Get the free Stock Participation Plan of Maynard Oil Co. template

Show details

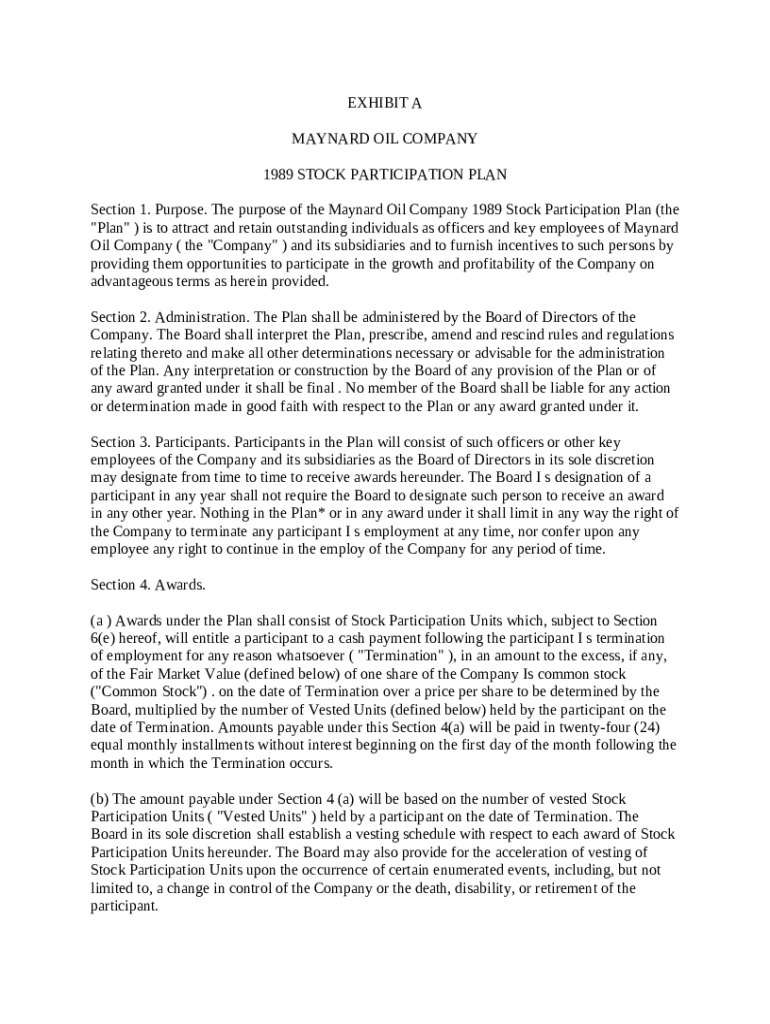

20-132 20-132 . . . Stock Participation Plan under which Board of Directors grants stock participation units to selected employees which entitle them to appreciation in value of corporation common

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is stock participation plan of

A stock participation plan is a program that allows employees to acquire stock in their company as part of their compensation package.

pdfFiller scores top ratings on review platforms

Great

Very user friendly and easy to use.

AWESOME

AWESOME HOW TO GO ABOUT

very good

very good website

GREAT

great platform where you can easily edit any form

Super easy and friendly

Super easy and friendly. Best editor I have used so far!

GREAT PRODUCT

GREAT PRODUCT

Who needs stock participation plan of?

Explore how professionals across industries use pdfFiller.

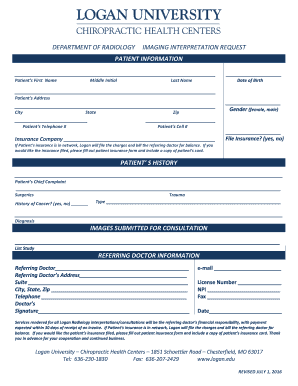

Understanding the Stock Participation Plan of Form Form on pdfFiller

To fill out a stock participation plan form, gather necessary information about the participant and the awards, use the interactive tools on pdfFiller for editing and signing, and ensure compliance with all requirements.

