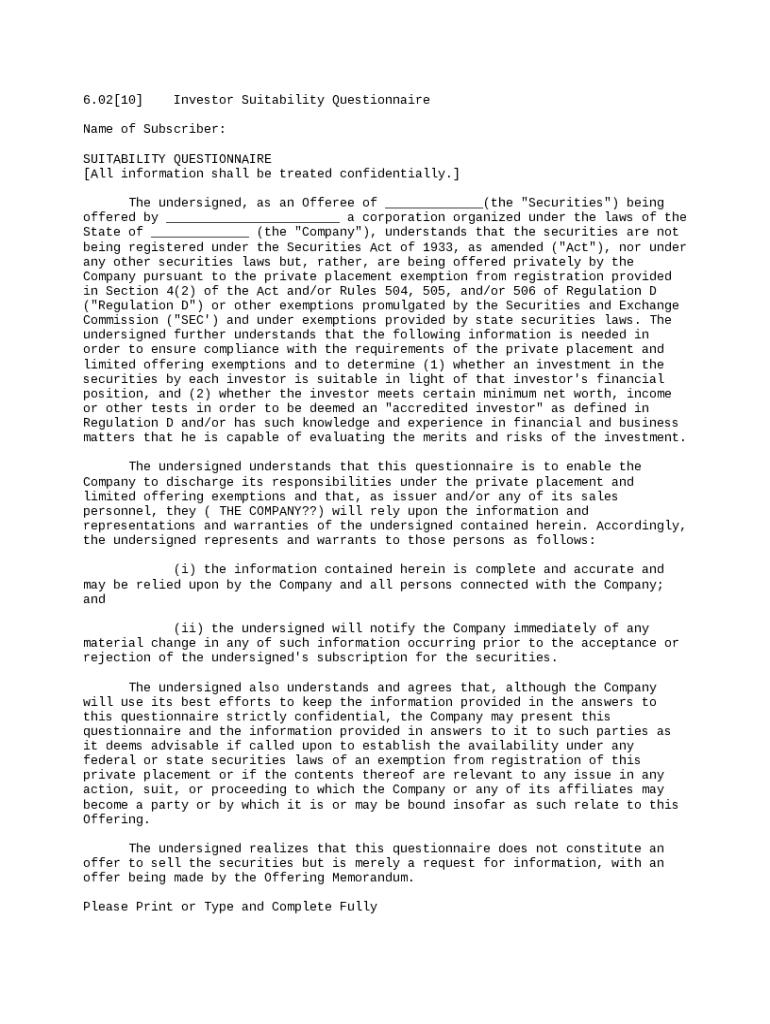

This due diligence questionnaire is to enable a company to discharge its responsibilities under the private placement and limited offering exemptions and that, as issuer and/or any of its sales personnel,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is investor suitability questionnaire

An investor suitability questionnaire is a tool used to assess an individual's financial situation, investment goals, and risk tolerance to determine suitable investment options.

pdfFiller scores top ratings on review platforms

It's so easy

it has been amazing

OK

great

pdfFiller Has Never Disappointed Me - They are My Trusted Admin Source

pdfFiller has never disappointed me with the choice of fillable forms and the ease of completing and saving the documents. For Form document completion, they are my Trusted Administrative Assistant, and I would not recommend any other company for the service they provide.

Great Site

Great Site Easy to Use and Print and Save.

Who needs investor suitability questionnaire template?

Explore how professionals across industries use pdfFiller.

Investor Suitability Questionnaire Form Guide

How to fill out an investor suitability questionnaire form

Filling out an investor suitability questionnaire form is essential for investors seeking private placement opportunities. To complete the form, gather your personal information, reflect on your financial status, and understand your investment knowledge. With guidance, you can navigate each section effectively to ensure compliance and suitability.

Understanding the investor suitability questionnaire

An investor suitability questionnaire is designed to evaluate an investor’s financial status and investment experience, ensuring they are fit to participate in specific investment opportunities. This assessment is crucial in private placements where the risk and complexity of investments vary significantly. Additionally, the confidentiality and security of the information provided are paramount, safeguarding both the investor and the issuer’s interests.

-

The questionnaire aims to assess an investor's capability and suitability for specific investments.

-

These assessments help protect both investors and issuers by ensuring compliance with legal standards.

-

Information disclosed in the questionnaire is treated with the highest level of confidentiality.

What information is included in Section A?

Section A of the investor suitability questionnaire focuses on the client's personal and contact details. Accurately identifying as a client has significant implications for both the investor and issuer, as it establishes the relationship and necessary disclosures.

-

Detailed identification information is required to ensure compliance and facilitate communication.

-

Correctly identifying the client helps the issuer tailor investment opportunities to suit their needs.

-

Investors must provide accurate details to comply with regulations and assessments.

What does Section B cover for high net worth investors?

Section B addresses high net worth investors specifically. It defines the criteria that categorize someone as a high net worth investor, requiring detailed financial disclosures to qualify for exclusive investment opportunities, which typically come with higher risks.

