Get the free Deed of Tax Indemnity template

Show details

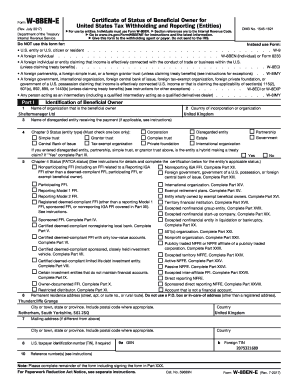

This is a sample Deed of Tax Indemnity. A Tax Deed is customarily entered in conjunction with the share purchase agreement. The Deed is usually an unconditional indemnity in respect of tax liabilities

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of tax indemnity

A deed of tax indemnity is a legal document that protects one party from financial loss due to another party's tax liabilities.

pdfFiller scores top ratings on review platforms

I usually use this program during a translation process when I get a request to translate a document in form of PNG or similar. But I believe that this app can still be further enhanced.

Interesente practico resulve muchos problemas y da muy buenas presentaciones profesionales les felicito muchas gracias

IT HELP ME OUT WITH THE PROBLEM THAT I WERE WORK WITH

good

It's okay

Tried so many others and this one works!

Who needs deed of tax indemnity?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Deed of Tax Indemnity Form on pdfFiller

How does a deed of tax indemnity work?

A deed of tax indemnity is a legal document that provides protection to one party against certain tax liabilities incurred by another party. It is crucial in various business transactions, particularly mergers and acquisitions, where unanticipated tax obligations may arise post-transaction. The party that assumes the risk is known as the Indemnifier, while the company benefiting from the indemnity is referred to as the Indemnitee.

Understanding the deed of tax indemnity

-

The deed serves as a contract between parties that outlines the conditions under which one party agrees to compensate the other for tax liabilities.

-

It safeguards businesses against unexpected tax liabilities that may surface after a transaction, ensuring financial stability.

-

Typically used in corporate acquisitions, real estate transactions, or any situation wherein the tax obligations transferred could impact profitability.

What are the essential components of the tax indemnity deed?

-

The deed must clearly identify the Indemnifier, who agrees to cover liabilities, and the Indemnitee, who requires this protection.

-

Key clauses such as indemnification limits, conditions for claims, and dispute resolution processes must be articulated to prevent misunderstandings.

-

Complete and accurate information about all parties involved must be included to validate the contract's enforceability.

How can you fill out the deed of tax indemnity form?

Filling out the deed involves careful attention to detail, ensuring all necessary information is correctly inputted. Start with the 'Dated' field to establish the agreement's effective date and proceed to fill out identifying information for both the Indemnifier and the Company.

-

Establish the effective date of the agreement here, as it sets the timeline for liability coverage.

-

Ensure names are spelled correctly and match the legal documents for all parties involved.

-

Accurate contact details facilitate smooth communication regarding any necessary clarifications or claims.

-

Clearly state the conditions under which the indemnity will apply, particularly in complex transactions.

How do you edit and customize the deed using pdfFiller?

pdfFiller offers a range of editing tools designed to simplify the customization of documents like the deed of tax indemnity. Users can leverage these functionalities to amend terms or insert specific requirements tailored to their business context easily.

-

The platform allows users to add, delete, or modify clauses in real time, making it incredibly adaptable.

-

Saving changes promptly avoids data loss and enables tracking of document revisions effectively.

-

The eSign feature ensures that the deed can be signed securely and efficiently, eliminating the need for physical copies.

Why should you choose pdfFiller for document management?

Opting for a cloud-based solution like pdfFiller streamlines the document management process and enhances collaboration among team members.

-

Users can access their documents from anywhere, providing flexibility and ease of use.

-

Multiple users can work on the same document simultaneously, facilitating teamwork.

-

pdfFiller complies with legal standards, ensuring all documents are secure and trustworthy.

What are the best practices for implementing a tax indemnity deed?

-

Engaging legal counsel ensures the deed meets specific regulatory and legal standards.

-

Proper documentation of all agreements and communications will provide clarity and support throughout the indemnity period.

-

Regular assessments of the deed and its relevance to the ongoing business operations are essential for maintaining protection.

How to fill out the deed of tax indemnity

-

1.Open the PDF file of the deed of tax indemnity on pdfFiller.

-

2.Carefully read through the entire document to understand its sections and requirements.

-

3.Begin with the date at the top of the document, and fill in the appropriate date format.

-

4.Identify the parties involved and input their full legal names and contact details in the designated fields.

-

5.Fill out the description of the property or subject matter related to the indemnity, ensuring accuracy.

-

6.Input the specific tax responsibilities that are being indemnified, clearly outlining the extent of the indemnity.

-

7.Have parties involved sign and date the document where indicated, ensuring that all signatures are accompanied by printed names.

-

8.Review the filled-out document for any errors or missing information before finalizing it.

-

9.Save the completed document and, if necessary, share it with the relevant parties to execute the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.