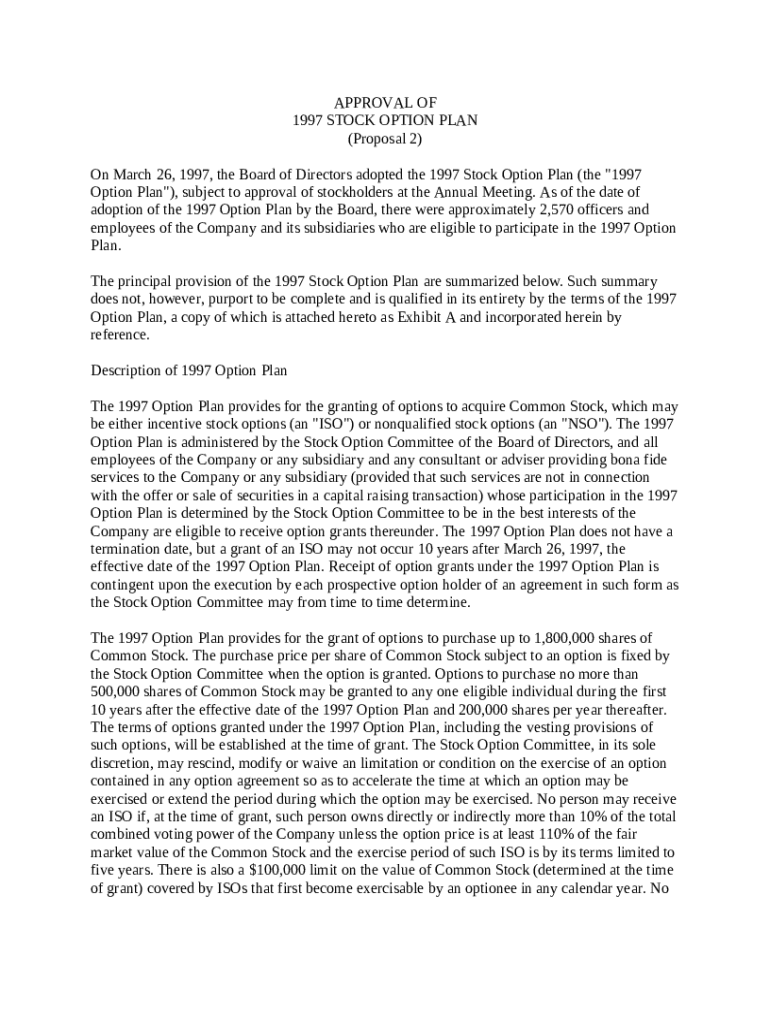

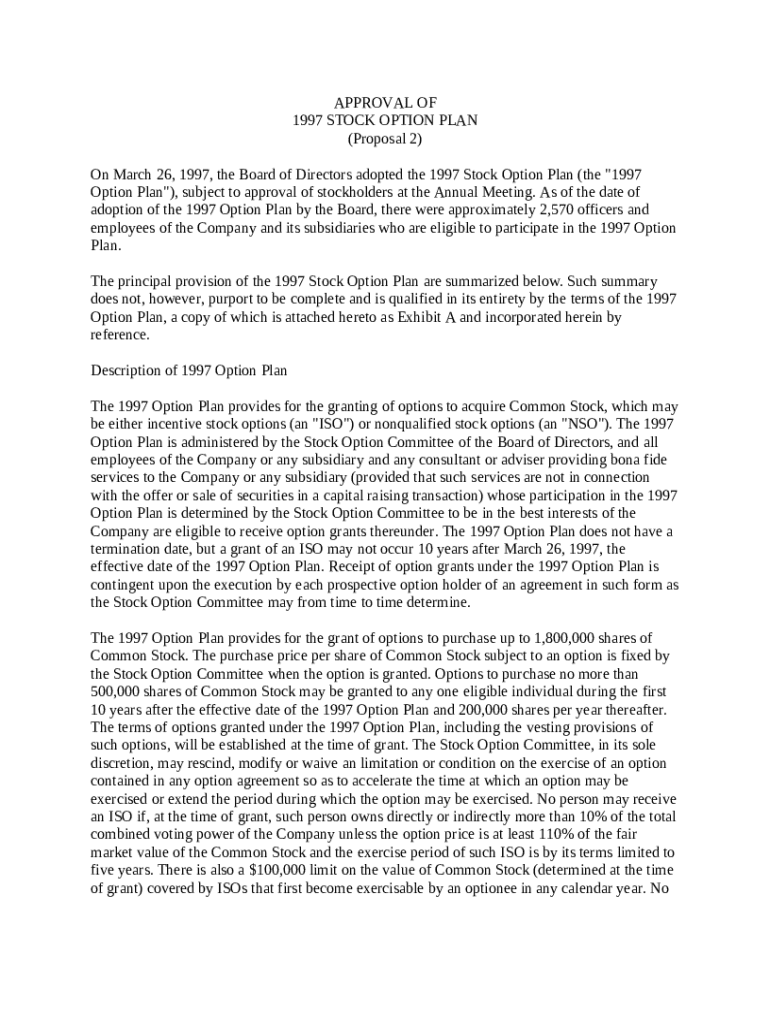

Get the free Approval of Stock Option Plan template

Show details

This sample form, a detailed Approval of Stock Option Plan, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is approval of stock option

The approval of stock option is a formal document that grants an individual the right to purchase a company's stock at a predetermined price, typically used as part of employee compensation packages.

pdfFiller scores top ratings on review platforms

PDFfiller is very fast, easy, and inexpensive to use.

