Get the free Employees' Stock Deferral Plan for Norwest Corp. template

Show details

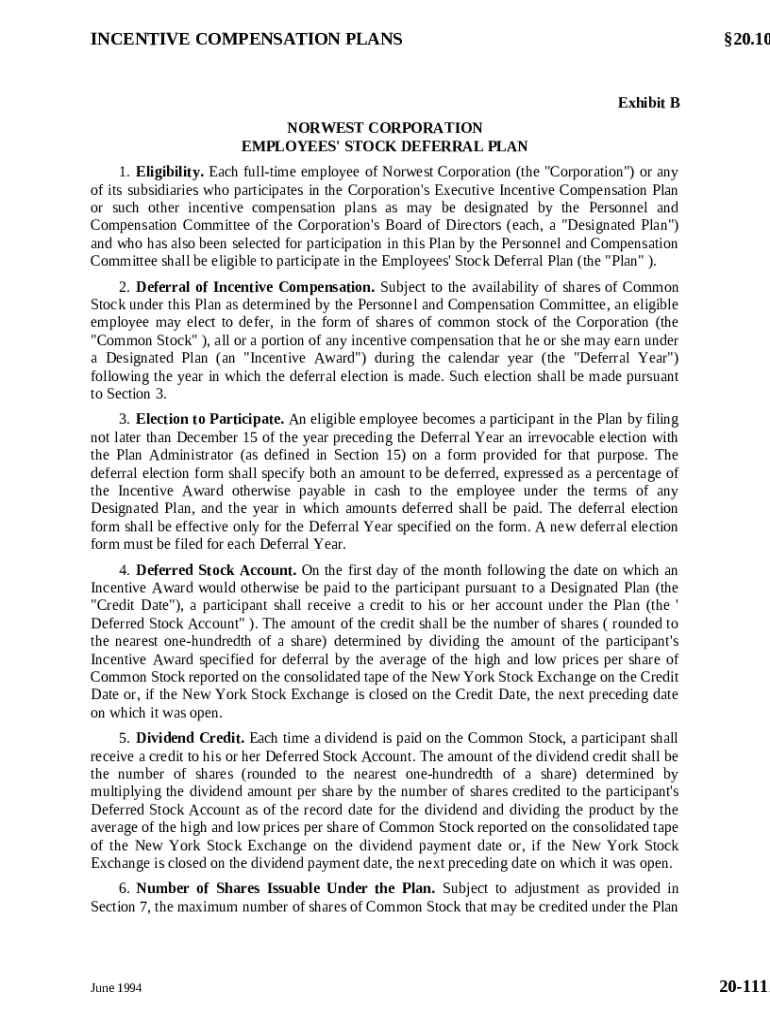

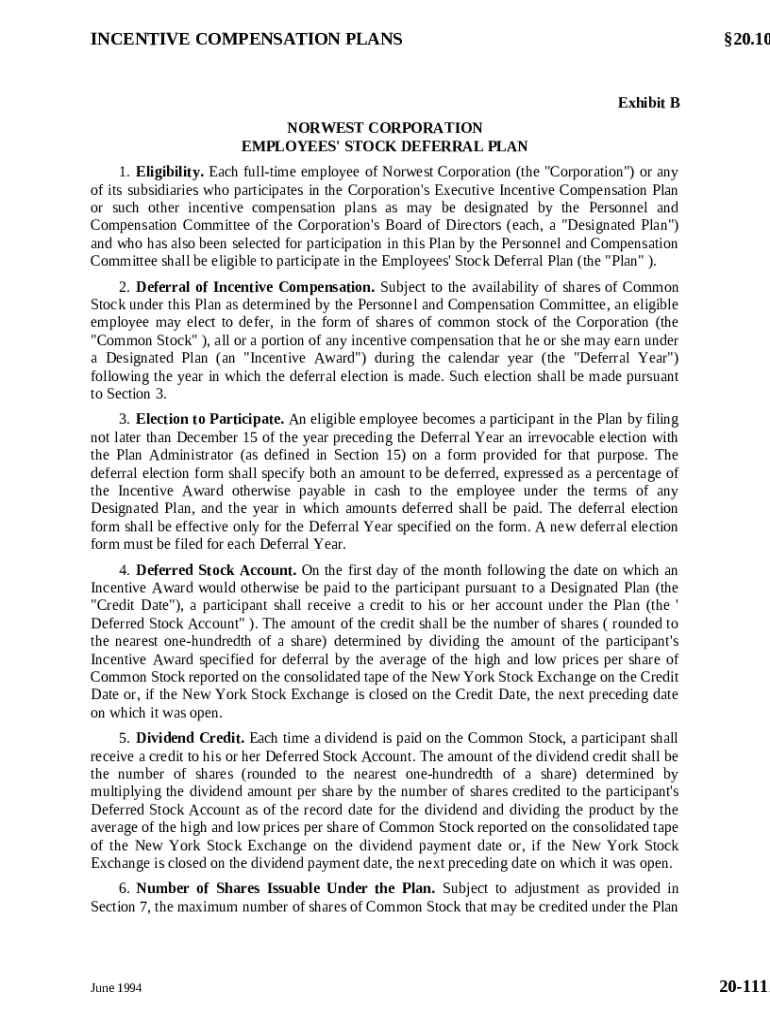

20-110 20-110 . . . Employees' Stock Deferral Plan which allow participants to defer to later year certain compensation which would otherwise be includable in income for tax purposes in year in which

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is employees stock deferral plan

An employees stock deferral plan is a retirement savings arrangement allowing employees to defer a portion of their salary to purchase company stock or mutual funds, often at a discounted rate.

pdfFiller scores top ratings on review platforms

Overall good experience. Sometimes have difficultly moving text box in my iPad. Very useful though. Thank you!

