Last updated on Feb 17, 2026

Get the free Qualified Investor Certification Application - Individual template

Show details

This application is intended for residents of the state to certify qualified investors seeking allocation of Angel Investment Tax Credits for investments in qualified small businesses. The application

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

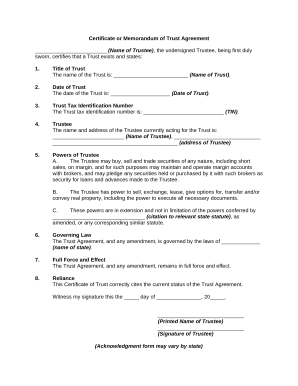

What is qualified investor certification application

A qualified investor certification application is a formal document used to verify the status of an individual or entity as a qualified investor under securities regulations.

pdfFiller scores top ratings on review platforms

Easy to use, however a 30 or limited use trial should be offer.

the efficiency and clarity are five star.

This is exactly what I needed for my home business needs.

Thanks

I used the program and was happy with the software and results. However, due to my own oversight I inadvertently made an annual purchase which I would not be in need of. I noted this in my comments when rating the app. To my surprise and complete satisfaction the service team provided me a credit. They went over and above in addressing my frustration. Based on this integrity and caring service I will use this program if needed in the future and will certainly recommend it to others.

love this product absolutely worth getting

I am very happy with the program and customer service!

Who needs qualified investor certification application?

Explore how professionals across industries use pdfFiller.

