Get the free Bankruptcy Client Interview template

Show details

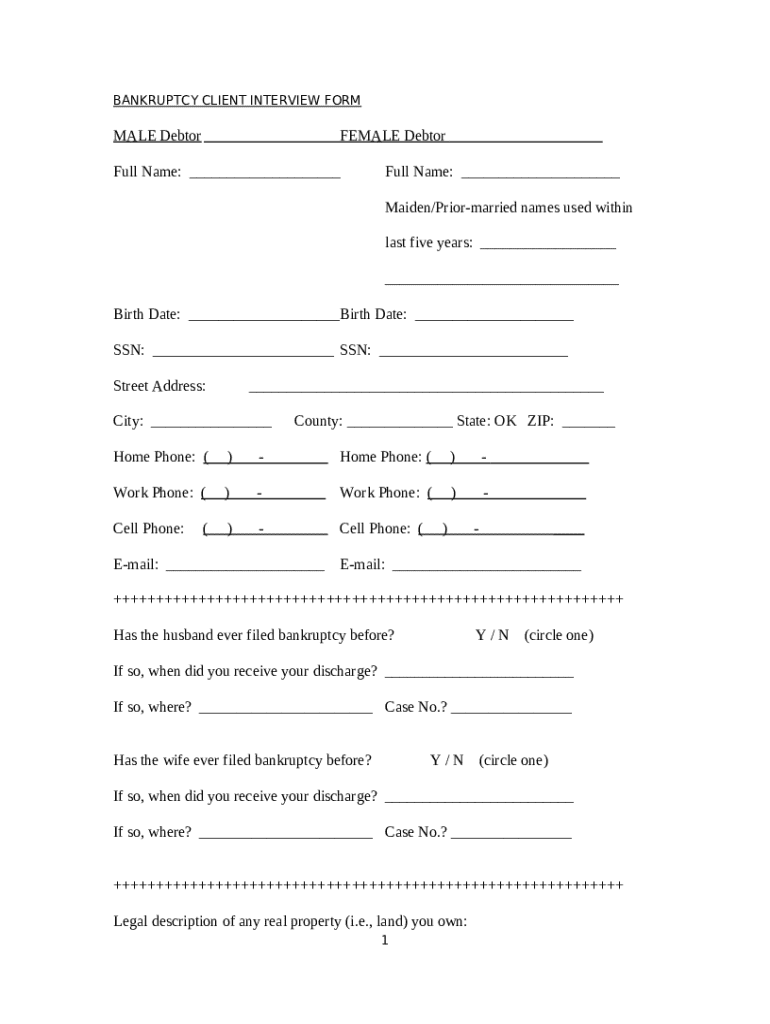

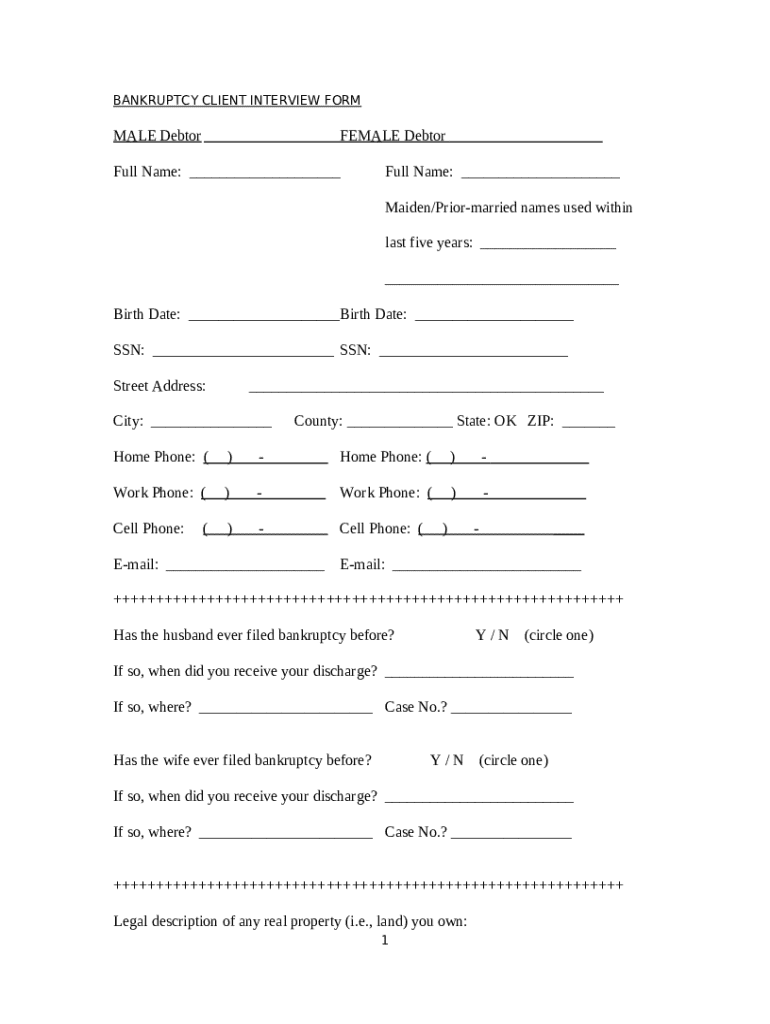

This forms allow the attorney to gather all necessary information about a debtor. The questionaire includes personal, financial, property, employment and debt information.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is bankruptcy client interview form

A bankruptcy client interview form is a document used by attorneys to gather essential financial information from clients seeking bankruptcy protection.

pdfFiller scores top ratings on review platforms

Really helped me out. I could not figure out how to be able to fill in the information. I would recommend to everyone!

