Get the free IRS 20 Quiz to Determine 1099 vs Employee Status

Show details

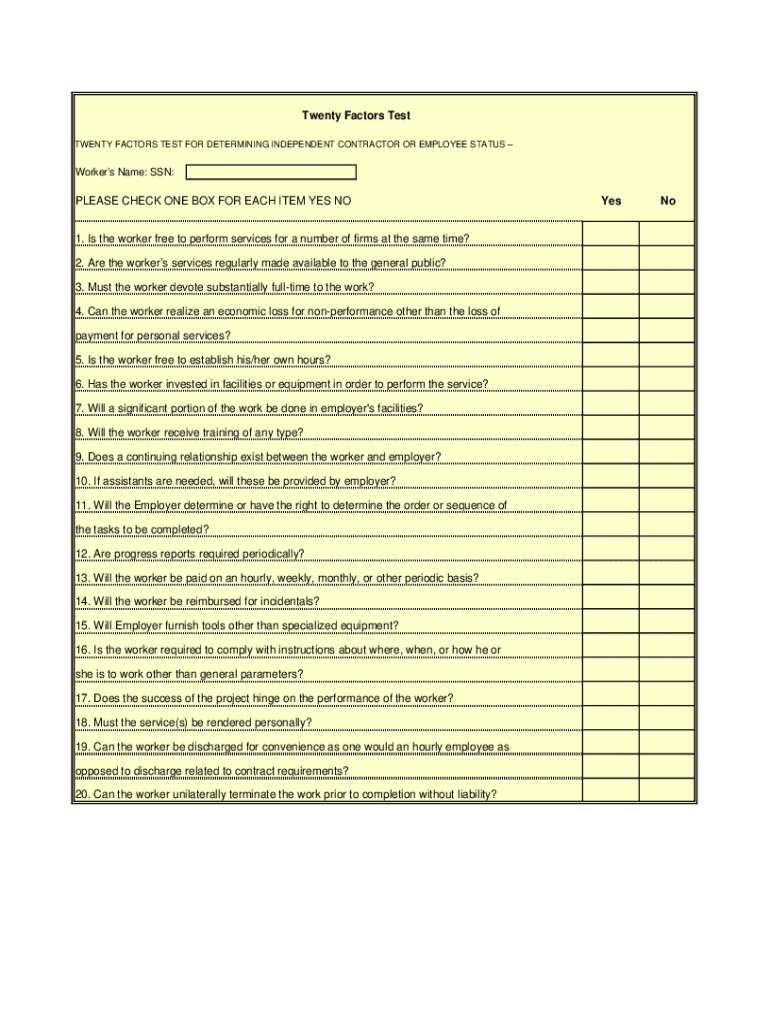

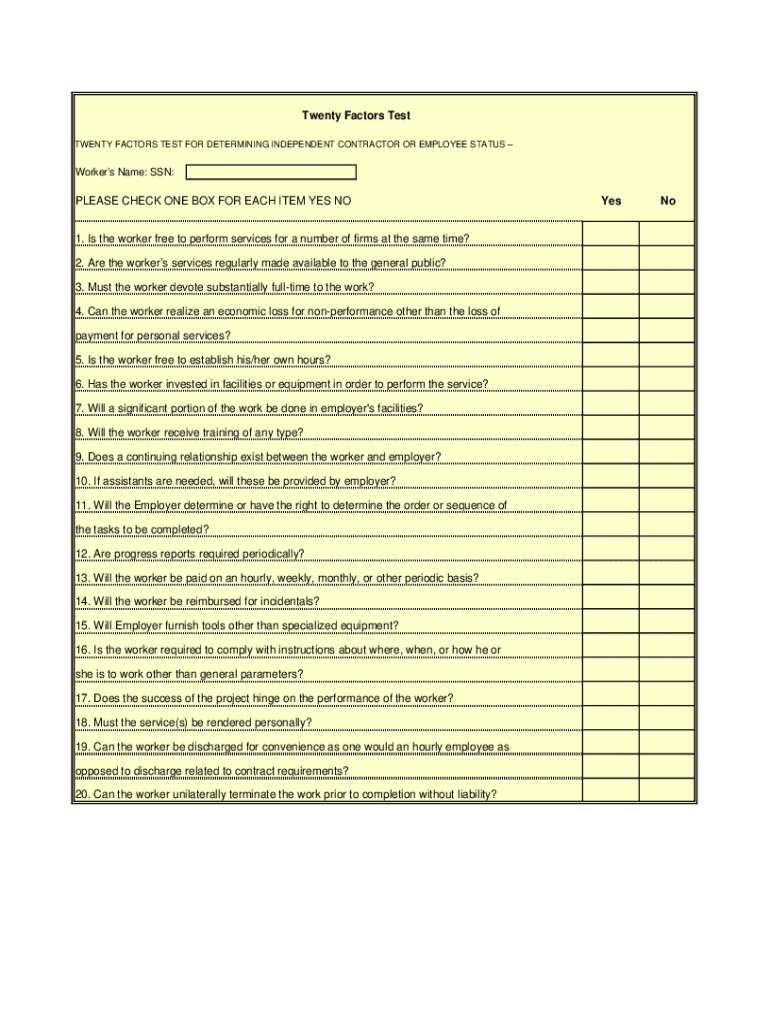

Employer's form to determine between employee and 1099 contractor.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is irs 20 quiz to

The IRS 20 Quiz To is a form designed to assist taxpayers in determining their eligibility for various tax-related deductions and credits.

pdfFiller scores top ratings on review platforms

Very good!

