Get the free Accredited Investor Self-Certification Attachment D template

Show details

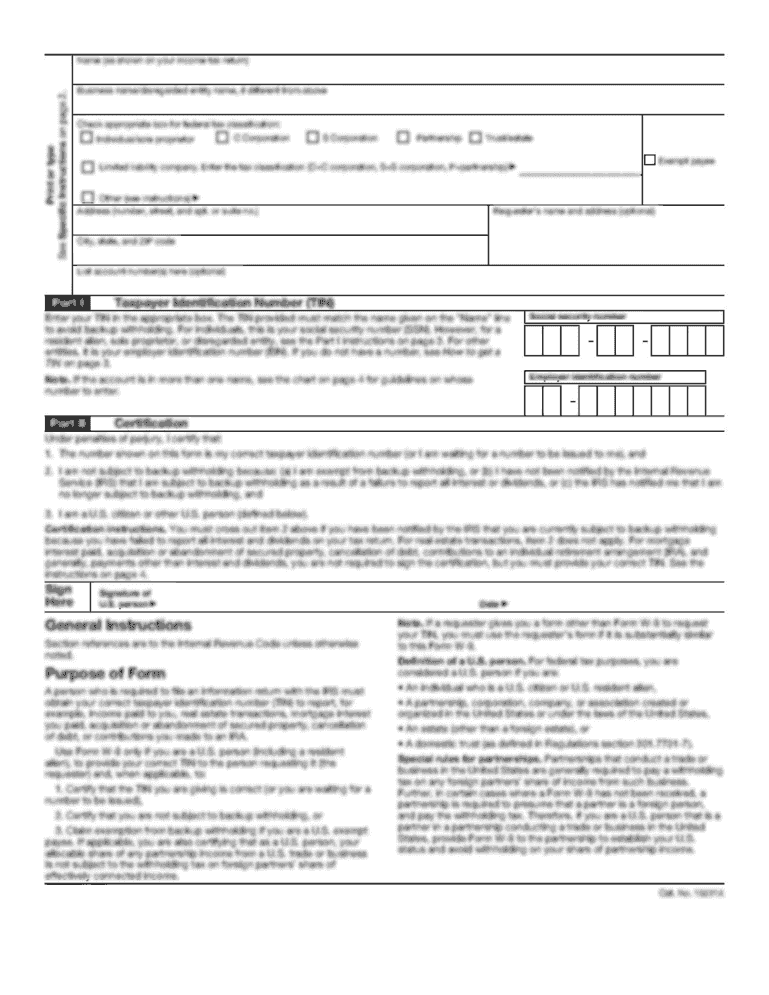

Under SEC law, a company that offers its own securities must register these investments with the SEC before it can sell them unless it meets an exception. One of those exceptions is selling unregistered

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accredited investor self-certification attachment

The accredited investor self-certification attachment is a document that allows individuals to confirm their status as accredited investors to comply with securities regulations.

pdfFiller scores top ratings on review platforms

This review is for support

This review is for support, I had Shannen and she was amazing! She was very fast and supportive of my problem, she is a great member to your team. Thank you Shannen!

very good and easy to work with

very good and easy to work with

Ecelent tool.

Ecelent tool.

I LOVE IT HERE

I LOVE IT HERE

As I learn more I have appreciated it…

As I learn more I have appreciated it more. Thanks for all the work that you have put into the process.

Customer service on top level

Customer service on to level. Sam was relly proffesional and solved my issue within secounds

Who needs accredited investor self-certification attachment?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Accredited Investor Self-Certification Attachment Form

How does one define an accredited investor?

An accredited investor is defined under Rule 501 of Regulation D in the Securities Act of 1933. This classification typically includes individuals who meet specific financial criteria, such as having a net worth exceeding $1 million (excluding primary residence) or an income exceeding $200,000 in the last two years ($300,000 for joint income). Additionally, there are exemptions allowing certain entities and professional investors to qualify without meeting these thresholds.

-

To qualify, an individual’s net worth must exceed $1 million, excluding the value of their primary residence.

