Get the free Five Percent Shareholder Checklist template

Show details

This form is a due diligence checklist that outlines information pertinent to five percent shareholders in a business transaction.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is five percent shareholder checklist

The five percent shareholder checklist is a document used to determine certain disclosures and compliance obligations for individuals or entities owning five percent or more of a company's outstanding shares.

pdfFiller scores top ratings on review platforms

Super easy to use and very convenient. I would highly recommend to anyone.

Terrific so far! Looking forward to utilizing more options! Thanks!

I worked with Elie tonight and your support is amazing. She was friendly, patient and knowledgeable. She was able me to better understand the PDFfiller and was able to accomplish what I wanted. Very Pleased with your service and product.

At first it was hard to get into, but i managed. I like it.

I LOVE IT IS VERY EASE FOR ME TO USE AND FAST.

This is the first time that I have used it. It has done what I needed and I will use it more often as time moves on

Who needs five percent shareholder checklist?

Explore how professionals across industries use pdfFiller.

Five Percent Shareholder Checklist Form Guide

TL;DR: How to fill out a five percent shareholder checklist form

To fill out a five percent shareholder checklist form, you will need to gather relevant ownership details, complete the form methodically, and ensure compliance with necessary legal requirements. Become familiar with the SEC regulations, and utilize tools like pdfFiller for easy document management.

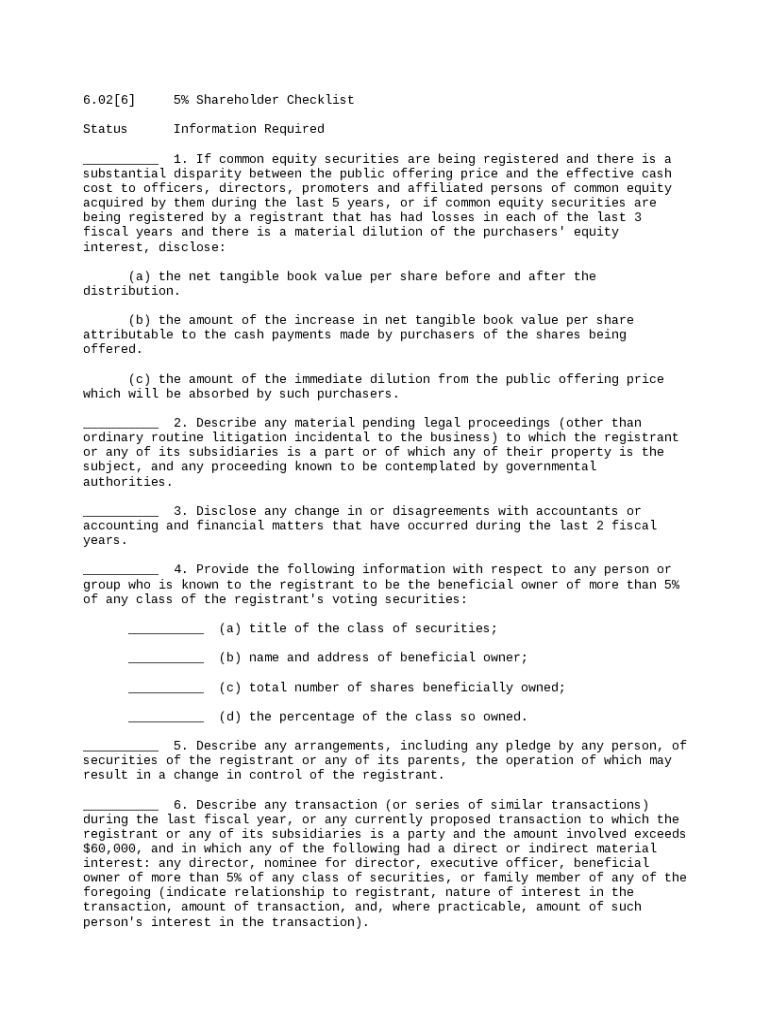

What is the five percent shareholder checklist?

The Five Percent Shareholder Checklist is a crucial document designed to help shareholders understand their obligations when they own five percent or more of a company's securities. This checklist is vital for maintaining compliance with SEC regulations, ensuring that shareholders are informed about their rights and responsibilities.

-

Failing to adhere to SEC guidelines could result in fines or legal ramifications.

-

Owning five percent of a company typically confers specific rights that must be understood clearly.

What are the key components of the checklist?

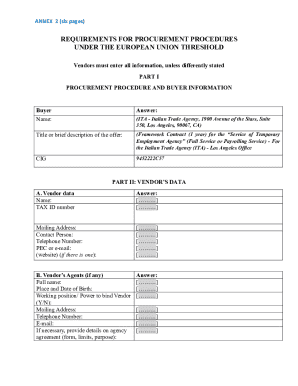

Understanding the components of the checklist is essential to ensuring that all necessary information is accurately reported. Key areas include ownership details, financial disclosures, and potential legal proceedings.

-

Identifying types of securities that need to be reported, such as stocks and bonds.

-

Detailing financial impacts and ownership information critical for accurate reporting.

-

Managing impending legal matters that may affect shareholder status.

How do complete the five percent shareholder checklist?

Completing the checklist requires careful attention to detail and an understanding of the documentation needed. Here are steps to complete the form effectively.

-

Follow each step sequentially, ensuring all information is accurate and complete.

-

Gather necessary documents, such as ownership records and financial statements, before starting.

-

Watch out for incomplete information or misunderstandings of disclosure requirements.

What are best practices for managing your shareholder documents?

Effective document management is key to maintaining compliance and organization. Utilizing platforms like pdfFiller can streamline this process.

-

Use pdfFiller for easy editing and signing of required forms.

-

Share documents efficiently with team members for feedback and approvals.

-

Securely store and organize documents in the cloud for easy access and compliance.

What are the financial aspects of shareholding?

Understanding the financial implications of being a five percent shareholder is necessary for an informed investment strategy. Certain key financial concepts can greatly impact shareholder value.

-

This figure represents the company's value after accounting for liabilities, an important aspect for shareholders.

-

Understanding how any cash flow affects your ownership and valuation.

-

Be aware of how new share purchases can impact ownership percentages and value.

What legal considerations should shareholders keep in mind?

Legal considerations are critical for shareholders, especially regarding disclosures and partnerships. Understanding these regulations can mitigate legal risks.

-

Knowing potential legal challenges and how they could impact shareholding is essential.

-

It is crucial to disclose any disputes regarding financial records to avoid regulatory scrutiny.

-

Understanding how pledging shares can affect ownership and control dynamics.

How to navigate ownership disclosure requirements?

Transparency in shareholder recordings ensures compliance and trust. Identifying beneficial owners is key to this process.

-

Understanding who the beneficial owners are and their specific rights.

-

Include class of securities, shareholder names, and equity percentages for full compliance.

-

Maintaining clear and accurate records establishes trust among shareholders and mitigates risks.

How to fill out the five percent shareholder checklist

-

1.Access the five percent shareholder checklist template on pdfFiller.

-

2.Begin by entering the name of the shareholder and the date of completion at the top of the document.

-

3.Fill in the company name and a brief description of its business activities.

-

4.Indicate the total number of shares outstanding and the number of shares owned by the shareholder.

-

5.Calculate the percentage of ownership by dividing shares owned by total shares and multiplying by 100.

-

6.Review the checklist items, ensuring all applicable sections are completed accurately.

-

7.Provide any additional required disclosures relating to shareholder activities or transactions.

-

8.Once all fields are filled, review the document for errors or omissions.

-

9.Save your changes, and submit or print the completed checklist as necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.