Get the free Qualified Investor Certification and Waiver of Claims template

Show details

Under SEC law, a company that offers its own securities must register these investments with the SEC before it can sell them unless it meets an exception. One of those exceptions is selling unregistered

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is qualified investor certification and

Qualified investor certification is a document that verifies an individual's eligibility to invest in certain financial products, typically requiring proof of financial sophistication or wealth.

pdfFiller scores top ratings on review platforms

too many download in converting documents to word Microsoft Program

I use the web software and the app. I love how it is seamless.

Easy to use once I learned the system. I would recommend to anyone.

So far it works great and has been a real time saver!!

I was disappointed with the services I purchased, but PDF filler made it right and refunded my money. I appreciate how attentive they were to my needs and what I was looking for.

I need a way to name the form entrys for the patient they apply to

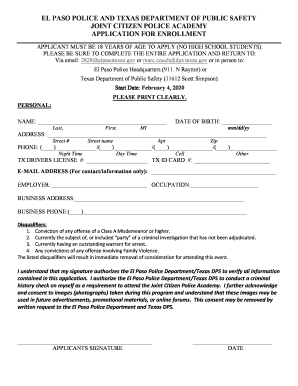

Who needs qualified investor certification and?

Explore how professionals across industries use pdfFiller.

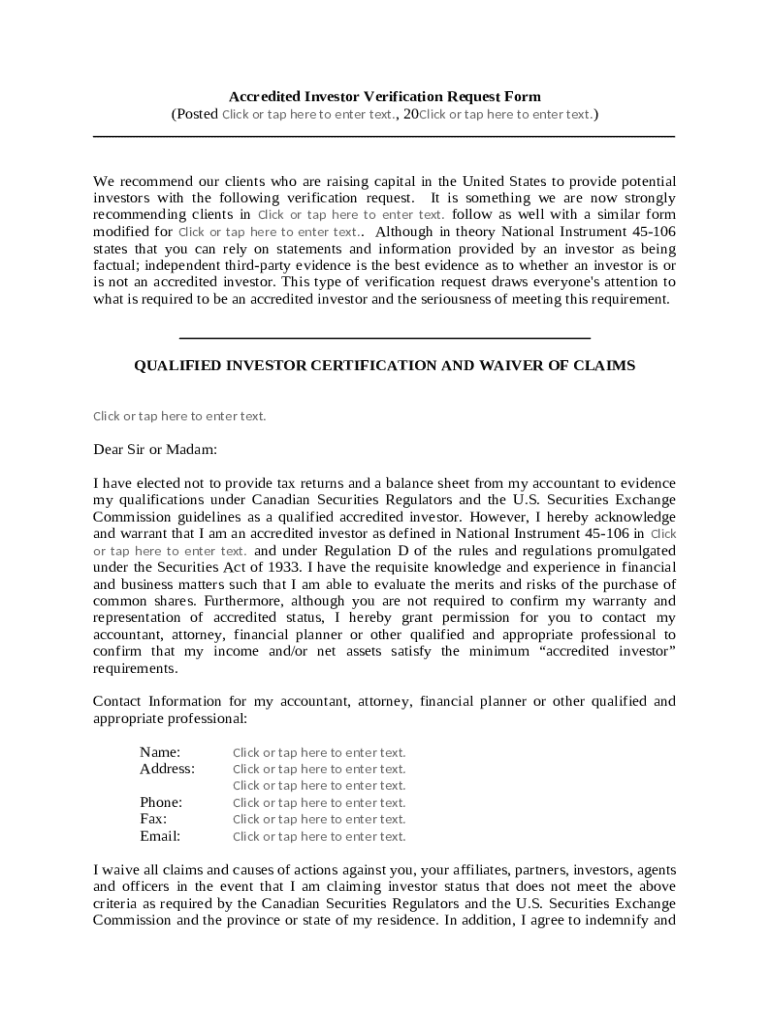

Comprehensive Guide to Qualified Investor Certification and Form-Filling on pdfFiller

What is qualified investor certification?

Qualified investor certification is crucial for individuals looking to access certain investment opportunities that are not available to the general public. It serves as a verification process to ensure that investors meet specific financial criteria set by regulatory authorities. Understanding this certification is the first step in navigating complex investment terrains.

-

It refers to the status bestowed on investors who meet income or net worth thresholds dictated by regulatory bodies.

-

This status allows individuals to invest in high-risk ventures that potentially offer higher returns compared to traditional investment options.

-

While both certifications allow access to exclusive investments, qualified investor status focuses on a different set of criteria that may vary by region and investment opportunities.

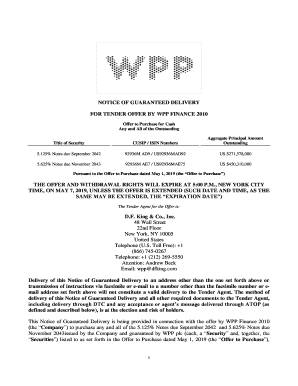

How does the accredited investor verification process work?

The accredited investor verification process requires multiple steps to confirm one's financial standing and experience. It’s essential to follow a clear procedure to ensure the smooth processing of your application.

-

Begin by gathering necessary documentation that reflects your financial situation, then complete the verification request.

-

Typical documents include tax returns, bank statements, and proof of professional licenses or certifications.

-

Investors must understand that the verification process may differ, taking into account the regulatory framework within their respective countries.