-

An individual must meet specific financial thresholds, often over $1 million in assets.

-

Documentation is needed to substantiate claims of high net worth status.

-

High net worth status typically leads to access to exclusive investment products.

What is the Certified Sophisticated Investor Statement?

The Certified Sophisticated Investor Statement is another key component in the questionnaire designed for investors who possess a certain level of knowledge and experience in complex financial products. Those who are certified carry significant advantages when considering investment opportunities.

-

A sophisticated investor has the experience and understanding to evaluate investment risks.

-

Certification influences the type of investments available and suitability assessments.

-

Investors must provide proof of sophistication, which may include evidence of prior investments.

Understanding the Self-Certified Sophisticated Investor Statement

Self-certification allows an investor to declare their sophistication independently. While empowering, it also carries legal implications, requiring the investor to assess their own knowledge and experience effectively.

-

Investors must understand that misrepresentation can lead to serious consequences.

-

The investor must self-assess their knowledge in complex investments.

-

Self-certified investors may face more scrutiny than those who are certified.

Why are declarations important in Section E?

In Section E, declarations are critical as they mark the investor's acknowledgement of accurate information. Misrepresentation can lead to severe legal and financial repercussions, emphasizing the importance of integrity in the suitability process.

-

Declarations confirm that the information provided is accurate and truthful.

-

False declarations can result in legal action or loss of investment.

-

Both parties share responsibility for compliance with regulations.

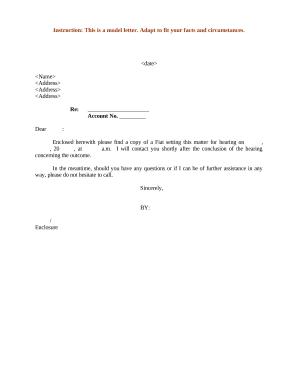

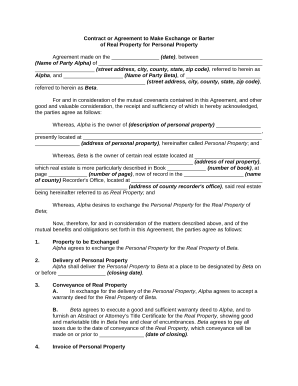

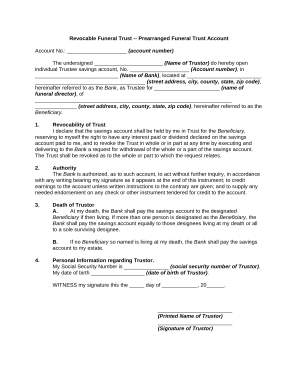

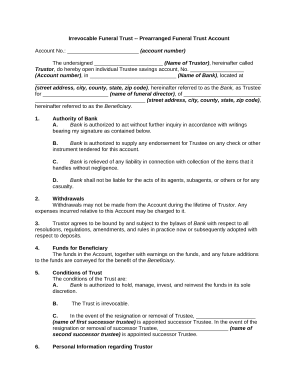

How to fill out the questionnaire through pdfFiller

Using pdfFiller to fill out the investor suitability questionnaire offers a streamlined process. The platform's user-friendly features allow easy editing, signing, and sharing of documents, ensuring compliance with security standards.

-

Users can follow interactive prompts within pdfFiller to complete the questionnaire seamlessly.

-

Automated tools are available for efficient document management.

-

pdfFiller ensures that all data is handled with high-level encryption.

What additional considerations should investors be aware of?

Investors must maintain a comprehensive understanding of their financial knowledge and evaluate investments carefully. It can be beneficial to seek out resources for further education on private placements to make well-informed decisions.

-

A well-rounded understanding of finances leads to better investment choices.

-

Investors must regularly assess potential risks associated with investment opportunities.

-

Investors can benefit from blogs, workshops, and seminars focused on suitability and investments.

Conclusion

In summary, the investor suitability questionnaire form is a vital tool for assessing an investor's profile and financial standing. By carefully completing each section and utilizing a platform like pdfFiller, individuals and teams can ensure they are making informed investment decisions tailored to their level of knowledge and financial capability.

How to fill out the investor suitability questionnaire template

-

1.Access the investor suitability questionnaire on pdfFiller.

-

2.Review the introductory section to understand the purpose of the questionnaire.

-

3.Begin by filling in your personal information, including name, contact details, and age.

-

4.Answer questions regarding your investment goals, such as growth, income, or preservation of capital.

-

5.Provide details about your financial situation, including annual income, net worth, and existing investments.

-

6.Evaluate your risk tolerance by selecting options that describe your comfort level with market fluctuations.

-

7.Complete any additional sections or questions as prompted by the form.

-

8.Review your answers for accuracy and completeness before submission.

-

9.Submit the completed questionnaire through pdfFiller, ensuring you follow any provided submission guidelines.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.