Get the free Stock Option Grants and Exercises and Fiscal Year-End Values template

Show details

This sample form, a detailed Stock Option Grants and Exercises and Fiscal Year-End Values document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is stock option grants and

Stock option grants are agreements that provide employees or investors the right to purchase company stock at a predetermined price within a specified timeframe.

pdfFiller scores top ratings on review platforms

It is a great product and is very user friendly!

the ease of using this to edit and send is beyond anything i can ask for!

Love this. I've used this over the years. one thing is they need to update on the forms the year!!!! still have 19xx(should be 20xx)

Very user friendly. Best PDF editing platform I have used

I love it and appreciate the ease of use.

Still finding it hard to locate the proper document ?

Who needs stock option grants and?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to stock option grants and forms

How to fill out a stock option grants and form form

Filling out a stock option grant form involves a systematic approach to ensure accuracy. Start by gathering all relevant information such as the number of shares being granted and the exercise price. Utilize tools like pdfFiller for easy editing, signing, and management of your form.

Understanding stock option grants

Stock option grants are agreements that give employees the right to purchase a company's stock at a set price, usually referred to as the exercise price. This option can motivate employees by aligning their interests with shareholders.

-

These are financial incentives that allow employees to buy company shares at a predetermined price.

-

Stock options provide the right to purchase shares at a fixed price, while restricted stock grants involve actual shares that may have restrictions on selling.

-

They allow employees to benefit from stock appreciation, potentially resulting in substantial financial rewards upon exercising their options.

What are the types of stock options?

There are primarily two types of stock options: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Each type has distinct tax implications and rules governing their use.

-

ISOs can provide favorable tax treatment, allowing employees to defer taxes until shares are sold, provided specific criteria are met.

-

NSOs are less restrictive but do not offer the same tax advantages as ISOs; taxes are owed upon exercise.

-

ISOs require holding periods and are only available to employees, while NSOs can be granted to non-employees as well.

How to fill out stock option grant forms?

Completing stock option grant forms involves knowledge of standard fields and procedures to ensure compliance and accuracy.

-

Follow a structured approach starting from personal information to additional specifics, using logical formatting.

-

Key entries such as number of shares granted, exercise price, and any applicable expiration dates are essential.

-

pdfFiller offers features for editing, signing, and securely managing stock option grant forms online.

How do you value stock options?

Valuing stock options involves calculating the potential earnings based on future stock prices and market conditions.

-

Use mathematical models to project future stock prices based on assumed appreciation rates.

-

Recognizing how stock prices are expected to change can significantly impact option valuing decisions.

-

Consider discussing scenarios that illustrate how realizable values vary and the tax impact on stock option exercises.

When and how to exercise stock options?

Exercising stock options should be timed for maximum benefit, considering market conditions and tax implications.

-

Understand that exercising options can create taxable income, influencing your overall tax situation.

-

Avoid missing exercise windows and failing to understand the financial consequences of your decisions.

Why is tracking and reporting stock options important?

Maintaining records of stock option grants and exercises is critical for compliance and personal financial management.

-

Accurate tracking helps ensure proper reporting for taxes and prevents issues arising from lost or misplaced information.

-

Transaction reporting can vary; it's important to understand what is required to comply with IRS regulations.

-

pdfFiller provides streamlined options for organizing records, making it easier to manage your stock options.

What are the compliance regulations for stock option grants?

Compliance with federal and state regulations ensures that stock option grants are managed correctly to avoid legal issues.

-

Understand the necessary legal frameworks that dictate how stock options must be documented and reported.

-

Each state may have unique regulations that can impact how stock options are offered and taxed.

-

pdfFiller's features assist in keeping your documentation compliant and organized.