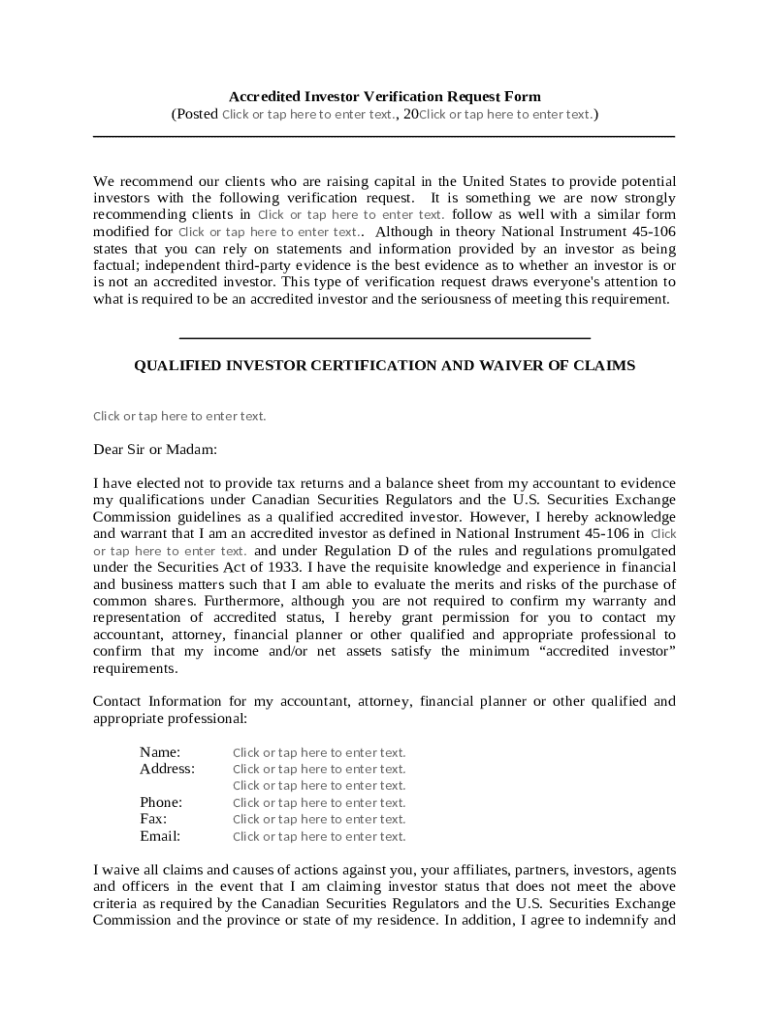

What are the components of the accredited investor verification request form?

Filling out the accredited investor verification request form accurately is critical to avoid delays. Familiarity with the key sections of the form can simplify this task.

-

Essential parts include personal identification information, financial background, and investment objectives.

-

Investors should provide precise details regarding their finances, which attests to their eligibility.

-

These elements are critical as they indicate consent for the use of submitted financial data and authorization for third-party verification.

What are the regulatory requirements for compliance?

Understanding compliance with regulatory requirements is fundamental in the certification process. Investors need to familiarize themselves with national instruments and SEC guidelines.

-

These are regulations that establish what constitutes a qualified investor across varying jurisdictions.

-

The SEC provides clear guidelines on the requirements and processes to become accredited in the United States.

-

Canadian investors must pay attention to local regulations that govern investment practices and qualified investor status.

How to evaluate your qualifications as an accredited investor?

Evaluating your qualifications is an important step in the investment verification journey. This involves a thorough understanding of your financial knowledge and risk management capabilities.

-

Investors should self-reflect on their financial literacy to gauge whether they can navigate complex investment scenarios.

-

It’s vital to consider the potential risks involved with different investment opportunities and how they align with your financial goals.

-

Investors should carefully complete their self-declaration to provide accurate representations of their financial status.

How can pdfFiller assist with the verification process?

Using pdfFiller simplifies the cumbersome process of filling out and submitting the required forms, providing interactive tools for a seamless experience.

-

pdfFiller walks users through each step, ensuring all necessary fields are completed correctly.

-

The platform offers various editing and signing tools that facilitate modifications without hassle.

-

Users can easily organize and retrieve their documents within the cloud-based system, ensuring convenient access wherever they are.

What common mistakes should be avoided during the certification process?

Understanding and avoiding common pitfalls can save time and frustration in the investor certification process. Awareness of these mistakes enhances overall efficiency.

-

Failing to submit all the required documents can lead to delays or rejection of the verification request.

-

Mistakes or inaccuracies in your declaration can jeopardize your application, so double-check for accuracy.

-

Misunderstanding this can result in unnecessary hurdles, as third-party support is often necessary for a successful validation.

What are the next steps after certification?

Once you have confirmed your qualified investor status, several important steps lie ahead. Understanding these can enrich your investment opportunities.

-

Begin exploring investment offerings that cater to accredited investors and align with your objectives.

-

Leverage your status to gain access to exclusive funds and investment platforms tailored to higher-net-worth individuals.

-

Continuously monitor regulatory updates that could affect your investment strategies and status.

How to fill out the qualified investor certification and

-

1.Access pdfFiller and upload the qualified investor certification form.

-

2.Begin filling out the personal information section, including your full name, address, and contact details.

-

3.Provide details regarding your financial status, including annual income and net worth, ensuring accuracy and honesty.

-

4.If applicable, include any relevant investment experience or qualifications that support your status as a qualified investor.

-

5.Review all entered information for errors, as accuracy is crucial.

-

6.Once satisfied, proceed to the signature section and sign the document electronically.

-

7.Submit the completed form through pdfFiller, choosing your preferred submission method, whether by email or direct download.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.