Get the free Tax Indemnity Agreement template

Show details

This is a sample Tax Indemnity Agreement. Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party)

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

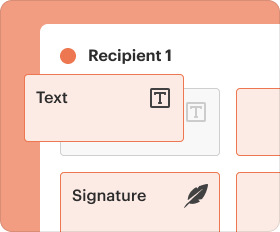

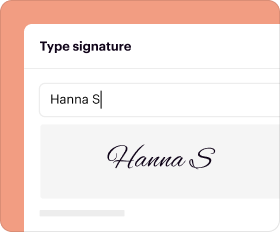

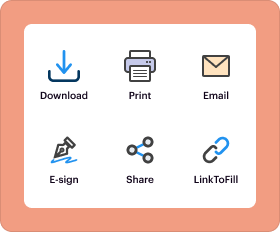

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is tax indemnity agreement

A tax indemnity agreement is a legal contract that protects one party from financial loss due to tax liabilities incurred by another party.

pdfFiller scores top ratings on review platforms

Works perfectly.

I like this app and after looking at several similar app. I choose this one. Its so powerful and helped me to do my task with out too much effort.

Currently at this moment _PDF is great…

Currently at this moment _PDF is great tool for exporting documents to another located place .Secondly the tool have significant tool in helping an individual from undertaking there work my using watermark validation.

THIS IS SUCH AN EXCELLENT PRODUCT

THIS IS SUCH AN EXCELLENT PRODUCT, AND SO EASY TO USE. I AM GLAD THAT I FOUND IT!!!

love it

love it , very convenniet

makes a lotta stuff easier.

Everything is easy to use and is saved automatically.

Who needs tax indemnity agreement template?

Explore how professionals across industries use pdfFiller.

Tax Indemnity Agreement Guide

How do tax indemnity agreements work?

A tax indemnity agreement form is a crucial document that defines the responsibilities related to tax liabilities between parties in a transaction. It is integral in business transactions where one party may be exposed to tax liabilities due to the actions or omissions of another party. Understanding the significance of this agreement ensures that businesses manage risks associated with unforeseen tax claims.

-

This is a legal document whereby one party agrees to compensate another for losses incurred due to tax obligations.

-

It protects involved parties from potential tax-related liabilities arising post-transaction.

-

Typically includes indemnity clauses, governing laws, and definitions of 'tax liabilities' or 'claims'.

When should you utilize a tax indemnity agreement?

Tax indemnity agreements are vital when specific situations may expose parties to significant tax risks. Engaging a tax indemnity agreement can be a proactive measure to safeguard against financial losses that could occur from tax liabilities.

-

These include mergers, acquisitions, or transactions involving complex tax structures.

-

Parties may face unanticipated tax liabilities that could impact their financial stability.

-

It's essential to comply with tax regulations to avoid legal complications and penalties.

What is the legal framework of tax indemnity agreements?

Tax indemnity agreements are governed by various laws depending on the jurisdiction. Understanding the legal framework is critical to ensure enforceability and compliance during transactions. In [region], specific regulations may apply, significantly influencing the contractual obligations outlined in such agreements.

-

Local, state, or federal laws serve as frameworks guiding tax indemnity agreements' execution and validity.

-

The region's laws may determine the terms or effectiveness of the indemnity agreement.

-

These may include warranties on tax liabilities or limitations on liability under the agreement.

How can you complete a tax indemnity agreement?

Filling out a tax indemnity agreement form involves careful consideration of the information included and the legal implications. Gathering all necessary details upfront can streamline the process and help avoid common pitfalls that could invalidate the agreement.

-

Parties involved, definition of indemnified tax liabilities, and governing law selections must be clearly stated.

-

Be precise, clearly define terms, and consult legal counsel if necessary.

-

Avoid vague language, ensure all parties review the agreement, and confirm the accuracy of details.

Where can you find a tax indemnity agreement template?

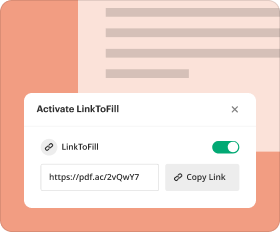

Utilizing a tax indemnity agreement template can simplify the agreement creation process. Many templates provide structured formats helping users customize their forms to meet their needs effectively. pdfFiller offers a convenient downloadable template for users.

-

Get a detailed look at the structure and necessary sections of a valid agreement.

-

Understanding each part’s purpose helps ensure you comply with legal standards.

-

Access a customizable template via pdfFiller for easy editing and eSigning.

How to manage tax indemnity agreements effectively?

Staying organized is critical when managing tax indemnity agreements. pdfFiller provides interactive tools designed to simplify document management, enabling users to edit, eSign, and collaborate on agreements.

-

It offers an all-in-one platform for document management, making it easier to update agreements.

-

Users can collaborate in real-time, ensuring all parties are aligned and all changes are documented.

-

Access your documents anytime and anywhere, ensuring flexibility and security.

When should you consult a legal professional?

It's advisable to consult with a legal professional when finalizing a tax indemnity agreement, especially in complex scenarios. pdfFiller can facilitate connections with legal experts who specialize in tax law, helping ensure your agreements are comprehensive and enforceable.

-

Consider consulting a lawyer when drafting or reviewing the agreement to clarify complex clauses.

-

pdfFiller can help connect users with relevant legal professionals specializing in tax indemnity agreements.

-

Understand potential costs and what services to expect when consulting legal professionals.

How to fill out the tax indemnity agreement template

-

1.Open pdfFiller and upload the tax indemnity agreement template.

-

2.Begin by filling in the date at the top of the agreement.

-

3.Identify the parties involved; enter their full names and contact details in the designated fields.

-

4.Clearly specify the scope of the agreement by outlining the specific tax liabilities being covered.

-

5.Include relevant tax periods or years that pertain to the liabilities.

-

6.Detail the indemnification process, including any limitations and responsibilities of each party.

-

7.Review the terms carefully, making sure all details are accurate and clear.

-

8.Provide space for signatures; ensure both parties sign and date the agreement where indicated.

-

9.Finally, save the completed document and download a copy for all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.