Get the free Stock Option Plan For Federal Savings Association template

Show details

18-220H 18-220H . . . Stock Option Plan For Federal Savings Association which provides for grant of Incentive Stock Options to officers and employees and Non-qualified Stock Options to officers, employees

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is stock option plan for

A stock option plan is a program that allows employees or stakeholders to purchase company stock at a predetermined price, often as part of their compensation package.

pdfFiller scores top ratings on review platforms

Maybe at a later date but to busy at the moment to watch one.

i thought it was a free program but I needed to pay for it when I tried to print the document, it required payment. I did so, but then complained to the company and they fully refunded my money

Good product. Difficulty rotating a document. It's free some versions of your app, but not others. Price is a bit high.

Hard to save to a location that I can find.

i want to save and send from my email address

I'm still trying to figure out all the tools. But the program is very helpful

Who needs stock option plan for?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Stock Option Plans for Form Form

What is a stock option plan?

A stock option plan is a program that provides employees with the right to purchase company shares at a predetermined price, known as the exercise price, often significantly below market value. This incentivizes employees to contribute to the company’s growth, aligning their interests with those of shareholders and fostering a culture of ownership. Understanding these plans is crucial for both business leaders and employees.

-

Stock option plans serve as a performance-based incentive for employees to increase their productivity and dedication to the company.

-

There are several types, including Incentive Stock Options (ISOs), Non-Qualified Stock Options (NSOs), and Restricted Stock Options, each having different tax implications and eligibility criteria.

-

These plans are vital for talent retention, as they motivate employees to work toward increasing the company's performance and ultimately their personal financial gain.

How do you establish an effective stock option plan?

Creating a successful stock option plan involves a structured approach that encourages participation while aligning with corporate objectives. It's essential to define clear eligibility criteria and tailor the plan to suit both the company's strategy and employees' expectations.

-

Evaluate the company’s goals, engage with stakeholders, and outline the plan structure reflecting the company’s vision and values.

-

Eligibility can range from all employees to just senior management, depending on the organization's philosophy regarding incentives.

-

Clearly define the objectives of the stock option plan to ensure employees understand how they can benefit from their contributions.

