Last updated on Feb 17, 2026

Get the free Stock Option Agreement of Key Tronic Corporation template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is stock option agreement of

A stock option agreement is a legal document that outlines the terms under which an employee can purchase company stock at a predetermined price.

pdfFiller scores top ratings on review platforms

I love this program. Wish I knew what all it does besides the basics

Great experience. A bit Pricey, but definitely worth it for the quality of the work provided.

SO FAR SO GOOD. NEEDED IT FOR 1099-MISC SUB CONTRACTOR FORMS

THANKFUL - IT HELPED ME LAST MINUTE ON FORMS I NEEDED

So far so good! About to try and make a fillable form of my own to use for membership applications.

easy to use, documents look much more professional than hand written

Who needs stock option agreement of?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to stock option agreements

How does a stock option agreement work?

A stock option agreement is a contractual document that provides an employee or consultant the right to purchase a specific number of shares at a predetermined price within a set time frame. These agreements are vital in financial compensation structures, providing incentives aligned with a company's performance. Understanding the nuances between various types—qualified stock options and non-qualified stock options—is essential for both individuals and businesses.

-

A formal contract that gives employees options to buy company stocks at designated prices.

-

Stock options are used to attract and retain talented employees by offering them equity in the company.

-

Qualified stock options tend to have tax advantages, while non-qualified stock options may require different tax treatments.

What are the key components of a stock option agreement?

Each stock option agreement consists of crucial elements that outline the rights and obligations of both the company and the optionee. The clarity of these components is essential to ensure all parties understand their commitments and benefits.

-

Clearly identifies the company and the person receiving the stock option.

-

Specifies the type and number of shares involved, clarifying what the optionee is entitled to.

-

The price at which the option can be exercised significantly affects the potential gain for the optionee.

-

Outlines when the options can be exercised, ensuring that the optionee meets necessary conditions.

What legal considerations should be kept in mind?

Legal compliance is critical when drafting stock option agreements, as various regulations govern these transactions. Ensuring that all agreements meet legal requirements protects both the company and the optionee.

-

Adheres to regulations ensuring proper issuance of stock options to avoid legal pitfalls.

-

Key clauses protect the interests of all parties, detailing expectations and obligations.

-

Legal counsel is vital for drafting agreements that comply with regulations and specify exemptions, if applicable.

How can you create and manage a stock option agreement?

Creating a stock option agreement involves detailed planning and accurate documentation. Platforms like pdfFiller provide tools to draft, edit, and sign these agreements, facilitating a smooth process for all involved.

-

Start by clearly identifying the parties, shares, and terms to ensure all legal requirements are met.

-

Utilize pdfFiller’s features to customize agreements and incorporate specific company policies.

-

Employ secure online signing features and cloud storage for easy retrieval and management.

How to manage stock options post-issue?

Once stock options are issued, effective management is crucial to ensure compliance with vesting schedules and shareholder communications. Companies must be proactive in tracking important dates and notifying employees about their options.

-

Keep a comprehensive record of when options vest and when they expire to optimize benefits.

-

Establish clear channels of communication surrounding vesting and exercise opportunities.

-

Regularly review and, if necessary, update agreements to reflect changes in employment status or laws.

What are best practices for employees and employers?

Understanding the parameters of stock option agreements can significantly influence both parties’ outcomes. Implementing best practices enhances decision-making related to exercising options and managing expectations.

-

Ensure clear understanding of key timelines to avoid missing out on beneficial exercises.

-

Plan exercises based on tax implications and market conditions to maximize gains.

-

Stay informed to prevent overlooking important deadlines or making uninformed decisions.

What industry-specific considerations exist?

Different industries may approach stock option agreements distinctively, influenced by their unique environments. Understanding these factors helps tailor agreements to align with specific requirements.

-

Tech companies often provide more flexible options to retain talent, while traditional industries might have stricter conditions.

-

Compliance with federal and state laws can vary widely; staying informed is crucial.

-

Reviewing successful agreements from industry leaders can provide valuable insights for crafting your policies.

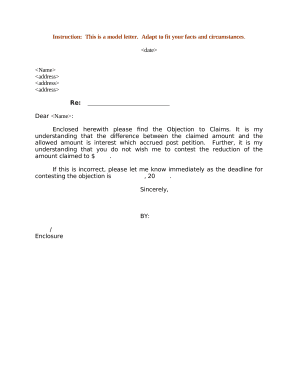

How to fill out the stock option agreement of

-

1.Start by downloading the stock option agreement template from pdfFiller.

-

2.Open the document in pdfFiller and review the pre-filled sections for accuracy.

-

3.In the designated area, input the names and contact information of the parties involved.

-

4.Fill in the number of stock options being granted and the exercise price in the corresponding fields.

-

5.Specify the vesting schedule, detailing when the options can be exercised.

-

6.Include any expiration dates for the options, ensuring compliance with regulatory requirements.

-

7.Double-check all entries for completeness and accuracy.

-

8.Save the filled document and consider sharing it with the other party for review.

-

9.Finally, e-sign the agreement if digital signing is available, or print and sign it manually before sending.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.