Get the free Summary of Terms of Proposed Private Placement Offering template

Show details

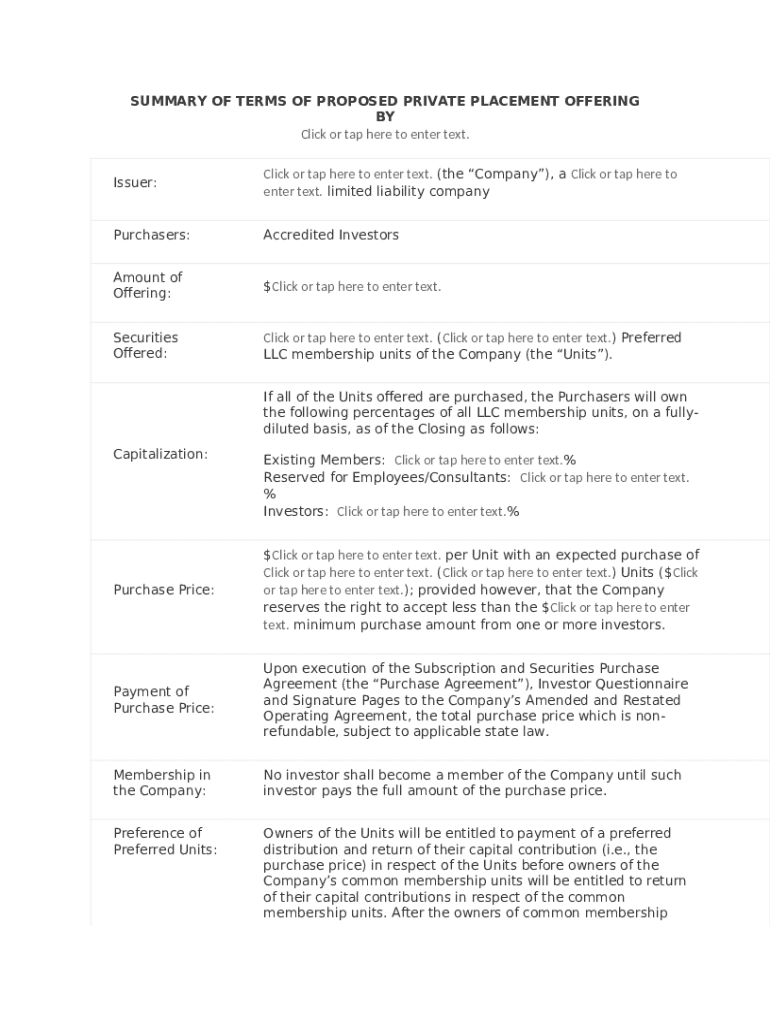

This Term Sheet summarizes the principal terms with respect to a potential private placement of equity securities of a "Company") by a group of investors ("Investors") led by a Venture Fund. This

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is summary of terms of

A summary of terms of is a concise document that outlines the key points and conditions of a legal agreement or contract.

pdfFiller scores top ratings on review platforms

It is a good tool but I just wasn't using it that much to justify the cost.

Not able to type two or three lines on the new Form BF item 6

Great program. Helped me with divorce papers recently and now I'm using it for my medical practice to fill out Workers Compensation Forms.

I just signed up today, lots of videos to show how to sue, learning curve

PDF filer is the perfect place for small business or start up businesses to go for much less expensive do-it-yourself renewals and many other type business files. My renewals looked awesome after I used their many tools to change the text and colors around!

Thanks PDF

MowsquitoTech,

Traverse City, Mi

It was easy to edit a bid i had to submit

Who needs summary of terms of?

Explore how professionals across industries use pdfFiller.