What is the purpose of the stock participation plan?

The stock participation plan serves a critical function in attracting and retaining key personnel such as officers and employees. It provides incentives that align with the company's growth and profitability, thereby fostering commitment and performance.

-

It serves as a competitive tool to attract top talent in the market.

-

Incentives tied to company performance encourage employees to work towards common goals.

How is the plan administered?

The stock participation plan is managed by the Board of Directors, who possess overarching authority regarding its interpretation and amendments. Their decisions are final and protect against liability when made in good faith.

-

The Board ensures that the plan is executed effectively and fairly.

-

The Board can amend the plan as necessary to respond to changing conditions.

How are participants identified?

Eligibility for the stock participation plan is determined at the discretion of the Board of Directors, with designations made annually. Importantly, the company retains the right to terminate participation at any time.

-

Participants are selected based on the Board's assessment and strategic objectives.

-

This annual designation allows for flexibility in participation.

What types of awards are under the stock participation plan?

Awards under the stock participation plan primarily consist of Stock Participation Units. These awards come with specific conditions and requirements as laid out in the plan documentation.

-

These units represent a financial interest in future stock options.

-

Details about conditions are clearly specified in the plan to ensure clarity.

How to fill out the stock participation plan form?

Filling out the stock participation plan form involves a clear step-by-step process. This includes entering participant details and award specifics, and making use of pdfFiller's interactive tools for editing, signing, and document management.

-

Follow the comprehensive guide created by pdfFiller to ensure accuracy.

-

Pay close attention to details such as participant names and award terms.

How to manage stock awards with pdfFiller?

Using pdfFiller, participants can efficiently track and manage their stock awards. The platform offers collaboration features for teams and options for eSigning and sharing documents.

-

Utilize tracking tools to monitor award status and deadlines.

-

Work seamlessly with stakeholders using file-sharing options.

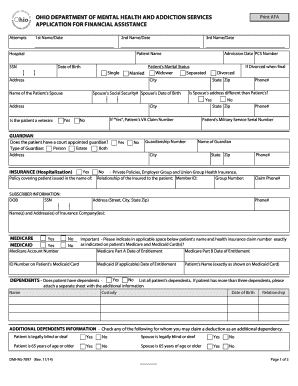

What are the compliance considerations?

Understanding compliance is vital in stock participation plans. Tax implications of stock awards must be considered, alongside ensuring regulatory compliance.

-

Be aware of potential tax liabilities that may arise from stock awards.

-

Ensure adherence to relevant laws and standards.

-

Maintain thorough records to support compliance efforts.

How to explore related documents and forms?

The pdfFiller platform provides an overview of related documents, such as Employee Stock Options and forms like Form W-2. Access additional resources for guidance on any transitions between different related forms.

-

Understand how Employee Stock Options integrate with others.

-

Easily navigate to other relevant forms and documents.

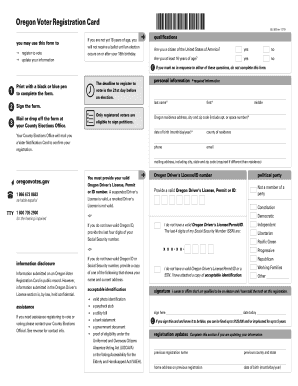

How to fill out the stock participation plan of

-

1.Access the stock participation plan form on pdfFiller.

-

2.Begin by entering your personal information at the top of the form including name, address, and employee ID.

-

3.Fill in the desired number of shares you wish to purchase under the 'Stock Options' section.

-

4.Review the eligibility requirements specified in the document and ensure you meet them before proceeding.

-

5.Complete the 'Payment Information' section to indicate how you will pay for the shares, such as via payroll deduction or direct payment.

-

6.Sign and date the form where indicated to confirm your acceptance of the plan terms.

-

7.Upload any necessary supporting documentation as prompted by the platform, such as proof of employment.

-

8.Once all fields are completed, review the entire document for accuracy before submitting.

-

9.Click the 'Submit' button to send your completed stock participation plan form for processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.