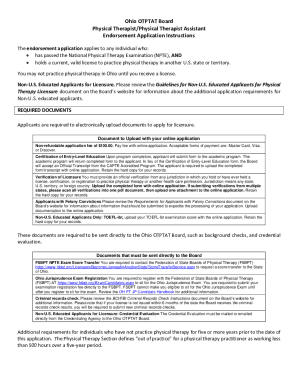

Get the free Nonemployee Directors Stock Plan of TJ International, Inc. template

Show details

18-361A 18-361A . . . Non-employee Directors Stock Option Plan under which Board can grant, during first year of Plan, options to purchase up to 2,000 shares of stock exercisable one year after grant

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is nonemployee directors stock plan

A nonemployee directors stock plan is a compensation strategy that allows companies to grant stock options or shares to their nonemployee directors as a form of remuneration.

pdfFiller scores top ratings on review platforms

Learning, but finding it very helpful for filing federal forms.

ONCE I TRIED SOME THINGS OUT AND TALKED TO THE SUPPORT PERSON, IT WAS OK

Really saves time filling out legal forms

I found this site through Google and it has been a great help in filling out those forms that are not offered as fillable PDFs. Thank you.

It is intuitive, easy to use, provides adequate help for new users requiring guidance, and provides flexible outlets for PDF use. On the down side, I do not require a secure connection for my PDF work, and the lag in loading and saving my changes & files is distracting and unpleasant.

Pretty easy to use, I wish I could erase in all directions.

Who needs nonemployee directors stock plan?

Explore how professionals across industries use pdfFiller.

Non-Employee Directors Stock Plan Form Guide

How do fill out a nonemployee directors stock plan form?

Filling out a nonemployee directors stock plan form typically involves several steps, including gathering necessary information, understanding eligibility criteria, and ensuring compliance with relevant laws. Begin by reviewing the plan details and the specific requirements for non-employee directors. Utilize digital tools to assist with the process for ease and accuracy.

Understanding the non-employee directors stock plan

A non-employee directors stock plan provides compensation to outside directors through stock options or stock awards. The primary objectives of this plan are to align the interests of the directors with those of the shareholders and incentivize their contributions toward the company’s growth and performance.

-

This plan offers equity-based compensation to directors who are not part of the company's management team.

-

It aims to attract and retain talented individuals who can provide independent oversight and guidance.

-

Their diverse perspectives can enhance strategic decisions that drive long-term performance.

What are the key components of the stock plan?

The stock plan incorporates various components designed to maximize its effectiveness for both the company and the directors. Understanding these components is critical to ensuring successful implementation and adherence to legal frameworks.

-

These options are not registered under the Securities Act, providing flexibility in compensation structures.

-

Stock awards may include restricted shares, which are subject to vesting conditions to ensure commitment from directors.

-

Typically, eligibility is based on the role being strictly non-executive and requires contributions that enhance governance.

How is the stock plan administered?

Effective administration of the nonemployee directors stock plan is crucial for its success. The governance process involves several key elements to ensure compliance and clarity in execution.

-

The board oversees the implementation and modifications to the plan, ensuring it meets corporate goals.

-

The Board has the authority to define the eligibility and compensation methodologies within the plan.

-

The Board interprets plan provisions to provide consistency in application and adhere to legal standards.

How do fill out the stock plan form?

Completing the nonemployee directors stock plan form may seem daunting, but following a systematic approach makes it manageable. It’s vital to provide accurate information to avoid delays or issues.

-

Begin by gathering required documentation, including identification and company details before filling out the provided sections sequentially.

-

Utilize tools from pdfFiller to streamline the process, including form fields and submission assistance.

-

Double-check for accuracy and completeness to prevent potential errors that could lead to rejection or delays.

How do sign and edit the document?

Once the stock plan form is filled out, it requires proper signing and, if necessary, editing before submission. Embracing technology can facilitate seamless execution.

-

With pdfFiller, users can eSign documents securely using their electronic signature.

-

The platform offers robust editing tools that enable users to modify any part of the document as needed.

-

Teams can collaborate in real-time, facilitating discussions and adjustments prior to finalizing the signing.

What should know about compliance and legal considerations?

Compliance with legal frameworks is crucial when dealing with stock options and awards. Understanding these considerations protects both the organization and its directors.

-

Non-statutory options may be subject to different tax treatments, affecting the financial implications for directors.

-

Consulting tax professionals ensures proper handling of stock awards in relation to the Internal Revenue Code.

-

Different states may have unique legal stipulations regarding stock plans, necessitating thorough review.

How to manage the stock plan over time?

Stock plans require ongoing management to remain effective. Tracking performance and market fluctuations is key to their sustainability.

-

Monitoring the performance of stock options helps assess the plan's impact and guides future decisions.

-

Reviewing plans in light of changes ensures they evolve with the organization's needs and market conditions.

-

Implementing consistent reviews and improvements can enhance engagement and retention of non-employee directors.

What are additional considerations for non-employee directors?

Non-employee directors also face unique challenges regarding stock plans. Evaluating these factors can provide critical insights.

-

The value of stock awards often fluctuates based on company performance, impacting directors’ compensation.

-

Monitoring industry trends helps anticipate changes that may influence stock options and awards.

-

Regular plan reviews ensure they remain competitive and legally compliant.

How to fill out the nonemployee directors stock plan

-

1.Open the PDF form for the nonemployee directors stock plan on pdfFiller.

-

2.Ensure you have the necessary information ready, such as director names, grant amounts, and vesting schedules.

-

3.Start filling out the top section with the name of the company and the date of the plan.

-

4.Proceed to enter the details of each nonemployee director, including their full names and relevant identification information.

-

5.Specify the type and number of shares or stock options being granted to each director.

-

6.Fill in the vesting schedule for the stock options, if applicable, detailing any performance criteria or time frames.

-

7.Review all entered information for accuracy to ensure compliance with board resolutions.

-

8.Once completed, save the document and choose the export option to share it with the appropriate parties for signatures or approvals.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.