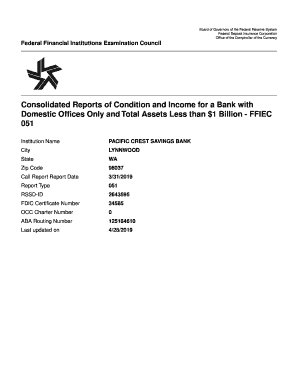

Get the free Accredited Investor Certification Letter template

Show details

Under SEC law, a company that offers its own securities must register these investments with the SEC before it can sell them unless it meets an exception. One of those exceptions is selling unregistered

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

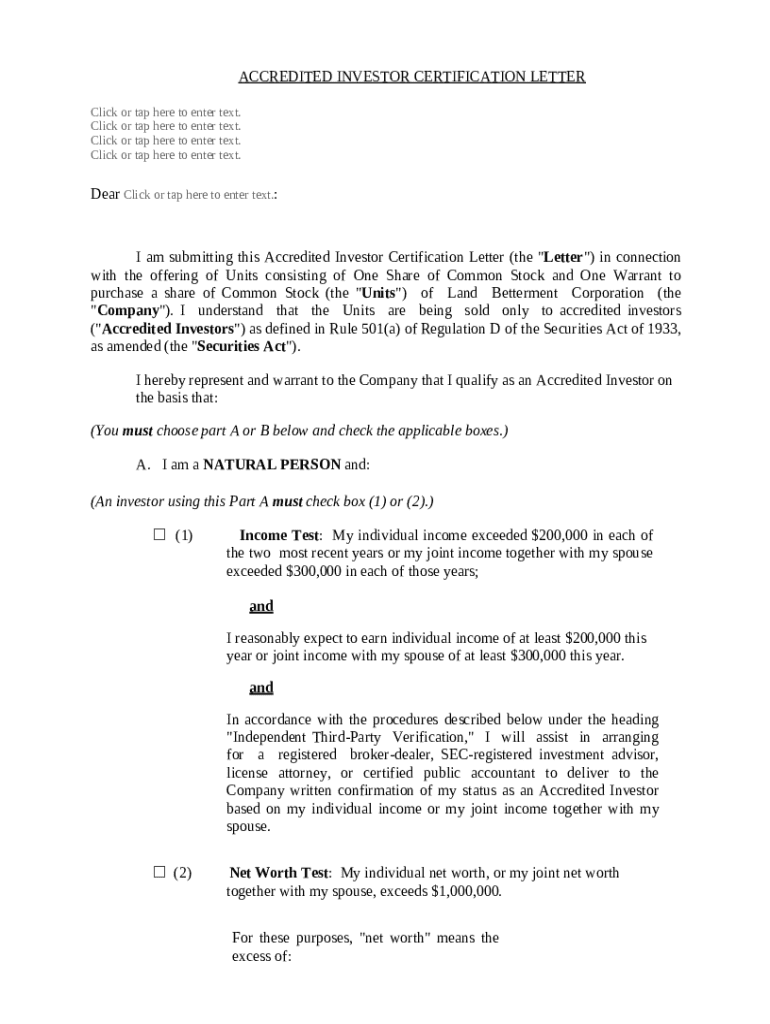

What is accredited investor certification letter

An accredited investor certification letter is a formal document verifying an individual's or entity's status as an accredited investor under applicable securities regulations.

pdfFiller scores top ratings on review platforms

excellent

It offers good tools and is easy to use on the browser. Works perfectly for what I need for now.

postive

I'm fairly new to this site but so far it's great for our business!!!

I am excited to use and learn this software, I've used it in the past and it's been super helpful

Good

Who needs accredited investor certification letter?

Explore how professionals across industries use pdfFiller.

How to Secure Your Accredited Investor Certification Letter

Obtaining your accredited investor certification letter is a critical step for individuals looking to explore exclusive investment opportunities. This document verifies your status as an accredited investor, meeting the criteria established by the Securities and Exchange Commission (SEC). Understanding and accurately filling out the accredited investor certification letter form can open doors to high-quality investment vehicles.

What is an accredited investor?

An accredited investor is defined by the SEC as an individual or entity that meets specific financial criteria, which allows them to invest in unregistered securities. Typically, individuals need to have a net worth exceeding $1 million, excluding their primary residence, or have an individual income of $200,000 or more in the past two years, or a joint income with a spouse of $300,000 or more.

-

The SEC outlines accredited investors as individuals or entities meeting certain income or net worth thresholds.

-

Becoming an accredited investor allows access to a wider range of investment opportunities that are not available to non-accredited investors.

What should you include in the certification letter?

The accredited investor certification letter must contain specific essential elements to verify your status. Accuracy in your personal information is paramount to prevent delays in the verification process.

-

You must include your full name and address to confirm your identity.

-

A clear statement verifying your status as an accredited investor according to SEC definitions.

-

Include financial documentation backing your claims, such as tax returns or bank statements.

How do you fill out the certification letter?

Filling out the accredited investor certification letter requires attention to detail and understanding of the both the Natural Person Criteria and the financial tests involved.

-

Understanding what constitutes a natural person and how it applies to you is crucial.

-

You need to verify income for the last two years, often requiring documentation to support your claims.

-

If applicable, provide guidelines that couples should adhere to when determining joint income.

-

Ensure you meet the net worth criteria, which includes the exclusion of your primary residence.

-

Know who can certify your status, such as CPAs or financial advisors.

Where should you submit the certification letter?

After filling out the accredited investor certification letter form, it is crucial to understand where to submit it. Many investment companies or funds require this certification before allowing you to invest.

-

Submit directly to firms or funds that specifically require your certification to participate in their offerings.

-

Be aware of the submission timelines, as they can affect your ability to invest in specific opportunities.

What common mistakes should you avoid?

Many applicants make common pitfalls when filling out their accredited investor certification letter, which can lead to delays or rejection of their application.

-

Double-check for any inaccuracies or typos that could undermine credibility.

-

Ensure you attach all necessary documents—missing paperwork is a common cause of delay.

-

Claims made must be verifiable through appropriate documents and certifications.

How does accredited investor status impact investments?

Holding accredited investor status can greatly benefit you by expanding your access to diverse investment opportunities. Issuers often regard accredited investors as more sophisticated and therefore may offer them exclusive options.

-

Accredited investors can access higher-quality deals, such as private equity or hedge funds.

-

Issuers often distinguish among investor types, providing unique opportunities based on one's accredited status.

What are some tips for a successful certification process?

A few best practices can lead to a smoother process in obtaining your accredited investor certification letter. The platform pdfFiller can assist you in efficiently managing the document creation process.

-

Collect all necessary financial documents beforehand to ensure accuracy.

-

Make use of pdfFiller’s platform for easy editing, signing, and managing documents to simplify the experience.

-

Seek help from financial advisors to ensure your forms are filled out correctly.

How to fill out the accredited investor certification letter

-

1.Open pdfFiller and upload the accredited investor certification letter template.

-

2.Begin by entering your personal information, including your full name and contact details in the designated fields.

-

3.Provide information required to verify your accredited investor status, such as your income, net worth, and any relevant documentation.

-

4.Review each section to ensure accuracy and completeness before proceeding.

-

5.Add your signature to the appropriate line, indicating your agreement to the statements made in the document.

-

6.Include the date of signing to finalize the letter.

-

7.Once complete, save or download the filled document in your preferred format directly from pdfFiller.

-

8.If necessary, print the letter for physical copies or to share it with relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.