I am very happy with PDF filler. I have only used it for one document so far, but I have no complaints except for the pop up every time you open the form.

App should be more user friendly with text boxes that explain the functions, when needed.

service was timely and effective Follow up was also timely, succinct and focused on the issues I needed addressed thank you

Easy to work with. My problem was printing.

Very quick to fix any problems you might have.

Who needs bankruptcy client interview template?

Explore how professionals across industries use pdfFiller.

How to effectively complete a bankruptcy client interview form

What is a bankruptcy client interview form?

The bankruptcy client interview form is a crucial document used in the bankruptcy filing process. It collects personal and financial information to determine eligibility for bankruptcy relief and to facilitate the review of the client's financial situation. Understanding this form is essential for anyone considering bankruptcy as it informs the legal process and ensures accurate representation of financial status.

-

A structured document capturing all relevant financial information from clients.

-

Accurate details are vital for the legal proceedings and decisions of the case.

-

pdfFiller offers interactive tools to edit and complete this form effortlessly.

What key information should you collect from debtors?

Accurate collection of specific personal and financial details is essential during a bankruptcy client interview. This information will not only streamline the process but also ensure all necessary disclosures are made. Specific focus should be on collecting comprehensive personal details, contact information, and understanding the impact of marital status on bankruptcy filings.

-

Capture full names, maiden names (if applicable), birth dates, and Social Security Numbers (SSN).

-

Ensure current address, phone numbers, and email addresses are documented.

-

Discuss how marital status may influence the filing process and debt liability.

What documents relate to past bankruptcy filings?

Understanding prior bankruptcy applications is crucial in the client interview. Gathering information about past cases, discharge dates, and outcomes can help tailor a current filing to ensure a smoother process. This knowledge informs potential errors that must be avoided in the current application.

-

Clients should disclose any previous bankruptcy filings which may affect the current process.

-

Knowing the discharge dates on prior filings can determine the viability of a new application.

-

Obtaining previous case numbers helps in retrieving records and understanding past outcomes.

How to disclose real property and assets?

Full disclosure of real property and assets is pivotal in the bankruptcy process. This section details how ownership is structured and the associated responsibilities concerning mortgages and other debts. Properly evaluating assets allows for informed decisions regarding retention versus liquidation during bankruptcy.

-

Include comprehensive legal descriptions of properties owned to ensure clarity and legal correctness.

-

Document mortgage information, account numbers, and estimated market values of properties.

-

Explore options for retaining properties despite outstanding mortgage balances.

What to do during automobile assets evaluation?

When evaluating automobile assets, detail is key. Clearly specifying the make, model, year, and VIN solidifies ownership verification and market value assessment. This will highlight any potential options to retain vehicles amidst bankruptcy.

-

Essential details such as make, model, year, and VIN should be clearly listed.

-

Document financiers involved with the vehicle and assess the outstanding balance.

-

Decide whether to keep vehicles based on their current market value versus outstanding debts.

How to fill out the bankruptcy client interview form?

Accurate completion of the bankruptcy client interview form is crucial for ensuring no important information is omitted. Following a step-by-step guide can simplify this often complex process. Leveraging pdfFiller’s interactive tools allows users to complete and edit their forms conveniently.

-

Use a structured approach aligning with the form's sections for accurate completion.

-

Take advantage of features like digital signature options, text edits, and form sharing functionalities.

-

Utilize cloud storage for saving documents and share them securely from anywhere.

What are best practices for submission?

Finalizing and submitting the form includes several best practices to ensure compliance with bankruptcy court requirements. Proper management of digital documents and understanding the submission process will aid in avoiding common pitfalls.

-

Ensure documents are signed digitally or physically as per the court's requirements.

-

Familiarize yourself with the bankruptcy court's procedures to prevent any delays.

-

Lean on pdfFiller's features to streamline form submission for efficiency.

What common mistakes should you avoid?

Whether it's omissions or inaccuracies, common mistakes when completing the bankruptcy client interview form can delay the process. Knowing these pitfalls enables clients to approach their applications with greater caution and precision.

-

Certain sections may be easy to miss; thorough checks against a checklist can be beneficial.

-

Discrepancies can lead to complications or even dismissal of a bankruptcy case.

-

Use built-in features to check for errors before final submission.

How to fill out the bankruptcy client interview template

-

1.Start by downloading the bankruptcy client interview form in PDF format from the provided link.

-

2.Open the form using pdfFiller to access the editing tools.

-

3.Begin by entering your personal information, including your full name, address, phone number, and email.

-

4.Provide details about your financial situation, including monthly income, expenses, assets, and liabilities.

-

5.Ensure you list all creditors, along with their contact information and the amount owed.

-

6.Answer any additional questions related to your previous bankruptcy filings, if applicable.

-

7.Review the completed form for accuracy and completeness before submission.

-

8.Once you are satisfied with the information provided, save the document and download a copy for your records.

-

9.Finally, submit the form according to your attorney's instructions, either electronically or in person.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.