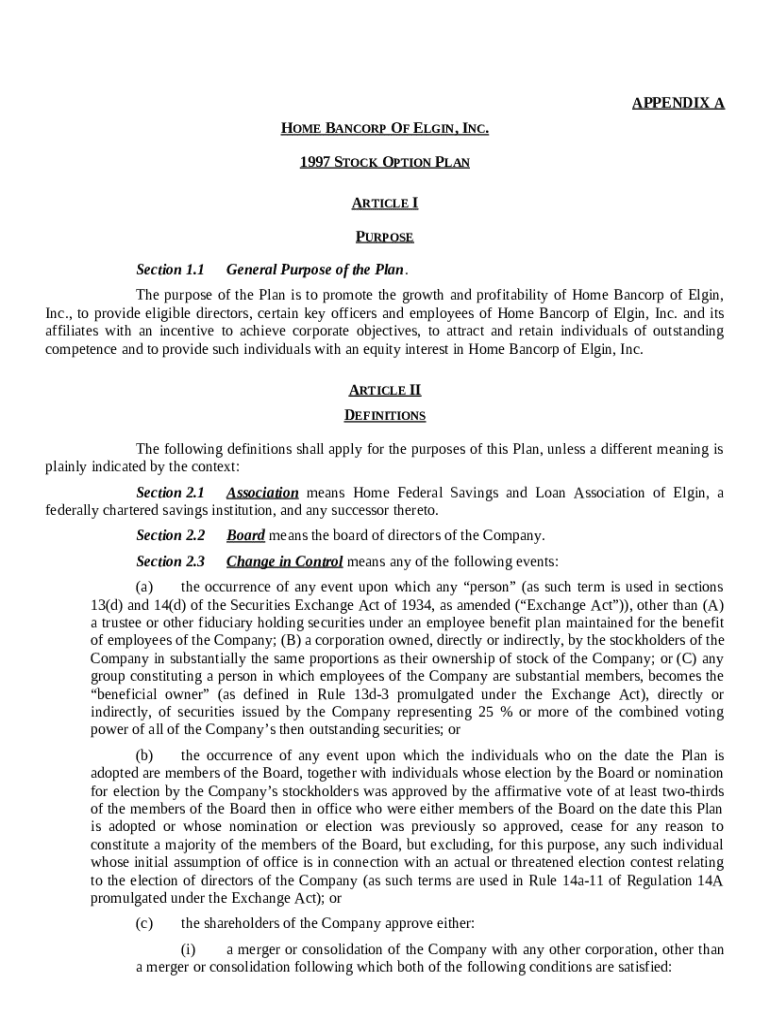

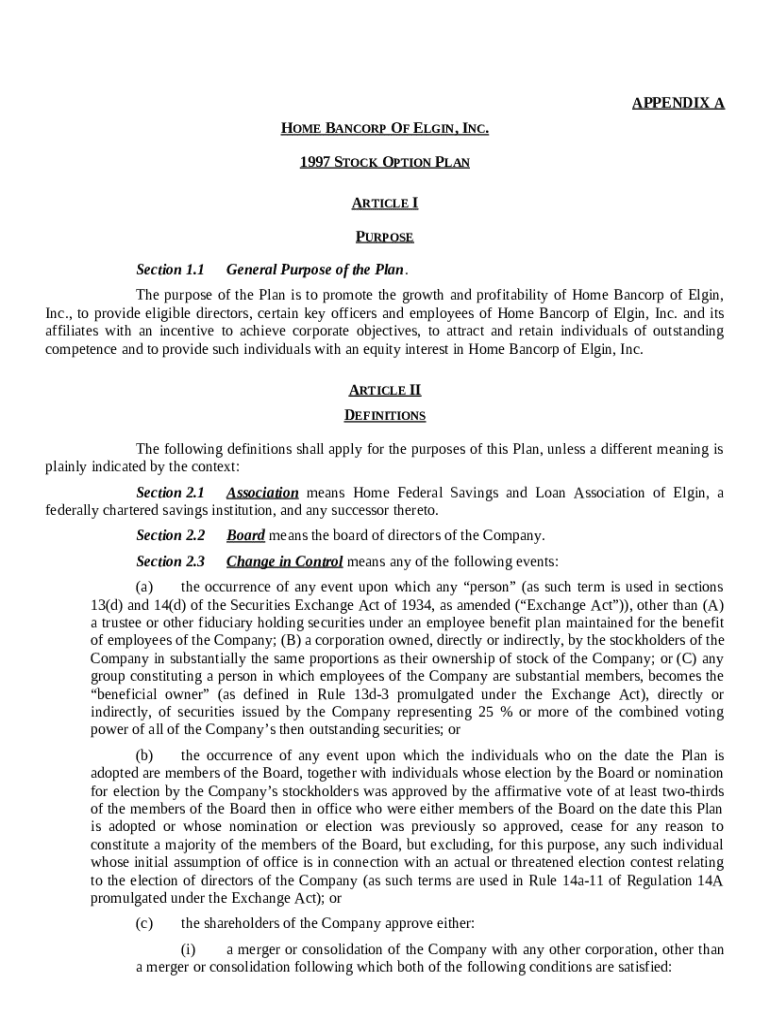

What is the structure of a stock option plan?

A well-defined structure is essential for the effective implementation of stock option plans. It clarifies the purpose, objectives, and key definitions, enabling better understanding among participants.

-

The plan should highlight goals like corporate growth incentives, retention of key talent, and aligning employee interests with company performance.

-

Clarifying terms such as 'association', 'board', and 'change in control' helps mitigate misunderstandings during implementation.

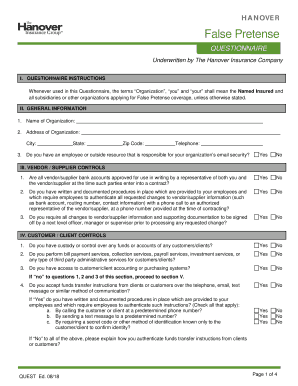

What legal considerations should be made in formulating a stock option plan?

Legal compliance is a crucial aspect of any stock option plan. Organizations must adhere to federal and state regulations to safeguard against potential legal risks, ensuring that the plan structure is robust and transparent.

-

It's vital to stay updated and comply with SEC regulations and state laws regarding securities offerings and employee stock ownership plans.

-

Mismanagement or non-compliance can lead to litigation, requiring ongoing legal consultation to navigate the complexities.

-

Engaging legal advisors during the development process ensures all aspects are covered and reduces the risk of future legal disputes.

How do you calculate stock options?

Calculating stock options involves understanding their valuation and assessing the financial implications for both the employee and the company. Proper calculations can help gauge the cost-benefit ratio, ensuring a win-win situation for all parties involved.

-

Valuation often involves complex financial modeling to forecast potential outcomes based on market conditions and company performance.

-

Assessing the upfront costs and potential long-term benefits can inform strategy and assist in communicating these aspects to employees.

-

Both employees and companies need to understand the tax responsibilities associated with stock options, which can impact financial decisions significantly.

How can interactive tools assist in managing your stock option plan?

Leveraging interactive tools can significantly streamline the management of stock option plans. Tools like pdfFiller allow organizations to manage documents seamlessly, making it easier for employees to access and understand their options.

-

This platform allows users to create, edit, and manage stock option plan documents in real-time ensuring accuracy and compliance.

-

The ability to electronically sign and modify documents enhances flexibility and reduces the overhead of paper-based processes.

-

Interactive elements allow companies to monitor engagement and compliance while making adjustments based on employee feedback.

What are the best practices for implementing and managing a stock option plan?

Successful stock option plans require continuous evaluation and communication to remain effective. Regular reviews ensure the plan evolves with changing organizational goals and employee needs.

-

Consistently evaluating the plan's performance and making necessary adjustments keeps it relevant and effective.

-

Clear and ongoing communication helps employees understand their benefits, which is key to increasing participation.

-

Collecting feedback actively from employees allows companies to refine their approaches and enhance employee satisfaction.

How to fill out the stock option plan for

-

1.Access the stock option plan template on pdfFiller.

-

2.Begin by entering the name of your company in the designated field.

-

3.Fill in the date of the plan's initiation and the effective date.

-

4.Specify the total number of shares that are subject to the stock options in the appropriate section.

-

5.Detail the eligibility criteria for participants, such as job titles or employment duration.

-

6.List the vesting schedule, noting the duration before options can be exercised.

-

7.Provide the exercise price, which is the price at which options can be converted to shares.

-

8.Include any relevant tax implications or conditions associated with the stock options.

-

9.Review all entered information for accuracy and completeness.

-

10.Save the completed document and submit it as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.