Get the free Accredited Investor Veri?cation Letter - Individual Investor template

Show details

Under SEC law, a company that offers its own securities must register these investments with the SEC before it can sell them unless it meets an exception. One of those exceptions is selling unregistered

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accredited investor verication letter

An accredited investor verification letter is a document that confirms an individual's or entity's status as an accredited investor as defined by securities regulations.

pdfFiller scores top ratings on review platforms

Super service

Super service. Thank you!

Wonderful Application

Got the job exactly how I wanted it do be done.

Takes a little getting used to and is…

Takes a little getting used to and is easier to use on a laptop than on an android. Otherwise great features.

its usefull

It is useful, quick, and easy to use. It does its purpose.

much better than most online editors

much better than most online editors. Thanks

Excellent program

Excellent program, with different features all of them very helpful for the people in the industry of Billing.

Who needs accredited investor verication letter?

Explore how professionals across industries use pdfFiller.

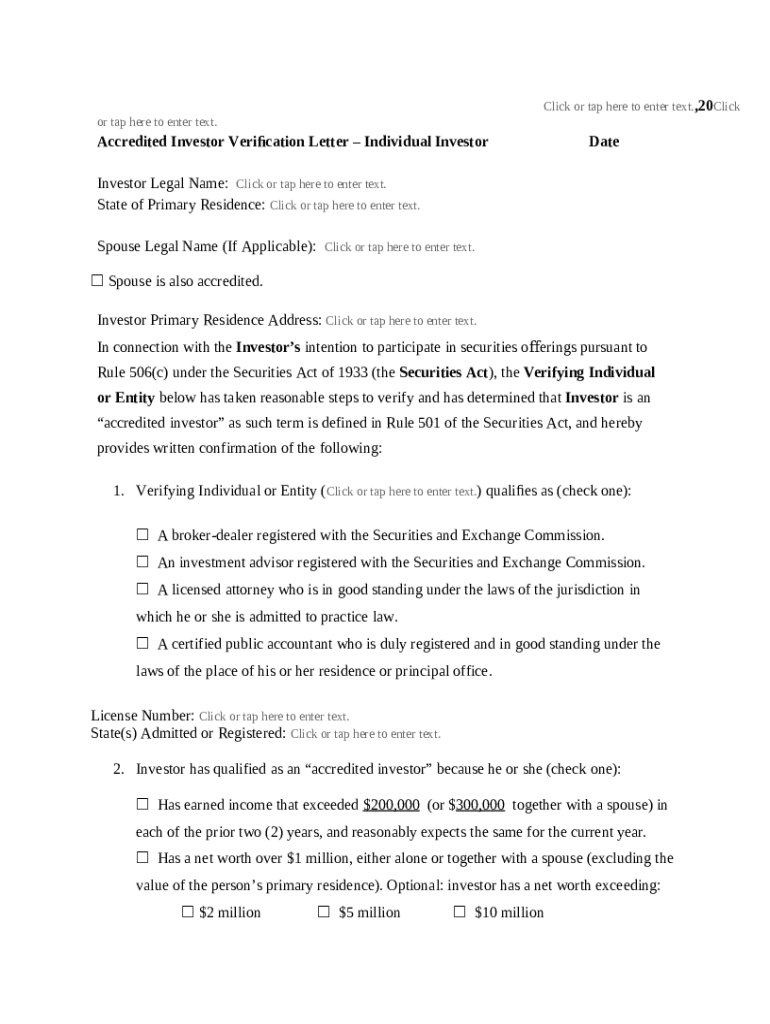

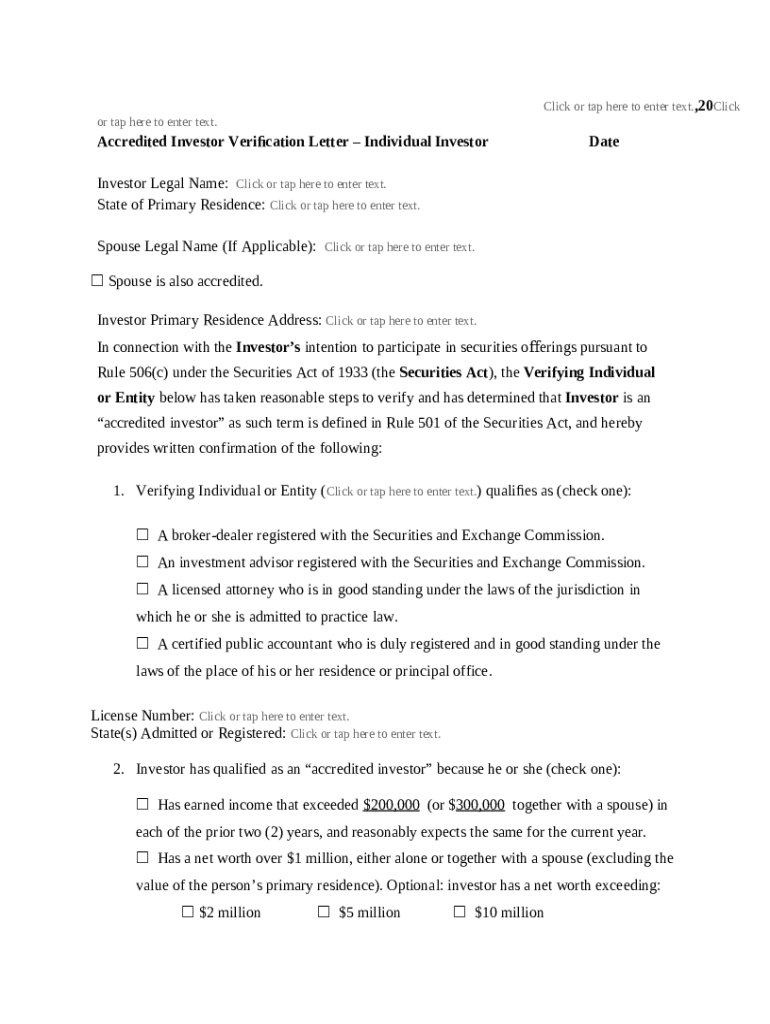

How to fill out an accredited investor verification letter form

Filling out an accredited investor verification letter form is essential for individuals seeking participation in exclusive investment opportunities. This form is a critical document that confirms the accredited status of an investor based on specific criteria set by the Securities and Exchange Commission (SEC). Understanding how to properly complete this form will streamline your investment process.

What defines an accredited investor?

An accredited investor is defined by the SEC as an individual or entity that meets certain financial thresholds, allowing them access to a wider range of investment opportunities. This definition plays a crucial role in ensuring that investors can handle the risks associated with more complex financial products.

-

Individuals must have an annual income exceeding $200,000 or $300,000 together with a spouse for the last two years, with an expectation of the same in the current year.

-

An accredited investor's net worth must exceed $1 million, excluding the value of their primary residence.

-

Entities, like banks or investment firms, can also qualify if they have total assets exceeding $5 million or specific professional qualifications.

What is an accredited investor verification letter?

An accredited investor verification letter serves as a formal document confirming an individual's accredited status. It plays a pivotal role in providing potential investors with the necessary proof to participate in investment opportunities that require accredited status.

-

The letter primarily aims to protect both the investors and the offering companies by verifying the investor's ability to participate in more complex financial offerings.

-

Essential parts of the letter include details about the investor's accredited status, the issuing entity's qualifications, and any relevant financial information.

-

Terms such as 'qualified purchaser' and 'verification provider' may be included; understanding these terms is critical for effective communication.

How do obtain an accredited investor verification letter?

Obtaining an accredited investor verification letter involves identifying a qualified party and preparing necessary documentation. Each step must be executed carefully to comply with SEC regulations.

-

This could be a broker-dealer, lawyer, or accountant who can verify your accredited status.

-

Prepare financial documents such as tax returns, bank statements, and proof of assets to support your application.

-

Once your documents are ready, formally request the verification letter from your chosen professional.

