Get the free Deed of Indemnity template

Show details

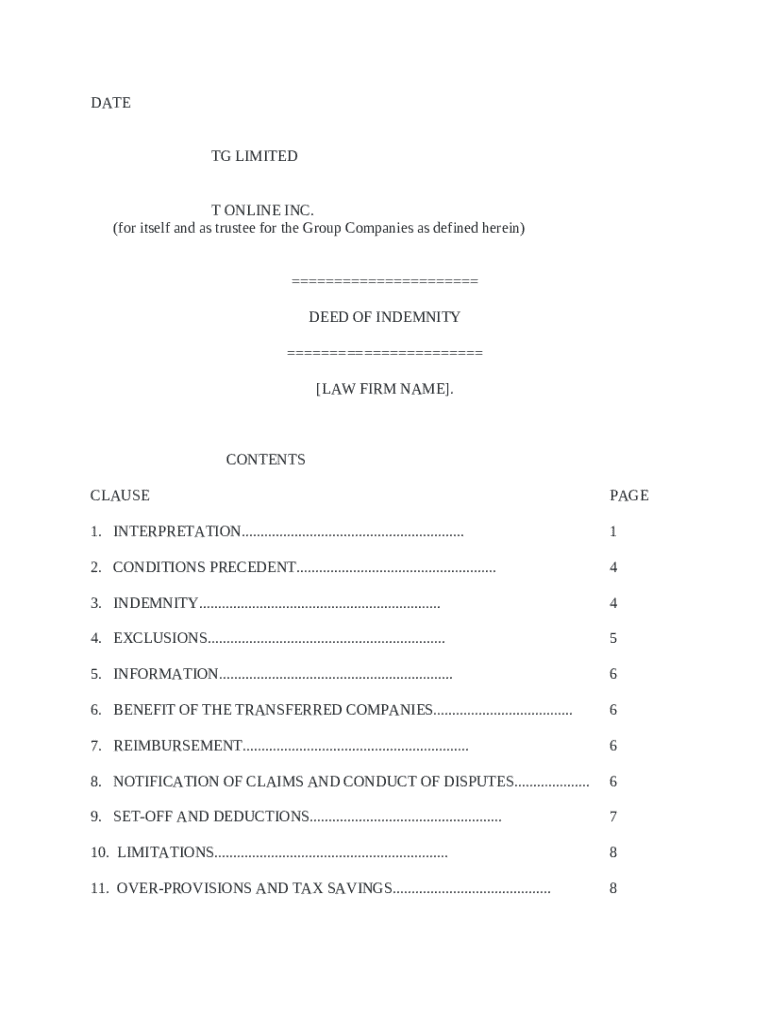

This is a sample Deed of Indemnity. A deed of indemnity is a type of agreement between multiple parties that specifies the consequences of a specific event or events, usually based on protecting

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of indemnity

A deed of indemnity is a legal document that provides protection against financial loss or liability incurred by one party due to the actions of another party.

pdfFiller scores top ratings on review platforms

GREAT.....AWESOME AND SELF EXPLANATORY...THANK YOU

So far so good. Limited usage at this point but seems simple and effective

I just signed up 10/5/2018 and it has saved me a ton of work! I am so impressed!

Still learning the in and outs but so far, a pretty good experience.

It makes our business so much easier to run. Our insured love not having to fill things out by hand (so do we!).

Great program. Easy to use and priced fairly. Keep up the great work!

Who needs deed of indemnity template?

Explore how professionals across industries use pdfFiller.

Deed of Indemnity Form Guide

How to fill out a deed of indemnity form

Filling out a deed of indemnity form involves a clear understanding of the key components and structure of the document. Ensure you have all required information at hand and utilize tools like pdfFiller for editing and signing to streamline the process.

What is a deed of indemnity?

A deed of indemnity is a legal document that outlines the arrangement between parties, where one party agrees to compensate the other for certain losses or damages. This type of agreement is crucial in protecting against future liabilities, thereby enhancing security in contractual relationships.

-

Establishes a legally binding obligation to indemnify losses.

-

Provides essential protection in business transactions and personal agreements.

-

Includes conditions for indemnification, obligations, and exclusions.

-

Used in scenarios such as contractor agreements, event planning, and affiliation contracts.

How is a deed of indemnity structured?

Understanding the structure of a deed of indemnity is essential for effective drafting. The layout usually consists of several distinct sections that clearly define the parties involved, the indemnified actions, and the legal obligations.

-

The specific date the agreement is entered into.

-

The party that promises to indemnify.

-

The entity benefiting from the indemnity protection.

-

Key clauses include indemnity clauses, exclusions, rights, and obligations.

How do you fill out a deed of indemnity form?

Completing the deed of indemnity form can be straightforward with proper guidance. Users should follow a systematic approach to ensure that all necessary information is accurately captured.

-

Begin with filling in the date and parties, followed by specific details of indemnity.

-

Avoid leaving sections blank or misrepresenting terms, as this can invalidate the agreement.

-

Ensure you have identifying documents for all parties involved.

-

Leverage pdfFiller’s features for real-time editing, signing, and managing the document.

What legal considerations come with a deed of indemnity?

A deed of indemnity carries significant legal implications. Parties entering such agreements should be aware of their rights and responsibilities, as well as any compliance requirements that may exist based on their region.

-

Understanding your rights in scenarios of defaults or breaches is crucial.

-

Be aware of any specific regulations that apply to your jurisdiction.

-

Ensure terms are clear and concise to withstand legal scrutiny.

-

Consulting with an attorney can provide clarity and enhance document validity.

How to manage risks with indemnity agreements?

Risk management is fundamental when dealing with indemnity agreements. A thorough understanding of risks involved allows parties to draft agreements that mitigate potential disputes.

-

Common risks include financial liabilities and compliance failures.

-

Draft terms that limit exposure and outline specific indemnity events.

-

Establish clear processes for resolving claims to avoid escalation.

-

Use the platform to maintain systematic records, allowing easy reference during disputes.

Final thoughts on using a deed of indemnity form

In conclusion, mastering the deed of indemnity form is crucial for effective risk management and legal protection. Utilizing pdfFiller can simplify the process, enabling seamless document editing, signing, and management.

-

Focus on clarity and completeness when drafting your deed.

-

Consider pdfFiller for ongoing document management and access to tools.

-

Explore additional templates and resources for comprehensive form management.

How to fill out the deed of indemnity template

-

1.Begin by downloading the deed of indemnity template from pdfFiller.

-

2.Open the template in the pdfFiller interface.

-

3.Fill in the names of the parties involved at the top of the document.

-

4.Specify the context of the indemnity, explaining the circumstances under which indemnification is provided.

-

5.Clearly outline the obligations and liabilities that are covered under the indemnity.

-

6.Include any specific terms or conditions associated with the indemnity agreement.

-

7.Provide space for signatures, ensuring that all parties initial or sign the document.

-

8.Review the document to ensure all information is accurate and complete.

-

9.Save the filled document and share with relevant parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.