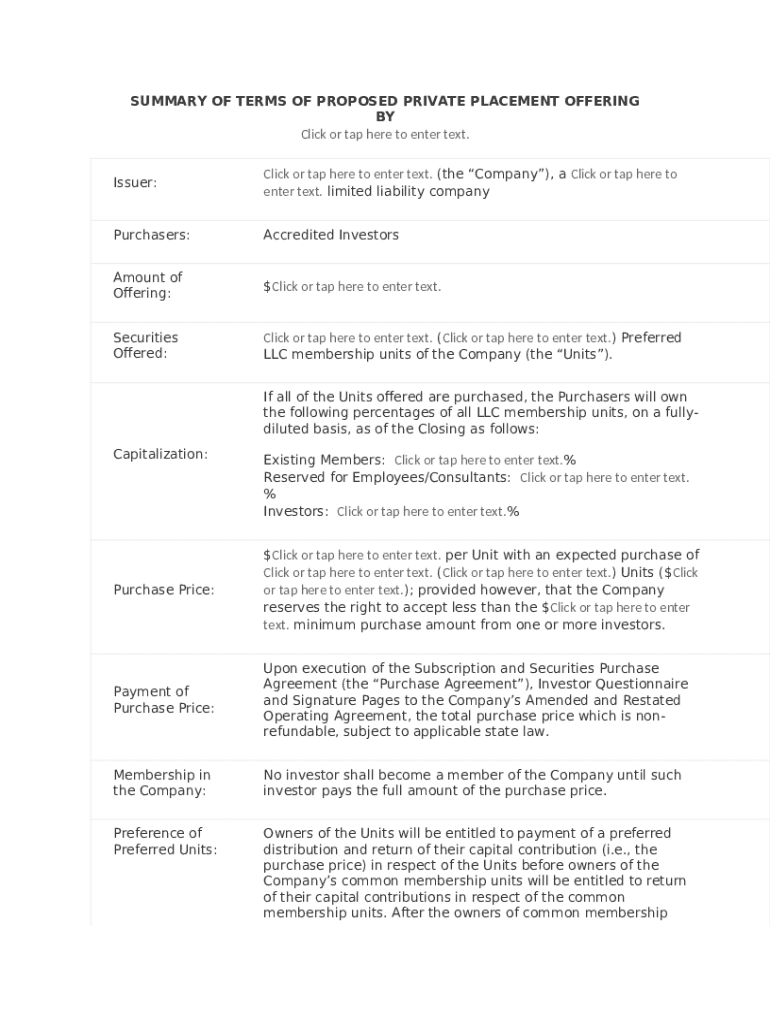

Summary of Terms of Proposed Private Placement Offering

A summary of terms of a form form is essential for understanding the nuances of private placements. This guide will take you through the specifics of a proposed private placement offering, addressing all key elements, from the initial understanding of private placements to compliance considerations.

What is a private placement offering?

Private placement offerings are investments made by selling securities directly to a select group of investors rather than through a public offering. This method allows issuers to raise capital while minimizing regulatory burdens. Key terms such as Private Placement, Issuer, and Purchasers are crucial to this process.

-

Selling securities to a small number of chosen investors, rather than publicly offering them to the general public.

-

The entity that is offering the securities to raise funds.

-

Individuals or entities that buy the securities being offered.

Comparing private placements to public offerings reveals significant differences in access and regulatory requirements, impacting how investments are approached.

What are key components of the offering document?

A well-structured offering document typically includes critical information about the issuer and the nature of the investment. Knowing the issuer's details and the legal structure of the company can influence an investor's decision significantly.

-

Detailed background about the entity issuing the securities.

-

Insight into the company's operations, mission, and governance.

-

Distinction between accredited investors and the general public, affecting who can participate in the offering.

What details of the offering must be specified?

Clarity on key financial aspects is paramount for potential investors. Understanding how much capital is needed, the type of securities being sold, and the corresponding purchase price is essential.

-

The total funds the issuer is seeking to raise, critical for understanding the scale of the investment.

-

Different types of units or shares available for purchase.

-

The cost per unit, which should be carefully determined to attract investors while valuing the offering appropriately.

How does ownership and capitalization work?

Ownership structures must be clear to avoid future disputes among investors. The offering document should lay out the ownership percentages of existing members versus new investors.

-

Outlining what share of the total capital is owned by current and new investors.

-

How the capital structure may influence potential returns for investors.

-

How additional offerings can dilute existing ownership stakes, impacting overall investor value.

What financial commitments are involved?

Understanding payment structures is vital for both the issuer and the investors. Clear specifications regarding how payments will be made can prevent confusion.

-

Detailed explanation of how and when the purchase price must be paid.

-

What documents investors need to sign and what to expect during the execution of the agreement.

-

Implications of any clauses that deem payments non-refundable, which could create risks for investors.

What are the investor membership regulations?

Assessing who qualifies to become a member of the issuing company is a critical component. Regulatory standards protect both the investors and the issuer.

-

Criteria necessary for individuals to invest in the offering.

-

Rights and obligations investors hold after purchasing units.

-

Rules surrounding how membership interests can be transferred, providing liquidity options for investors.

What are preferred units and their returns?

Preferred units often offer better returns than standard common shares. Understanding their importance can give investors distinct advantages.

-

Special shares that give holders certain privileges over common shareholders.

-

Preferred investors often receive dividends before common unit holders.

-

Considerations for how returns are distributed in case of liquidation or exit events.

What are compliance and regulatory considerations?

Navigating the regulatory landscape is crucial for the success of a private placement. Knowledge of state laws and required documents can ensure a smoother process.

-

Review of legal considerations based on geographic location.

-

Necessary forms and documentation required for regulatory compliance.

-

Tips for efficiently managing compliance checks during the offering.

How to use pdfFiller for document management?

pdfFiller provides an intuitive platform for managing your offering documents. From editing to eSigning, it consolidates necessary functionalities into an accessible interface.

-

Step-by-step guidance on how to modify your offering document efficiently.

-

Facilitates signing processes for all stakeholders involved.

-

Options for engaging with investors and making necessary changes collaboratively.

How to fill out the summary of terms of

-

1.Access pdfFiller and log into your account.

-

2.Select the 'Create New' option and choose 'Upload Document' to upload your blank summary of terms template.

-

3.Use the 'Text' tool to input key elements like names, dates, and essential terms of the agreement.

-

4.Ensure each section is filled with accurate and relevant information, summarizing complex topics into clear terms.

-

5.Utilize formatting options like bold or underlining to highlight important sections.

-

6.Review the document for completeness and accuracy by comparing it against the original agreement.

-

7.Once satisfied, save the document and choose the option to download or share it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.