Get the free Business Acquisition Agreement template

Show details

This is a sample Business Acquisition Agreement. This is a legally binding document that offers the complete framework and intricacies of the business acquisition. The form may be customized to

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business acquisition agreement

A business acquisition agreement is a legal document that outlines the terms and conditions under which one business acquires another.

pdfFiller scores top ratings on review platforms

Extremely easy to use and very user friendly. Does exactly what I want it to do.

PDF Filler resulted to me a very useful and agile application.

I liked the ease of using the pdf filler and being able to save and print my documents. If I needed this service regularly, I probably would purchase the service and explore pdf filler furthe

I find this really easy to use. We are travelling full-time so haven't got a printer. This saves us searching for a Library or private printer to use.

Took only 4" to respond to my email request, with action I requested completed. Outstanding Client Service!

muy bueno y completo sobre todo bastante practico y funcional

Who needs business acquisition agreement template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Business Acquisition Agreement Form

How to fill out a business acquisition agreement form

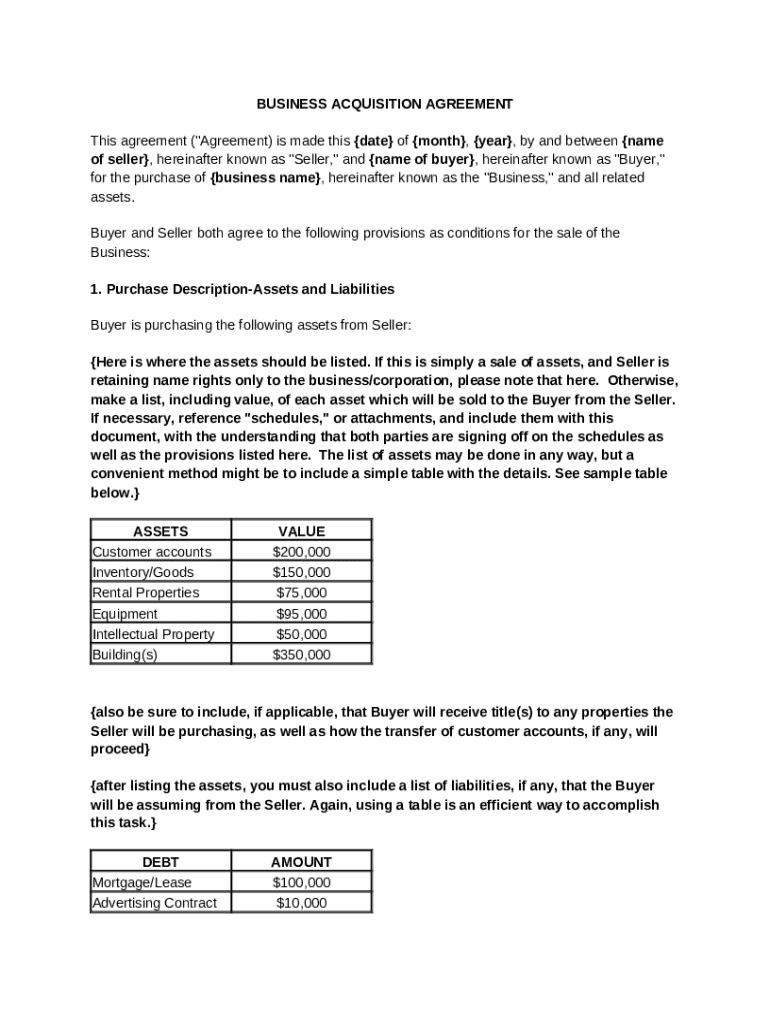

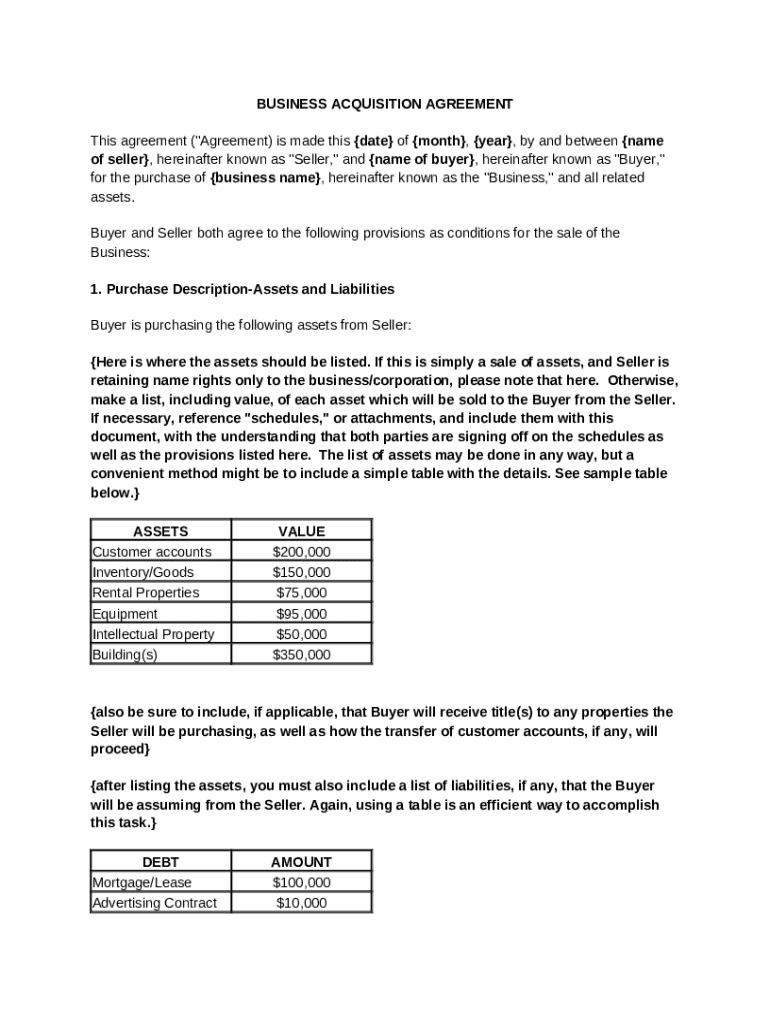

Filling out a business acquisition agreement form is a structured process that involves clearly defining the transaction's terms. First, accurately capture the names of the buyer and seller and the effective date. Next, provide a thorough description of the business and the transaction's financial terms before signing.

What are business acquisition agreements?

A business acquisition agreement is a legally binding contract outlining the terms under which one party purchases another business's assets or stock. The primary objective is to ensure that both the seller and buyer agree on essential aspects such as purchase price, liabilities, and the assets being transferred.

Essential components of the agreement

-

This section emphasizes the importance of stating the effective date of the agreement to avoid disputes.

-

Accurate listing of party names helps prevent legal complications and ensures all parties are correctly recognized in the agreement.

-

Clear articulation of the business being sold and the assets included in the sale is crucial for transparency.

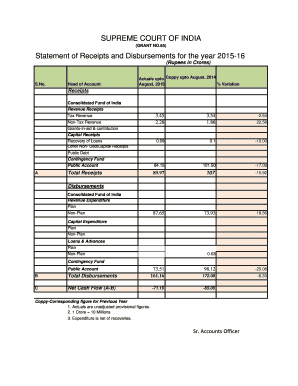

How to list assets and liabilities

The specifics of assets and liabilities are critical in a business acquisition. Listing all assets and liabilities clearly helps both parties understand what is being transferred and assumed during the acquisition process.

-

