Last updated on Feb 17, 2026

Get the free Terms of Class One Preferred Stock template

Show details

This sample form, a detailed Terms of Class One Preferred Stock document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is terms of class one

Terms of Class One outlines the fundamental rules and conditions that govern the expectations and responsibilities of Class One participants.

pdfFiller scores top ratings on review platforms

Been a God Send for my Realty Business .Thank You Bonnie Stutes

Great product and reasonably inexpensive.

All good. However it would be nice to be able to move the type up and down when placed on the page rather than have to keep placing the type symbol in a spot where you think it will fit on the line.

Very handy, just a little complicated to open/save/etc. Overall love it!!

Very interesting to use, but the subscription is a minus

This was a great tool to use as I have suffered a horrible arm injury which made it very difficult to hand write. Your program was a life savior as I had numerous pages of medical documents to file.

Who needs terms of class one?

Explore how professionals across industries use pdfFiller.

Terms of Class One Preferred Stock How-to Guide

What is Class One Preferred Stock?

Class One Preferred Stock is a type of equity security offered by companies that provides certain privileges over common stock. Preferred stock is typically assigned fixed dividends and is prioritized over common stock in case of liquidation.

-

Preferred stock serves as a middle ground between common stock and debt, appealing to investors seeking fixed return options.

-

Class One shares usually come with specific voting rights or convertibility options that can make them more attractive to investors.

-

Issuing Class One Preferred Stock can help a company raise capital without diluting existing shareholders’ equity significantly.

How is Class One Preferred Stock Designated and What is its Amount?

The designation of Class One Preferred Stock refers to the specific attributes assigned to these shares, which include voting rights, dividend frequency, and liquidation preferences.

-

Class One shares are tailored to meet the unique financing needs and goals set by the issuing corporation.

-

Each class can have a predefined maximum number of shares issued, which influences valuing the stock, along with a stated par value.

-

Class One can be further divided into series based on varying rights, providing flexibility in capital-raising strategies.

What are the Dividends for Class One Preferred Stock?

Dividends for Class One Preferred Stock are typically fixed and are paid out annually or semi-annually, depending on the company's policies.

-

Investors in Class One Preferred Stock enjoy a steady income stream, making it a potentially safer investment compared to common stock.

-

To receive dividends, shareholders must be on record by a specific cut-off date set by the company.

-

Understanding how and when dividends are paid helps shareholders manage expectations and investment strategies effectively.

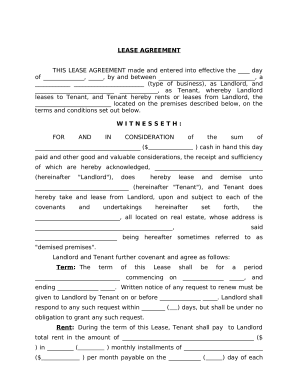

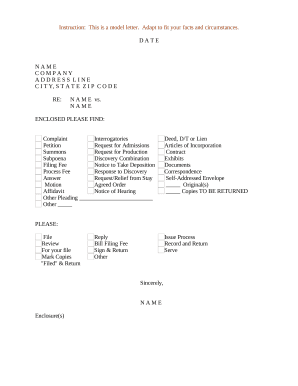

How to Fill Out the Class One Preferred Stock Terms?

Filling out the Class One Preferred Stock terms requires careful attention to detail to avoid mishaps during submission.

-

Ensure you have all pertinent documents such as corporate bylaws and prior stock issuance data ready.

-

Follow a clear checklist while filling out the form to avoid any discrepancies that could delay processing.

-

Double-checking entered information helps to mitigate issues like incorrect share counts or mislabeling of stock classes.

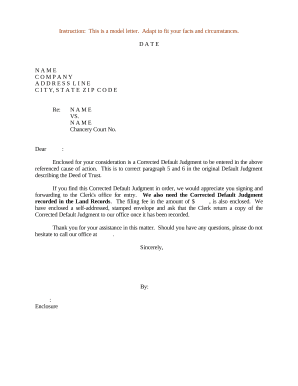

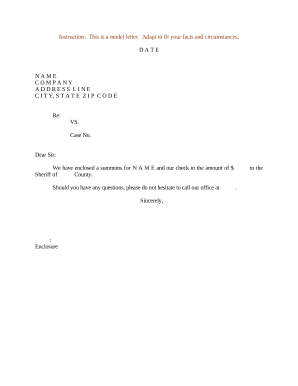

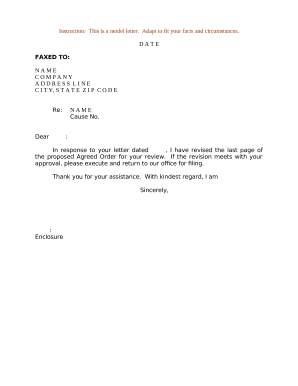

How to Manage Class One Preferred Stock Documents with pdfFiller?

pdfFiller is an efficient way to edit, sign, and store Class One Preferred Stock documents securely and conveniently.

-

Users can easily modify specific sections of the Form, adding or removing content as necessary.

-

The platform allows multiple stakeholders to review and sign documents electronically, significantly speeding up approval processes.

-

Keep all documents organized within pdfFiller for easy access during annual reviews or shareholder meetings.

What are the Differences Between Class One Preferred Stock and Other Classes?

Understanding how Class One Preferred Stock differs from other investments can inform strategic financial decisions.

-

Class One Preferred Stock typically offers fixed dividends and priority in assets, unlike common stock, which is subject to variable returns.

-

Different classes provide varying degrees of voting rights and dividends, impacting investment risks and returns.

-

Investors seeking steady returns without extensive risks may find Class One to be a preferable option compared to other classes.

How to fill out the terms of class one

-

1.Download the 'Terms of Class One' PDF from the official website or provided link.

-

2.Open the PDF using a PDF reader or editor that supports form filling.

-

3.Identify sections marked for input, such as personal information, course details, and agreement signatures.

-

4.Carefully read through all the terms and conditions mentioned in the document to ensure understanding.

-

5.Fill in your personal details accurately in the designated fields.

-

6.Complete any specific course or program information required, ensuring all entries are clear and legible.

-

7.If applicable, read through any additional clauses and fill out corresponding sections to confirm your agreement.

-

8.Review the completed document for any errors or omissions before submitting.

-

9.Save your filled PDF and submit it as instructed, either digitally or in print form.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.