It's easy to use, eliminating the need to printout, fill in and scan forms. It makes my life easier.

Customer service is helpful and quickly resolved my problem.

I love the site, I don't like all of the pop ups though! I constantly have to click out of the pop ups when opening a new form. That is my only complaint! But, all in all, I love this site and it helps me be more efficient.

Very Quick, saves me a lot of time. I regularly get pdf's that need to be completed and sent back. Now I can upload, fill out and return in a fraction of the time. Since the data is typed, I never get a question about what I wrote.

I can't believe how easy it is to fax with PDFiller! Awesome!

google drive connection issues, but overall great product

Who needs employees stock deferral plan?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Employees Stock Deferral Plan Form

This comprehensive guide details everything you need to know about the employees stock deferral plan form, including how to fill it out correctly and what to expect from the process.

What is the employees stock deferral plan?

An employees stock deferral plan is a financial arrangement that allows eligible employees to defer a portion of their stock awards to a later date, potentially reducing their immediate tax liabilities. Such plans are designed to benefit employees by offering a means to save and manage their stock-based compensation more effectively. The primary purpose is to provide flexibility in taxation and investment opportunities for the employees.

-

The plan allows employees to postpone tax on their stock awards, optimizing their financial strategy.

-

Benefits include tax deferral, potential investment growth, and the ability to manage stock compensation more effectively.

Who is eligible to participate in the plan?

Eligibility criteria for participating in the employees stock deferral plan generally include full-time employment status and working for an organization that offers such a plan. This eligibility often has specific parameters dictated by the company’s personnel and compensation committee.

-

Typically, full-time employees are granted eligibility based on company policy.

-

Companies establish designated eligible stock plans with clear guidelines to ensure fairness.

-

Companies define eligibility through a structured selection process, usually managed by HR or a compensation committee.

How to make a deferral election?

Making a deferral election is crucial for maximizing the benefits of the employees stock deferral plan. This process involves submitting a deferral election form which specifies the amount of stock compensation you wish to defer.

-

Submit the deferral election form by the designated deadline for your plan to be active.

-

Carefully select the percentage of your incentive award to defer, considering your financial situation.

-

Remember to file a new deferral election each year to maintain your participation in the plan.

What should you know about managing your deferred stock account?

Once you have deferred stock, it's important to manage it effectively. Deferred stock accounts provide an overview of your investments and the performance of your deferred incentives.

-

Understand your deferred stock account and what is held within it.

-

Keep track of your deferments to make informed decisions on stock management.

-

Be aware of the tax implications for your deferral elections to avoid surprises at tax time.

What are common challenges and solutions?

Employees might face various challenges when filing their deferral election forms or managing their deferred stock. Understanding these common issues can help mitigate risks and facilitate better planning.

-

Mistakes in filing can lead to delays or disqualification from the plan.

-

Utilize resources such as pdfFiller to help you navigate complex forms.

How to use pdfFiller for your documentation needs?

pdfFiller offers a cloud-based solution to streamline your documentation processes, making filling out, signing, and managing forms much simpler. This platform empowers users to collaborate more effectively.

-

Easily edit and sign files digitally on pdfFiller, saving you time.

-

Access your documents from anywhere, enhancing flexibility and productivity.

-

Integrate with various tools for improved collaboration on form submissions.

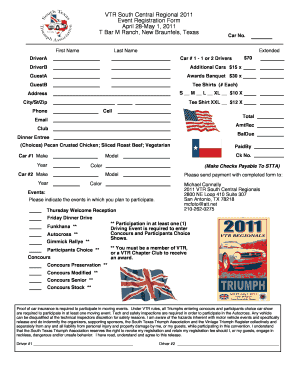

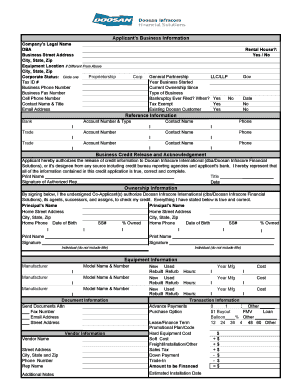

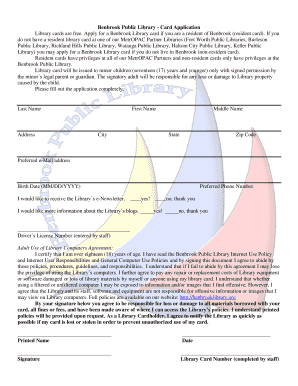

How to fill out the employees stock deferral plan

-

1.Access the PDF document of the employee stock deferral plan through pdfFiller.

-

2.Begin by entering your personal information in the designated fields, including your full name, employee ID, and department.

-

3.Next, specify the percentage of your salary you wish to defer into the plan by filling in the appropriate section.

-

4.Select the type of stock or mutual fund you want to invest in from the provided options.

-

5.Review the terms and conditions outlined in the plan and check the box indicating you agree to them.

-

6.If applicable, provide any additional information or special requests in the comments section if included in the form.

-

7.Finally, before submitting, review all the entries to ensure accuracy and completeness, then sign and date the document as required.

-

8.Click the 'Submit' button to send your filled plan to the appropriate department for processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.