Include tangible assets like equipment and inventory, as well as intangible assets such as trademarks and customer lists.

-

Clearly indicate which liabilities the buyer will assume, as these can greatly influence the overall value of the deal.

What are the legal requirements?

Business acquisition agreements must comply with state-specific legal requirements. Understanding common terms and their interpretations varies by jurisdiction, making legal review a vital step in the finalization of the agreement.

How to determine purchase price and payment terms

Determining the purchase price is essential and typically involves various valuation methods. Factors like market conditions and the business's current financial health can influence the overall purchase price.

-

Outlining terms such as down payments and financing options helps ensure that both parties have a clear understanding of the financial commitments involved.

-

Incorporating contingencies can protect both parties if certain conditions are not met prior to finalizing the sale.

Steps to finalize the agreement

Finalizing the business acquisition agreement involves a thorough review of the document, seeking amendments if necessary. It’s important for both parties to understand and agree to all terms before signing.

-

Ensuring that both parties sign is crucial for the agreement’s legality, and having witnesses can further solidify its enforceability.

-

Recommendations for organizing, filing, and safely storing the signed agreement should be adhered to for future reference and legal protection.

Additional resources for document management

Utilizing tools such as pdfFiller can simplify the process of editing, collaborating, and signing documents. This platform empowers you to efficiently manage your business acquisition agreement from anywhere.

How to fill out the business acquisition agreement template

-

1.Begin by downloading the business acquisition agreement template from pdfFiller.

-

2.Open the document in the pdfFiller editor and review the fields that need to be filled out.

-

3.Enter the names and addresses of both the buyer and the seller in the designated sections.

-

4.Provide a detailed description of the business being acquired, including its assets, liabilities, and any necessary documentation.

-

5.Specify the purchase price and the payment terms, such as upfront payments and installments, ensuring clarity.

-

6.Include any contingencies or conditions that must be met before the transaction is finalized.

-

7.Carefully review the timeline for the acquisition, outlining significant dates such as the agreement signing and closing date.

-

8.Add any necessary signatures, ensuring both parties acknowledge the agreement.

-

9.Finally, save and share the completed document with all involved parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.