Just started using it. I will see if the insurance company accepts the Form and then write further. So far it is easy once I figured it out.

JUST HOPE THE INSURANCE COMPANIES WILL ACCEPT THIS FORM AND PAY US. WISH IT HAD A CAPABILITY OF ALIGNING ALL LINE HORIZONTALLY SO IT DOESN'T LOOK SO HAPHAZARD

I like this service, but having trouble finding/searching for some documents.

Simple and easy to use. Fills forms, easy to edit. Love it. Trying for a month before full sub.

The service is great. It is extremely overpriced in my opinion.

Who needs approval of stock option?

Explore how professionals across industries use pdfFiller.

Approval of Stock Option Form Guide on pdfFiller

Filling out an approval of stock option form can be a crucial step in understanding how stock options work within your organization. This guide will lead you through the nuances of the stock option approval process and offer insights on effectively using pdfFiller's tools to streamline your experience.

What is a stock option plan?

A stock option plan is a program established by a company that allows employees to purchase shares of the company at a predetermined price. This plan serves multiple purposes, including motivating employees by aligning their interests with that of the company’s growth and share value.

-

These options provide tax benefits under certain conditions when exercised and sold, making them attractive to employees.

-

These do not qualify for special tax treatments and are taxed as ordinary income upon exercise.

Eligibility for these options often differs based on company policy, making it essential for participants to understand their standing within the plan. A Stock Option Committee typically manages these plans, ensuring compliance and overseeing the grants.

What are the key components of the stock option plan?

The key components of a stock option plan include detailed provisions on the option grants that are available. These specific conditions dictate who can participate in the plan and under what circumstances options can be granted.

-

Provisions detail the number of shares awarded, vesting schedules, and expiration dates.

-

These may include tenure requirements or performance milestones that must be met.

It's vital to have a summary of the principal provisions as outlined in the plan document to inform participants about what they can expect.

How to fill out the stock option approval form?

Completing the stock option approval form can seem daunting; however, with a systematic approach, it can be simplified. This form collects critical information regarding the applicant’s eligibility and the specifics of the stock options being requested.

-

Begin by thoroughly reviewing the requirements of your stock option plan before accessing the form.

-

Typically, you will need to provide your name, position, the number of options requested, and any relevant tax information.

-

Double-check entries against the plan's guidelines to avoid any discrepancies that may delay approval.

How to manage your stock options?

Managing your stock options effectively requires diligence and an understanding of different factors such as vesting schedules and tax implications. Keeping track of your options is crucial for financial planning.

-

Consider using tools provided on pdfFiller for tracking option grants visually so you can better understand your potential investments.

-

Be aware of your vesting schedule - the time period over which options become available for exercise.

-

Consult a tax advisor to understand the potential tax burden when exercising stock options.

What are the compliance and legal considerations?

Stock options are subjected to various laws and regulations, which vary by jurisdiction. Understanding these legalities is essential for compliance and avoiding common mistakes when completing the stock option form.

-

Ensure familiarity with local, state, and federal laws affecting your stock options.

-

Avoid failing to meet eligibility criteria or completing fields improperly, as these can result in your application being delayed or denied.

How to utilize interactive tools on pdfFiller?

pdfFiller offers robust features to edit PDF documents related to stock options efficiently. These tools not only help you complete forms but also facilitate smooth communication with your team.

-

You can make quick edits to forms, ensuring that data is correct before submission.

-

The electronic signature feature allows you to approve stock option forms without the need for printing.

-

Utilize collaboration tools to gather input from key team members during the approval process.

How to fill out the approval of stock option

-

1.Obtain the necessary stock option approval form from your company’s HR or finance department.

-

2.Open the PDF form using pdfFiller by uploading it or selecting it from your files.

-

3.Carefully read the instructions provided on the form to ensure you understand the requirements.

-

4.Fill in the required details such as the employee's name, position, and the number of options being approved.

-

5.If the form requires specific thresholds or conditions, ensure that these are accurately noted in the designated sections.

-

6.Review the entire form for accuracy, checking for any missing information or errors.

-

7.Once the form is completed, sign it electronically if required, or follow the provided instructions for printing and signing.

-

8.Submit the completed approval form to the relevant department, ensuring that all necessary parties are notified.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.