Get the free The FACTA Red Flags Rule: A Primer

Show details

The Red Flags Rule requires covered entities to design and implement written programs and policies to detect, prevent and mitigate identity theft connected with the opening of a "covered account"

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is form facta red flags

Form facta red flags are indicators that highlight potential issues or discrepancies in a financial document.

pdfFiller scores top ratings on review platforms

working well with the forms I need printed and saved

It was good I wish it would auto add things up

Just started but it seems very user friendly

Cool! So much easier than filling out by hand.

I paid for a month at a time, and now I'd like to upgrade to the yearly subscription and save some money How do I do that?

Easiest way to make professional looking reports

Who needs form facta red flags?

Explore how professionals across industries use pdfFiller.

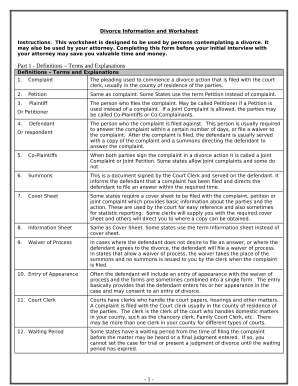

How to fill out a FACTA Red Flags form effectively

What is the FACTA Red Flags Rule?

The FACTA Red Flags Rule is a key part of the Fair and Accurate Credit Transactions Act, aimed at identifying potential identity theft risks. It mandates that institutions create a comprehensive identity theft prevention program which includes the identification of 'red flags.' Compliance with this rule is crucial for preventing fraud and protecting consumers.

-

It helps businesses detect and prevent identity theft, improving consumer trust.

-

Agencies like the Federal Trade Commission and the Federal Reserve play a role in enforcement.

Who must comply with the FACTA Red Flags Rule?

Covered entities under FACTA include financial institutions and creditors that issue consumer reports. Businesses of varying sizes and structures can fall under this category, requiring them to develop and implement an identity theft prevention program.

-

This includes banks, credit unions, mortgage brokers, and retailers offering credit.

-

Failure to comply can lead to significant legal penalties and reputational damage.

What are the components of an identity theft prevention program?

An effective program must identify potential red flags, implement detection strategies, and establish appropriate responses. Regular updates and administration tasks are also essential to keep the program relevant and effective.

-

Cataloging signs of potential identity theft, such as mismatched information.

-

Using automated systems and staff training to monitor red flags.

-

Creating clear steps for handling identified red flags efficiently.

How to identify red flags of identity theft?

Common indicators of identity theft include unusual account activity and altered documents. Understanding these patterns can enhance detection and improve responses.

-

Monitor for alerts placed on consumer credit reports indicating potential issues.

-

Look for unusual transaction patterns that deviate from regular behaviors.

-

Assess authenticity when discrepancies arise in presented documentation.

How to detect red flags effectively?

Integrating technology can greatly enhance detection capabilities. Employing automated tools alongside staff training ensures readiness to address any identified red flags.

-

Utilize software that can identify anomalies in financial transactions.

-

Implement AI-driven solutions for better analysis and faster response.

-

Examine successful detection strategies employed by peers in the industry.

What steps should be taken upon detecting a red flag?

Once a red flag is detected, immediate action is essential. Proper documentation and staff training ensure effective responses.

-

Take immediate action to secure affected accounts, ensuring no further damage.

-

Keep detailed records of all actions taken to address the detected red flag.

-

Regularly train employees on how to recognize and act on red flags.

How to maintain an ongoing identity theft prevention program?

The board of directors should regularly assess the program, ensuring it functions effectively. Designating responsibilities among staff members helps maintain oversight.

-

The board must regularly review the program and approve necessary updates.

-

Assign specific duties to team members for consistent program management.

-

Conduct frequent training sessions to keep staff informed about new threats and systems.

Where to find resources for FACTA compliance?

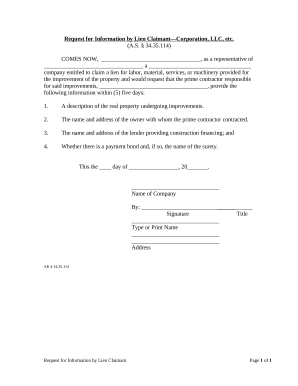

Utilizing platforms like pdfFiller can streamline the creation of necessary documentation. Templates and interactive tools are vital for maintaining compliance.

-

pdfFiller provides resources for creating compliance-related documents with ease.

-

Access a variety of templates specifically tailored for FACTA compliance.

-

Leverage tools for efficiently documenting and reporting any identified red flags.

How to fill out the form facta red flags

-

1.Download the form facta red flags template from pdfFiller.

-

2.Open the PDF in the pdfFiller application.

-

3.Begin by filling in your personal or business information at the top of the form, ensuring accuracy.

-

4.Proceed to the section requiring financial data; input relevant figures and check for any math discrepancies.

-

5.Review each line item against your accounting records to identify any potential red flags.

-

6.Utilize dropdowns or prefilled options where applicable to streamline the process.

-

7.Include any notes or comments in designated sections to clarify unusual entries or discrepancies.

-

8.After completing the form, use the 'Check for Errors' tool to ensure all data is accurately inputted.

-

9.Once verified, save your completed form and submit it through the designated channel or email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.