-

An individual must have an income of $200,000 in the last two years, or $300,000 with a spouse to qualify.

-

Certain trusts, estates, and other entities can qualify as accredited investors under specific circumstances.

What are the key components of the accredited investor self-certification form?

The accredited investor self-certification attachment form comprises essential details that validate an applicant’s financial status. The legal name is critical for accurately identifying the applicant, while certification details require detailed financial disclosures. Understanding the terms, such as 'individual income' and 'net worth,' is vital for proper self-certification.

-

Accurate disclosure of the applicant's legal name is essential for validating the certification.

-

Applicants must provide comprehensive financial details to document compliance with accredited investor requirements.

-

Understanding the distinction between individual income and net worth is crucial for accurate reporting.

How to complete the accredited investor self-certification form?

Filling out the accredited investor self-certification form requires attention to detail. Begin by navigating through the form fields and ensuring accurate interpretations of financial sections. Finally, signing and dating the form is necessary, as it has legal implications concerning the validity of the certification.

-

Review each field carefully to ensure that all necessary information is included.

-

Double-check all financial calculations and ensure you meet the requirements for certified investor status.

-

Remember that signing and dating verifies the authenticity and legal accountability of your submission.

What features does pdfFiller offer for electronic completion and submission?

pdfFiller provides various tools for seamless electronic completion and submission of the accredited investor self-certification form. Utilizing pdfFiller’s editing tools allows users to prepare forms efficiently. Additionally, secure e-signing features enable safe submission while managing completed forms effectively.

-

pdfFiller offers intuitive tools for easy editing, including drag-and-drop features to insert information.

-

Users can sign documents securely online, ensuring legal compliance without physical paperwork.

-

Easily store and access completed forms from any device, facilitating organization and retrieval.

What common mistakes should be avoided in the self-certification process?

Properly completing the self-certification form is crucial, and various common mistakes can jeopardize your accreditation. Forgetting to disclose additional income or assets is a frequent oversight, as is misunderstanding how to calculate income when it involves joint earnings. Staying diligent and ensuring all documentation is current will help in avoiding uncertainties during audits.

-

Forgetting to include all relevant income or assets can lead to certification rejection.

-

Misinterpretation of income calculations, especially for joint filers, can cause inaccuracies.

-

Maintaining current documentation is vital for credible audits and compliance.

When should you consult an accredited investor specialist?

Hiring a specialist can be beneficial when the self-certification process feels overwhelming. Such consultants can provide valuable insights and assistance throughout the form completion. Locating credible consultants can be sourced through various professional networks or through targeted online search, understanding cost considerations and potential benefits.

-

Consider hiring a consultant if you are unfamiliar with the certification requirements or face complex financial situations.

-

Accredited investor consultants can be found through financial advisors or specialized accreditation websites.

-

Weigh the costs of hiring a specialist against the potential for successful accreditation and future investment opportunities.

What are the real-world implications of accredited investor status?

Becoming an accredited investor opens doors to exclusive investment opportunities, often not available to non-accredited individuals. These can include higher-risk investments that typically yield higher returns. Understanding the regulatory landscape ensures compliance and enhances investment strategies based on accreditation standing.

-

Accredited investors often gain access to private placements, venture capital, and hedge funds.

-

Understanding regulations can help navigate potential pitfalls in investment strategies.

-

Analyzing successful investors can provide insights and inspire strategic investment decisions.

How to fill out the accredited investor self-certification attachment

-

1.Download the accredited investor self-certification attachment from the provided source.

-

2.Open the document using pdfFiller or upload it to the platform if necessary.

-

3.Begin by filling in your full legal name and address in the designated fields.

-

4.Indicate whether you are an individual or represent a business entity.

-

5.Provide your financial details, ensuring you meet the income or net worth criteria for an accredited investor.

-

6.Review the self-certification statements carefully to verify you qualify as an accredited investor based on the definitions provided.

-

7.Sign and date the document in the appropriate area to attest to the accuracy of your claim.

-

8.Once completed, save the document and submit it as required by the offering entity or retain it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.