Get the free Internal Revenue Service Ruling Letter template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is internal revenue service ruling

An Internal Revenue Service ruling is a written statement issued by the IRS that interprets and applies tax laws to specific situations or transactions.

pdfFiller scores top ratings on review platforms

Great UI and lots of templates to…

Great UI and lots of templates to choose from. Overall great utility.

Easy to use

Easy to use. No glitches, excellent support

EXCELLENT customer support

I had a great experience with PDFfiller. Although I was not able to keep my subscription with them, their customer support was fantastic and their services are great.

I love the product and service

I love the product and service, and will soon use all my 5 licenses. Honored to reference your Company for any prospects. Keep up the good work and stay safe.Thanks and regardsAlan L. Krishnan(703) 628-6422

Great program

Great program - still learning, but it's easy to follow!

Best pdf editor

It is so easy to use

Who needs internal revenue service ruling?

Explore how professionals across industries use pdfFiller.

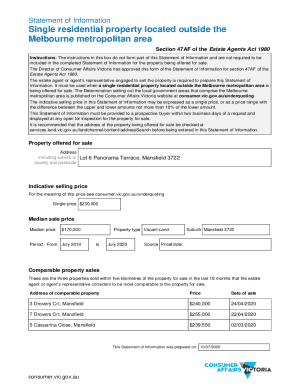

Internal Revenue Service Ruling Form Guide

How to fill out an internal revenue service ruling form

Filling out an Internal Revenue Service (IRS) ruling form is essential for ensuring tax compliance. A detailed understanding of the form and the IRS's ruling process can save you time and prevent costly mistakes. This guide provides step-by-step instructions to help you effectively complete the form and manage your documents using pdfFiller.

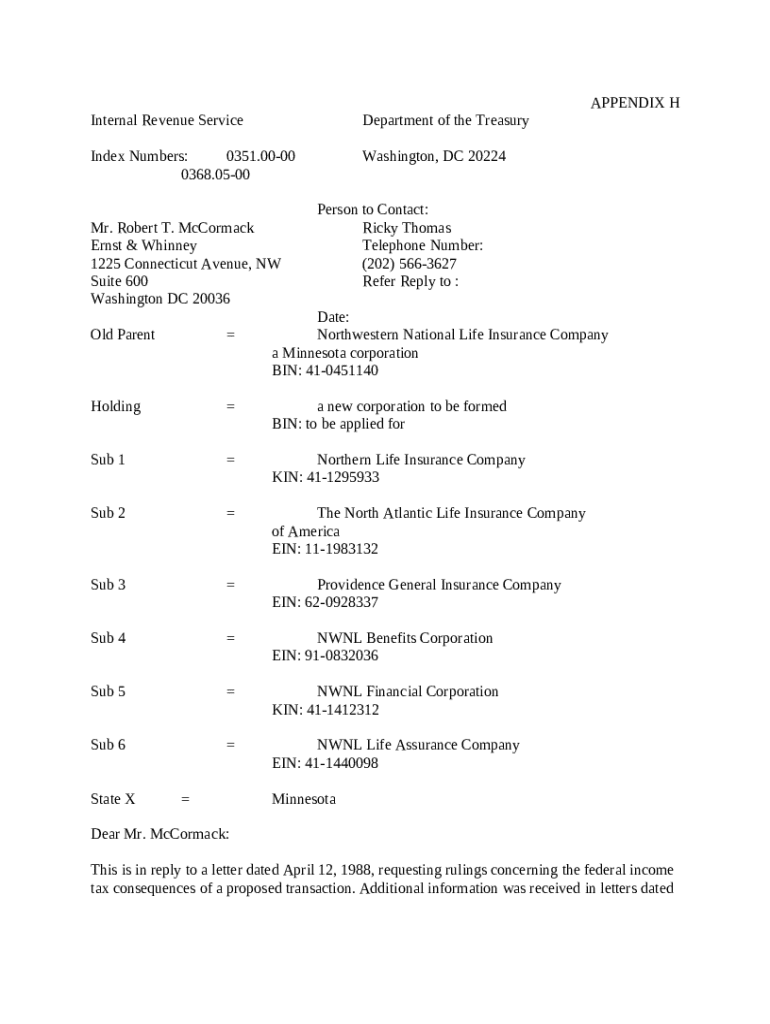

What are IRS rulings and forms?

-

An IRS ruling is a formal interpretation or application of tax laws that clarifies the tax implications of specific transactions or situations, which is significant for maintaining proper tax compliance.

-

Different forms are associated with various rulings, such as Form 1023 for charitable organizations or Form 8832 for entity classification. Understanding the right forms is crucial in the IRS ruling process.

-

The Internal Revenue Code provides the legal framework for tax laws, and IRS rulings often reference specific code sections. Knowing these references can enhance your understanding of rulings.

What are the key sections of the IRS ruling form?

-

The form usually begins with sections for basic contact information, which must be filled out accurately to avoid delays in processing.

-

Index Numbers categorize your ruling requests while Entity Information identifies the taxpayer. Proper completion of these sections is vital for accurate tax processing.

-

Filling out these sections correctly ensures that your request is clear and meets IRS requirements, making it less likely that you'll face requests for further information.

How do fill out the IRS ruling form step-by-step?

-

Make sure to gather all necessary documents and information ahead of time. This includes tax identification numbers and relevant tax forms.

-

It’s crucial to provide accurate contact information to ensure that the IRS can reach you. Double-check this section for typos.

-

Different types, such as BIN, KIN, and EIN, serve varying purposes. Knowing your tax identification type and correctly entering it is critical.

-

Your company type affects tax obligations, so be sure to select the classification that accurately reflects your business entity, whether it be LLC, corporation, etc.

What are common mistakes to avoid when submitting IRS rulings?

-

Omitting essential details can lead to delay or rejection of your application. Always review all sections for completeness.

-

Neglecting to include necessary documents can adversely affect your ruling request. Ensure you know what supplemental documentation is required.

-

Incorrectly understanding the implications of your submission can lead to greater tax liabilities down the road. Consult professional advice if needed.

How can use pdfFiller for efficient form management?

-

pdfFiller offers tools to edit IRS forms easily, allowing you to make precise changes without hassle.

-

With pdfFiller, you can easily eSign documents, collaborate with other team members in real-time, and share forms without complex processes.

-

Access your forms efficiently with pdfFiller’s cloud services, which are available anywhere, making document management easier for individuals and teams.

What should expect after submission?

-

Processing times for IRS ruling forms can vary widely depending on the complexity of your request and the IRS backlog.

-

You can check the status of your submission online or by contacting the IRS directly. It’s wise to keep records of any communications.

-

Understand the IRS's communications, which may include approval, denial, or requests for more information. Knowing how to respond is critical.

Conclusion and final thoughts

In summary, accurately completing the internal revenue service ruling form is vital for tax compliance. Utilizing tools such as pdfFiller can streamline your document handling and eSigning processes. Being informed and prepared will significantly enhance your experience with tax matters, making it easier to navigate the complexities involved.

How to fill out the internal revenue service ruling

-

1.Visit the pdfFiller website and log into your account or create one if you don't have it.

-

2.Search for the specific IRS ruling form template you need within the platform.

-

3.Fill out the required information in all relevant fields accurately, including taxpayer details and the specific tax questions you have.

-

4.Attach supporting documents or explanations as required by the IRS for the ruling request.

-

5.Review the completed form for any errors or omissions and ensure all necessary signatures or declarations are included.

-

6.Submit the completed form electronically through pdfFiller or download it for mailing to the appropriate IRS office as per the form’s instructions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.