Get the free Instructions for Completing IRS Form 4506-EZ

Show details

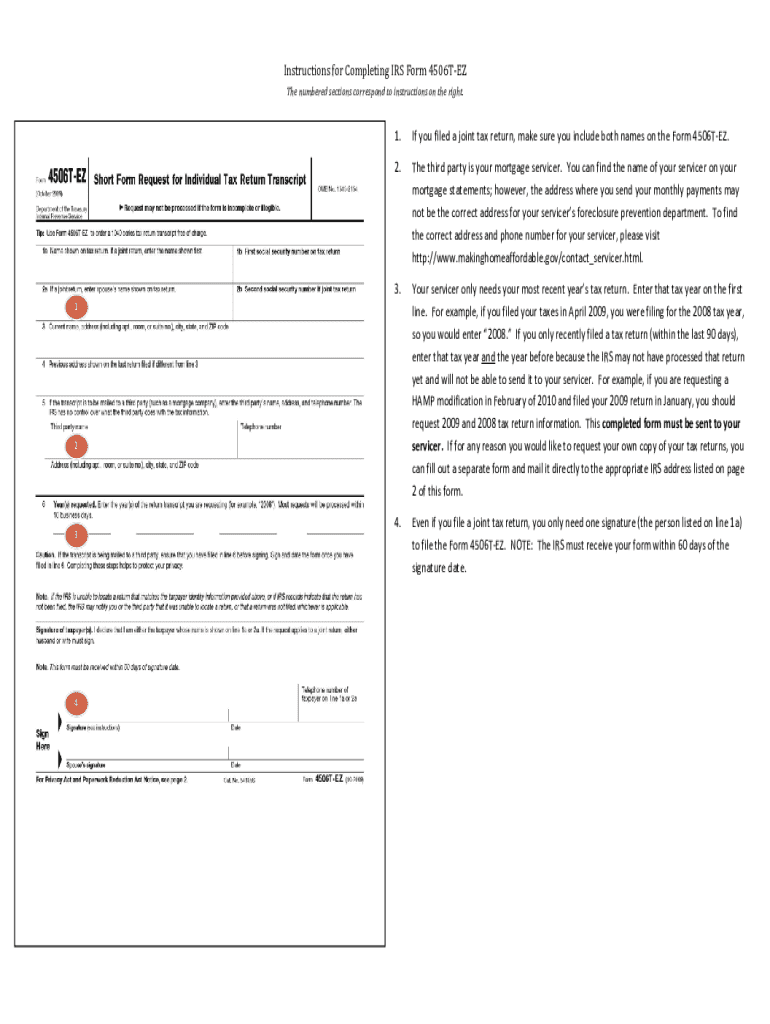

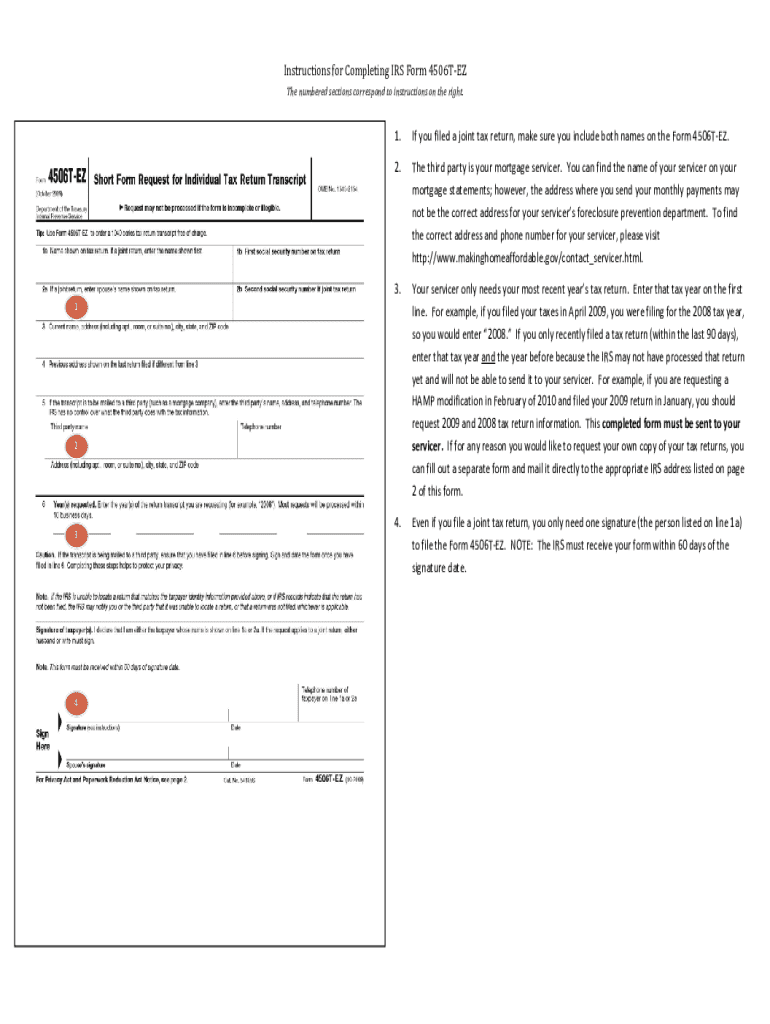

These are instructions for how to complete Form 4506T-EZ. Use Form 4506T-EZ to order a 1040 series tax return transcript free of charge.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is instructions for completing irs

Instructions for completing IRS documents provide guidance on how to accurately fill out tax-related forms required by the Internal Revenue Service.

pdfFiller scores top ratings on review platforms

Intuitive and does all I need and more

great for making any type of document

smooth work

Not at this moment thank you

AMAZING CUSTOMER SERVICE

AMAZING CUSTOMER SERVICE! Problem resolved within MINUTES! Highly recommend.

Saves lots of time with form completion.

Saves lots of time with form completion.

Who needs instructions for completing irs?

Explore how professionals across industries use pdfFiller.

How to fill out the instructions for completing irs

-

1.Open pdfFiller and upload the IRS form you need to complete.

-

2.Review the form carefully to identify all required fields that need to be filled in.

-

3.Begin by entering your personal information, such as name, address, and Social Security number, in the specified sections.

-

4.Input your financial information as requested, such as income, deductions, and credits, adhering strictly to the form's guidelines.

-

5.Double-check any calculations, ensuring accuracy to avoid errors that may face penalties or audits.

-

6.Utilize pdfFiller's tools to add or erase information as necessary, ensuring clarity in the submission.

-

7.Once the form is completely filled out, preview it to ensure all data is correctly placed and readable.

-

8.Save your document within pdfFiller, and then print or electronically submit the completed form to the IRS as per the established deadlines.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.