Last updated on Feb 10, 2026

Get the free Convertible Secured Promissory Note template

Show details

A Convertible Note Subscription Agreement details the factors in the coversion of a note. A convertible note is aform of short-term debt that converts into equity, typically in conjunction with a

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is convertible secured promissory note

A convertible secured promissory note is a financial instrument that allows a borrower to obtain funds while providing the lender with the option to convert their loan into equity at a later date.

pdfFiller scores top ratings on review platforms

Awesome tool

THANK YOU

THANK YOU, I LOVE TO USE PDFFILLER.

It does what I want it to do and even…

It does what I want it to do and even gives me options on how to execute these tasks

Excellent application. Very intuitive

Very satisfying!!! It has been a very helpful tool to modify and to fill up forms related to my work. The only thing I regret is not have been subscribed earlier.

Perfect website and features for the professionals out there. I use it to mark up my construction drawings and many more things.

Who needs convertible secured promissory note?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Convertible Secured Promissory Note Form

How does a convertible secured promissory note work?

A convertible secured promissory note serves as a hybrid financial instrument, combining traits of both debt and equity. It allows the lender to convert the outstanding balance into equity at a later date, often at a predetermined rate or during specific funding rounds. This multi-faceted design provides flexibility for both lenders and borrowers while mitigating risks associated with unsecured loans.

-

A convertible secured promissory note is a loan that can be converted into company equity, secured by collateral to reduce risk.

-

Includes details such as the principal amount, interest rate, conversion terms, and collateral specifics.

-

Secured notes are backed by collateral, while unsecured notes are not, making secured notes typically less risky for lenders.

What key terms should you know?

Understanding the key terms within a convertible secured promissory note is crucial for navigating the complexities of the agreement. Important provisions define the obligations and rights of both parties involved, ensuring clarity and protecting interests.

-

Outlines the hierarchy of debts in the event of liquidation, impacting the eventual recovery for different creditors.

-

Specifies the collateral backing the loan, which provides security to lenders against default.

-

Addresses the requirements for registering securities or relying on exemptions, crucial for legal protection and investor communication.

How do you fill out the convertible secured promissory note form?

Accurately completing the convertible secured promissory note form is vital to ensure the document's validity and functionality. Following a clear step-by-step approach can help prevent common pitfalls.

-

Begin by inputting the borrower's and lender's information, followed by the loan terms such as amount and interest rate.

-

Make sure to add relevant details in the Subordination Agreement to clarify rights and obligations.

-

Utilize features such as text editing and signature placement to enhance accuracy and compliance in your document.

What interactive features can assist in managing your note?

Utilizing online tools for managing your convertible secured promissory note not only simplifies processes but also augments collaboration. Features such as eSigning and version control can streamline document journeys.

-

Use pdfFiller to digitally sign documents and share them with involved parties for quick feedback and approvals.

-

Track document changes easily, allowing adjustments based on stakeholder insights without losing original data.

-

Access your notes from any device, ensuring you have your documents when you need them, whether at home or on the go.

What legal considerations and compliance issues should you address?

Adhering to local regulations when drafting convertible secured promissory notes is imperative. Local laws vary significantly and can impact the enforceability and legitimacy of your agreements.

-

Understand the legal landscape concerning promissory notes specific to your jurisdiction to ensure compliance.

-

Different areas may have unique requirements for securing notes; awareness of these can prevent costly legal issues.

-

Consult a legal professional when drafting notes to safeguard against potential challenges or misunderstanding.

What common mistakes should you avoid?

Avoiding common pitfalls when working with convertible secured promissory notes can save time and prevent legal issues. Recognizing frequent errors as well as their implications is essential.

-

Check for incomplete sections or inaccurate details that can jeopardize the integrity of the note.

-

Errors in documentation can lead to enforceability challenges and financial repercussions.

-

Always review completed forms and consult with knowledgeable sources to ensure accuracy and completeness.

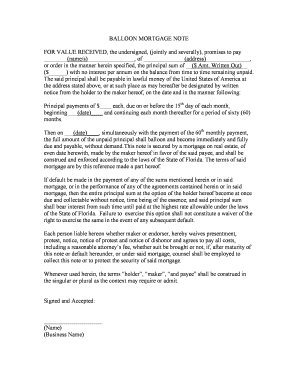

How to fill out the convertible secured promissory note

-

1.Begin by downloading the convertible secured promissory note template from pdfFiller.

-

2.Open the document in pdfFiller to start editing.

-

3.Fill in the date at the top of the document to indicate when the note is being issued.

-

4.Enter the borrower's name and address in the designated fields to identify who is issuing the note.

-

5.Provide the lender's name and address to clarify the recipient of the funds.

-

6.Specify the principal amount that the borrower is borrowing, ensuring it is clear and accurately represented.

-

7.Include the interest rate, detailing how this will be calculated over the term of the note.

-

8.Clearly define the maturity date, which is the date by which the loan must be repaid unless converted into equity.

-

9.In the section regarding conversion terms, specify the conditions under which the lender can convert the debt into equity.

-

10.Add any additional clauses or agreements that are relevant to the secured nature of the note.

-

11.Review all entered information for accuracy before saving the document.

-

12.Once everything is filled out correctly, save and download the completed note from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.