-

Ensure that all provided information is accurate to mitigate any potential compliance issues with SEC regulations.

How do fill out the accredited investor verification letter form?

Filling out the accredited investor verification letter form accurately is crucial for a successful submission. It's essential to understand the details required in each section.

-

You can typically find the accredited investor verification letter form on various financial service websites, including pdfFiller.

-

Interactive elements on pdfFiller assist users in filling out forms accurately and easily.

-

Avoid filling out information incorrectly, such as personal details or financial thresholds.

-

Focus on critical sections like the investor's legal name, state of residence, spouse's information, and confirmation of status.

What should do after submitting my letter?

Once submitted, your accredited investor verification letter will undergo review by the relevant parties. Understanding this process can help you prepare for potential follow-ups.

-

Know where to submit your verification letter, whether directly to the investment firm or through a broker.

-

Be aware that there may be a waiting period for the review and approval of your letter.

-

It's advisable to remain proactive by following up on your submission to ensure that everything is progressing smoothly.

How does my accredited investor letter influence my investment opportunities?

Holding an accredited investor letter significantly expands your investment options. This status qualifies you for exclusive investment opportunities that may be unavailable to non-accredited investors.

-

Being accredited opens doors to privately offered funds, real estate deals, and startups seeking affluent investors.

-

Failure to achieve accreditation can limit your access to potentially lucrative investment opportunities.

What compliance considerations should keep in mind?

Compliance considerations are crucial for maintaining accredited investor status. Understanding SEC guidelines will benefit your investment journey.

-

Stay updated with SEC regulations surrounding accredited investors to ensure compliance.

-

Regularly check financial thresholds and ensure accurate documentation to maintain your accredited status.

-

Avoid misrepresentation of your financial status, which can have repercussions on your investment credibility.

What quick tips can follow as an investor?

Successful management of your accredited investor status involves several quick strategies. Leveraging tools like pdfFiller can enhance your documentation process.

-

Consider regular audits of your financial status to ensure compliance with accredited investor definitions.

-

pdfFiller can help manage all your investment-related documents seamlessly, allowing for easy editing and signing.

-

Explore resources to learn more about accredited investing and remaining compliant.

How to fill out the accredited investor verication letter

-

1.Access the pdfFiller platform and log in to your account.

-

2.Locate the accredited investor verification letter template by using the search bar.

-

3.Once you find the template, click on it to open in the editor.

-

4.Begin filling in your personal information, including your full name, address, and contact details.

-

5.Provide relevant financial information to demonstrate your accredited status, such as your income or net worth.

-

6.If applicable, include information about any entities for which you're acting as an accredited investor.

-

7.Carefully review the filled-out information for accuracy and completeness.

-

8.After verifying all details, proceed to sign the document electronically, ensuring your signature is valid and visible.

-

9.Finally, save the completed letter and download or share it as needed through the platform options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.