Get the free Investment-Grade Bond Optional Redemption template

Show details

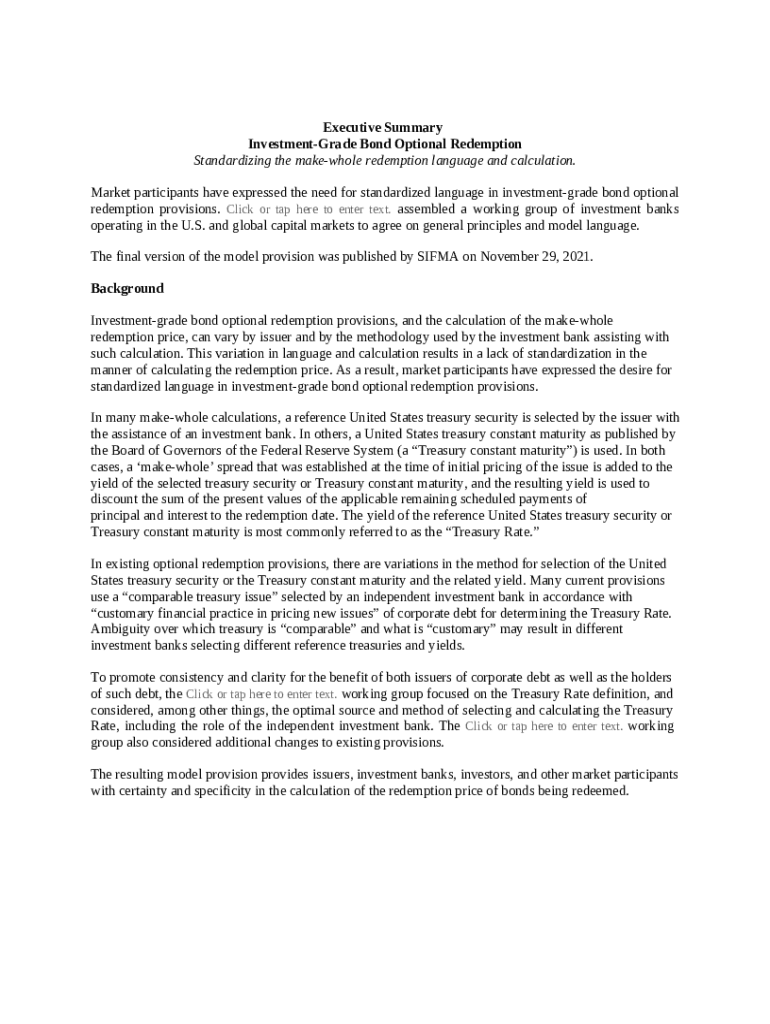

Executive Summary InvestmentGrade Bond Optional Redemption Standardizing the makewhole redemption language and calculation.Market participants have expressed the need for standardized language in

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is investment-grade bond optional redemption

An investment-grade bond optional redemption allows the issuer to redeem the bond prior to its maturity at specific times and under set conditions.

pdfFiller scores top ratings on review platforms

works exactly like I was hoping. Excellent software.

Great for editing and creating PDF's makes my job 100% easie

Great time saving service. Easy, efficient.

It works and is the best value I could find.

It's solved a HUGE need for our business.

Although I wish there were more forms from the American Welding Society, I have found this very useful for many of my needs.

Who needs investment-grade bond optional redemption?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to completing an investment-grade bond optional redemption form

Filling out an investment-grade bond optional redemption form can streamline the process of redeeming your bonds. This practical guide will walk you through each step, ensuring you have all the necessary information to successfully complete the form.

What are investment-grade bonds and their redemption clauses?

Investment-grade bonds are fixed-income securities rated 'BBB' or higher by major credit rating agencies, indicating a lower default risk. Optional redemption clauses allow bond issuers to redeem the bonds before their maturity date, providing flexibility in financial management. It's crucial to compare optional redemption with mandatory redemption, as the terms and conditions can significantly differ.

What is a make-whole redemption provision?

-

Make-whole redemption refers to a provision that allows the bond issuer to redeem the bonds at a price calculated to make the bondholder whole, factoring in the present value of future cash flows.

-

This provision ensures that bondholders receive fair compensation, promoting transparency and confidence in investment-grade bond markets.

-

The make-whole redemption price considers the yield of a comparable U.S. Treasury security, adjusted by a make-whole spread.

How is the redemption language standardized?

Standardization of redemption language is a response to market demand for clarity and simplicity. Various working groups focus on creating guidelines that enhance consistency across bond contracts. This standardization benefits both investors and issuers by reducing confusion and potential disputes.

What role does treasury security selection play?

-

A U.S. Treasury security is often used as a benchmark to determine the yield for calculating make-whole redemption prices.

-

Investment banks aid in selecting the most appropriate treasury security to reflect current market conditions effectively.

What are the components of the make-whole calculation process?

-

The calculation begins by adding a make-whole spread to the yield of the reference treasury security.

-

Subsequently, you must discount the present values of the scheduled payments to arrive at the total redemption amount.

-

Understanding the yield references is crucial, as varying terms can affect redemption calculations.

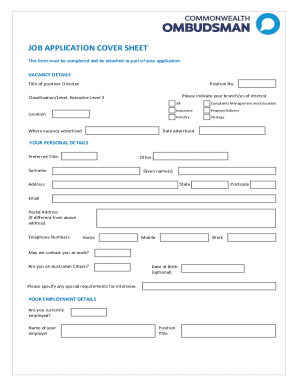

How to fill out the investment-grade bond optional redemption form?

-

Start by entering your personal information accurately in the designated fields of the pdfFiller form.

-

Many users encounter challenges with understanding specific redemption terms; consulting an expert can help clarify these points.

-

Take advantage of pdfFiller's editing and signing tools to ensure your form is correctly filled out and submitted.

What document management features does pdfFiller offer?

pdfFiller provides a robust platform for managing documents, offering features like cloud storage and real-time collaboration. Users can create, edit, and sign documents efficiently, ensuring a streamlined process. By utilizing the cloud-based document management system, teams stay organized and can access their materials from anywhere.

What are the legal considerations for bond redemption?

-

Understanding the legal framework surrounding bond redemptions is essential to ensure compliance with relevant laws.

-

Specific compliance considerations pertain to U.S. regulations, which may impact how redemption provisions are structured.

-

Investors should keep up to date with legal updates and changes to maintain compliance.

What does the future hold for investment-grade bond optional redemption?

Market trends suggest that bond redemption practices are evolving in response to changing investor preferences and legislative frameworks. Potential changes in laws could influence how optional redemptions are structured, leading to increased flexibility for issuers and investors alike. Staying informed on these trends is crucial for adjusting investment strategies.

Conclusion

The investment-grade bond optional redemption form is a key document for managing bond investments effectively. By understanding the definitions, calculations, and legal considerations involved, individuals and teams can utilize pdfFiller to streamline their experience in filling out and managing forms seamlessly. With the right tools and knowledge, navigating the bond landscape can be a smooth process.

How to fill out the investment-grade bond optional redemption

-

1.Download the investment-grade bond optional redemption form from pdfFiller.

-

2.Open the form in pdfFiller and ensure you have all required information at hand.

-

3.Begin by entering the bond's identification details: name, CUSIP number, and issue date in the designated fields.

-

4.Specify the amount to be redeemed and the proposed redemption date according to the bond's terms.

-

5.Include the signature field for the authorized signatory and ensure it is properly signed if required by the issuer.

-

6.Review all entered information for accuracy and completeness before submitting the form.

-

7.Save a copy of the completed form for your records after submission of the optional redemption request.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.