Very good! So convenient for everything that's PDF related.

Great website - very useful

++++ PDFfiller helped me out a lot

Brilliant

Brilliant document management

I've just started the trial service but…

I've just started the trial service but so far I'm finding the software very user friendly. I've uploaded an application used by our non-profit and marked all the fields needing completion. It was very easy to do. Testing has gone well. Looking forward to using this for our membership drive.

It's perfect for any forms of editing…

It's perfect for any forms of editing and filling out forms couldn't get any easier.

PDFFiller has FANTASTIC customer…

PDFFiller has FANTASTIC customer service. They are responsive, friendly, and ready to help. You can't go wrong!

Who needs irs 20 quiz to?

Explore how professionals across industries use pdfFiller.

How to fill out the IRS 20 quiz to form form

Understanding the IRS 20 questions for worker classification

The IRS 20 questions for worker classification provide a framework for distinguishing between independent contractors and employees. Understanding this twenty factors test is crucial for ensuring compliance with tax laws and minimizing legal risks.

-

This test comprises specific criteria to determine the nature of a worker's relationship with a business.

-

Correct classification affects tax liabilities and legal responsibilities for businesses.

-

Businesses may face penalties, back taxes, and lawsuits if they fail to correctly classify workers.

Why does worker classification matter?

Worker classification is fundamental for both businesses and employees. It determines how taxes are withheld and what benefits may apply to the worker.

-

Misclassifying a worker can lead to hefty fines and legal troubles.

-

Employees are typically entitled to benefits like health insurance and retirement plans, while independent contractors are not.

-

Incorrect classifications can disrupt business operations and create financial liabilities.

How can you navigate the twenty factors test?

Navigating the twenty factors test requires a thorough breakdown of each question to assess the worker's status accurately.

-

Familiarize yourself with the twenty specific questions that the IRS uses.

-

Reflect carefully on each aspect of the worker's role to answer accurately.

-

pdfFiller allows users to fill out and save assessments conveniently.

What is the process for submitting your assessment?

Submitting the IRS 20 quiz form is streamlined with pdfFiller, making it easy to manage your documents.

-

Follow straightforward steps provided by pdfFiller to fill out and submit your form.

-

Access and collaborate on documents from anywhere with pdfFiller's features.

-

Use eSignatures to secure your submissions, enhancing efficiency.

How do you evaluate your results?

Interpreting the results of the twenty factors test can guide your next actions.

-

Understand what your answers imply about the worker's classification.

-

Be prepared for potential outcomes based on the results.

-

Seek professional advice if necessary to ensure compliance.

What are the best practices for maintaining accurate classifications?

Regular reviews and meticulous documentation play crucial roles in ensuring ongoing compliance.

-

Conduct periodic evaluations of worker classifications to avoid misclassification.

-

Keep detailed records of worker status decisions and supporting evidence.

-

Enjoy easy access and management of all related documents with pdfFiller.

What are the common traps and risks of misclassification?

Businesses often fall into traps when it comes to classifying workers. Being aware of these pitfalls can help mitigate risks.

-

Identify frequent errors in judgment concerning worker status.

-

Implement checks and balances to safeguard against misclassification.

-

Review real-life examples to understand the implications of misclassification.

What resources are available for navigating worker classification?

Numerous resources can assist you in successfully completing the IRS 20 quiz form.

-

Discover more about completing the IRS form efficiently.

-

Utilize pdfFiller's resources for document creation and management.

-

Connect with professionals through pdfFiller collaboration features for additional guidance.

How to fill out the irs 20 quiz to

-

1.Download the IRS 20 Quiz To PDF from the IRS website or a trusted source.

-

2.Open the PDF using pdfFiller or upload it to the platform if not directly accessible.

-

3.Read through the instructions provided on the first page for context and guidelines.

-

4.Begin filling out the form by entering your personal information as required, ensuring accuracy with names and identification numbers.

-

5.Proceed to answer each question honestly based on your tax situation, making sure to follow the prompts.

-

6.Review your responses carefully to avoid any mistakes, as accurate information is crucial for proper assessment.

-

7.Once completed, save your progress and download a copy of the filled form for your records.

-

8.Consider printing the quiz if you prefer a physical copy, or submit it electronically if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.