How to fill out a qualified investor certification application form

Understanding the qualified investor certification application form

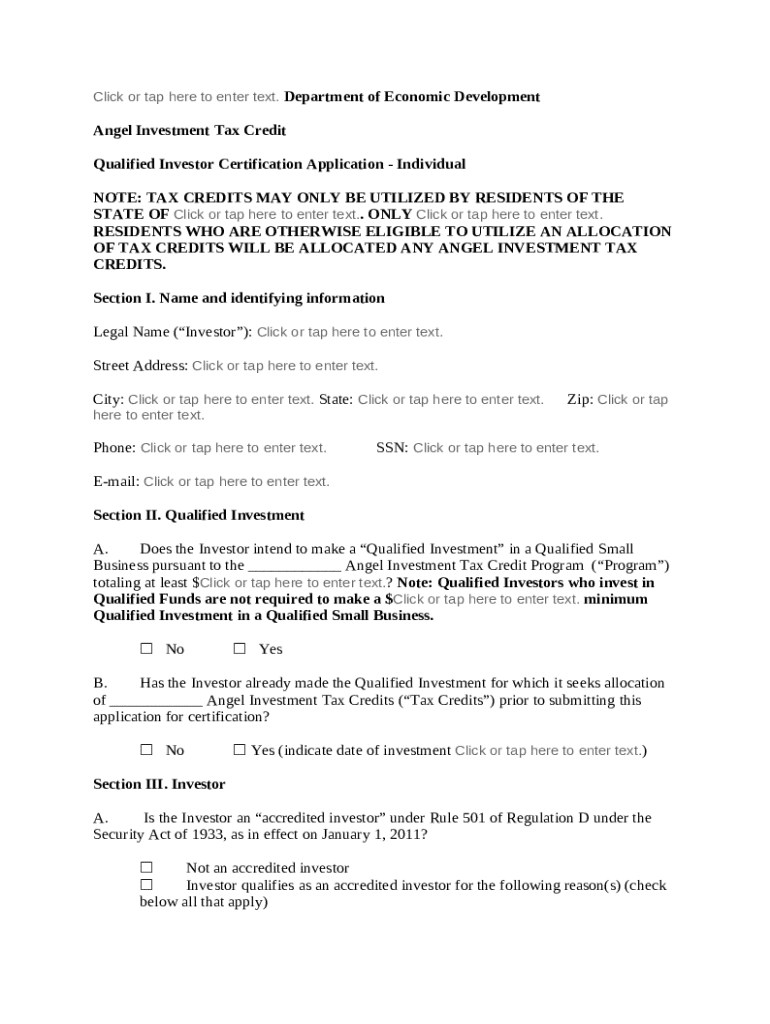

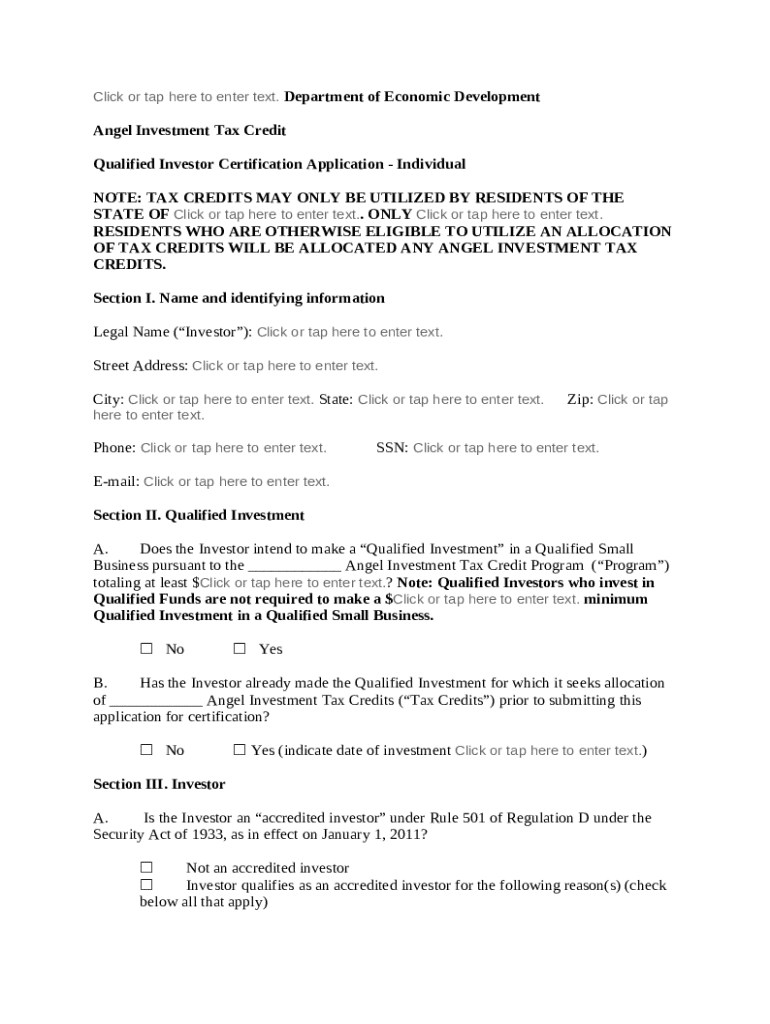

A qualified investor is defined as an individual or entity meeting specific financial criteria, which signifies their capacity to engage in higher-risk investments. The qualified investor certification application form is a crucial document that validates an investor's status, enabling them to participate in investment opportunities that qualify for the Angel Investment Tax Credit Program. This certification not only ensures compliance but also provides access to potential tax benefits.

Who needs to fill out the qualified investor certification application?

The qualified investor certification application must be completed by individuals or entities seeking to leverage the tax benefits provided by the Angel Investment Tax Credit Program.

-

Natural persons must meet specific income or net worth thresholds to qualify as investors. Generally, individuals need to have an annual income exceeding a certain limit or possess assets of a designated value.

-

Groups of investors or firms can apply, as long as they meet the necessary criteria set forth in relevant regulations.

-

Applicants often must reside in the state where they are investing, ensuring compliance with local tax laws and regulations.

Step-by-step instructions for completing the application form

Filling out the qualified investor certification application form involves several steps, with each section demanding precise information.

Section : Personal Information

-

Ensure your legal name matches the name on your identification documents to avoid discrepancies.

-

Include your complete street address, city, state, and zip code to establish residency.

-

Provide a valid phone number and email address for follow-up communications.

-

You may need to disclose your Social Security Number (SSN) or equivalent for verification purposes.

Section : Qualified Investment

-

Clearly state your intention to make a qualified investment in a specific qualified small business.

-

Detail any prior investments you have made, as these play a crucial role in your eligibility for tax credits.

-

Provide documentation regarding the timeline and nature of your previous investments to support your application.

Section : Investor Accreditation

-

Identify the criteria that confirm your status as an accredited investor, such as income levels or net worth.

-

Prepare documentation that substantiates your accreditation status, such as tax returns or financial statements.

-

List valid reasons for your accreditation and ensure that all necessary checks are complete.

Common pitfalls to avoid when completing the application

Many applicants encounter common mistakes that can derail their applications. Being aware of these can maximize your chances of success.

-

Failing to fill in mandatory fields can lead to immediate rejection of your application.

-

Double-check all entered information to avoid discrepancies that could cause delays or rejections.

-

Be fully informed on how the tax credit allocation works to ensure you are preparing the application with the correct expectations.

Utilizing pdfFiller for streamlined application management

pdfFiller offers various features that can significantly aid in managing your application process more effectively.

-

Take advantage of pdfFiller’s capabilities to edit and electronically sign your documents conveniently.

-

Utilize collaborative tools that allow teams to work on the application together seamlessly.

-

Access your filled forms from any device, ensuring you can manage your applications anytime, anywhere.

Additional considerations and compliance notes

Keeping up with compliance and additional considerations is vital for a successful application.

-

Be aware of any state-specific requirements that could affect your ability to qualify.

-

Stay updated on any recent changes in tax law which may impact investment tax credits.

-

Consider consulting with a financial adviser or attorney for tailored advice on your investment plans.

How to fill out the qualified investor certification application

-

1.Start by downloading the qualified investor certification application from pdfFiller.

-

2.Open the form in pdfFiller and review the sections for required information.

-

3.Begin filling in your personal details, including your name, contact information, and any relevant identification numbers.

-

4.In the financial information section, provide details about your income, net worth, and investment experience as required.

-

5.If applicable, include information about any entities you represent and their qualification status.

-

6.Review all provided information for accuracy and completeness before submission.

-

7.Sign and date the application where indicated, acknowledging the accuracy of the information.

-

8.Finally, submit your completed application through the pdfFiller platform, ensuring all pages are properly included.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.