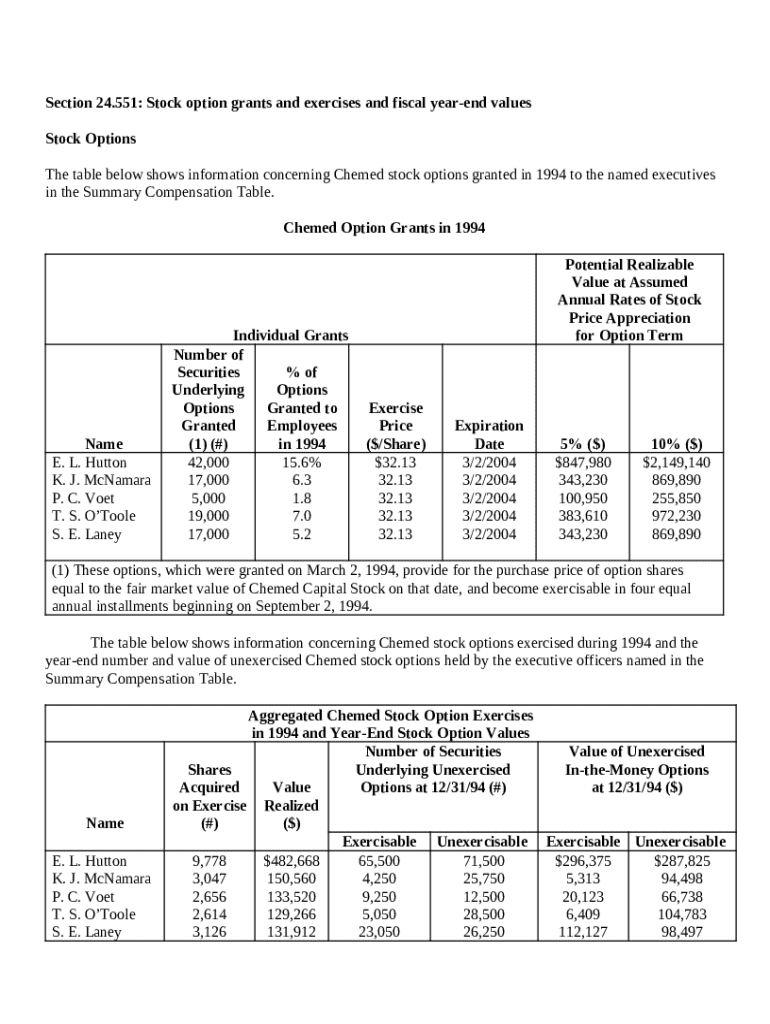

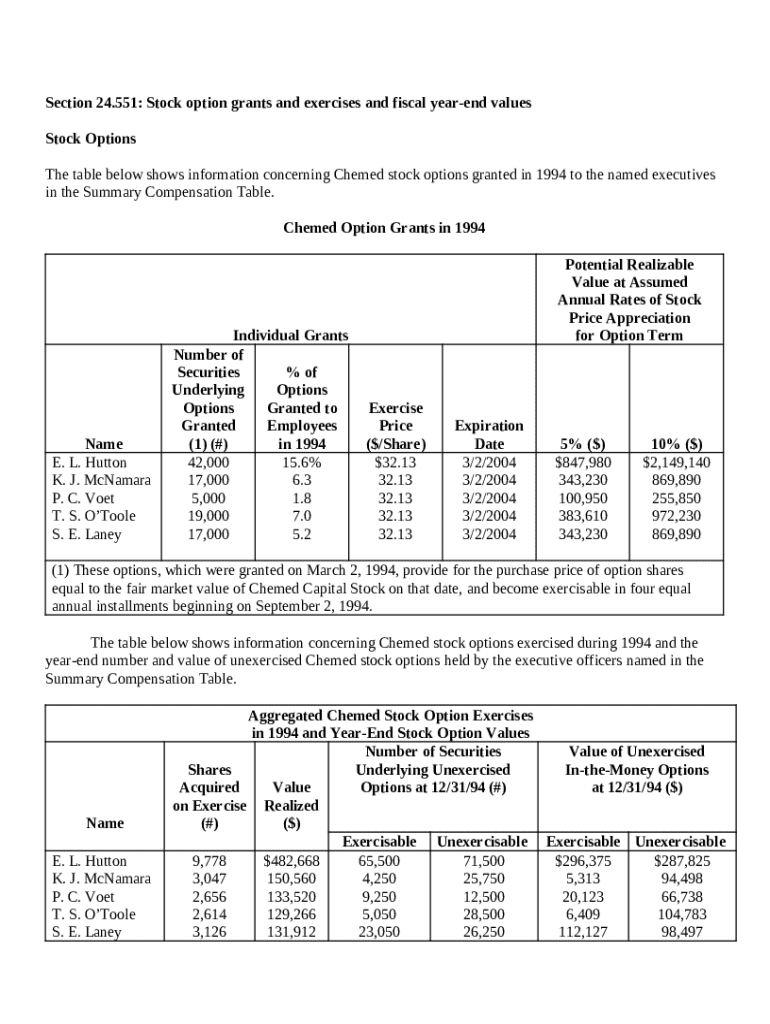

Real-world examples of stock option grants

Examining actual corporate stock option grants can provide insights into how these financial instruments work in practical scenarios.

-

These examples highlight different strategies companies employ regarding stock options.

-

Understanding specific terms can inform decisions and expectations regarding stock options.

-

Consider various outcomes based on different market conditions and their effect on the options granted.

How can pdfFiller enhance document management?

pdfFiller offers an intuitive platform for managing stock option forms efficiently through its robust features.

-

From document editing to electronic signing and managing collaboration, pdfFiller provides essential tools for efficient documentation.

-

Utilize the platform for real-time collaboration, ensuring all team members are updated with the latest information.

-

pdfFiller ensures enhanced document security to protect sensitive information related to stock option grants.

How to fill out the stock option grants and

-

1.Open the stock option grant form on pdfFiller.

-

2.Review the introductory information to understand the purpose of the document.

-

3.Fill in the employee's name and position in the designated fields.

-

4.Enter the number of stock options being granted and the exercise price clearly.

-

5.Include the grant date and specify the vesting schedule if applicable.

-

6.Sign the document electronically in the appropriate signature field.

-

7.Review all entered information for accuracy before finalizing.

-

8.Save the completed document and download it for your records.

-

9.Distribute copies to the involved parties, such as the employee and HR department.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.