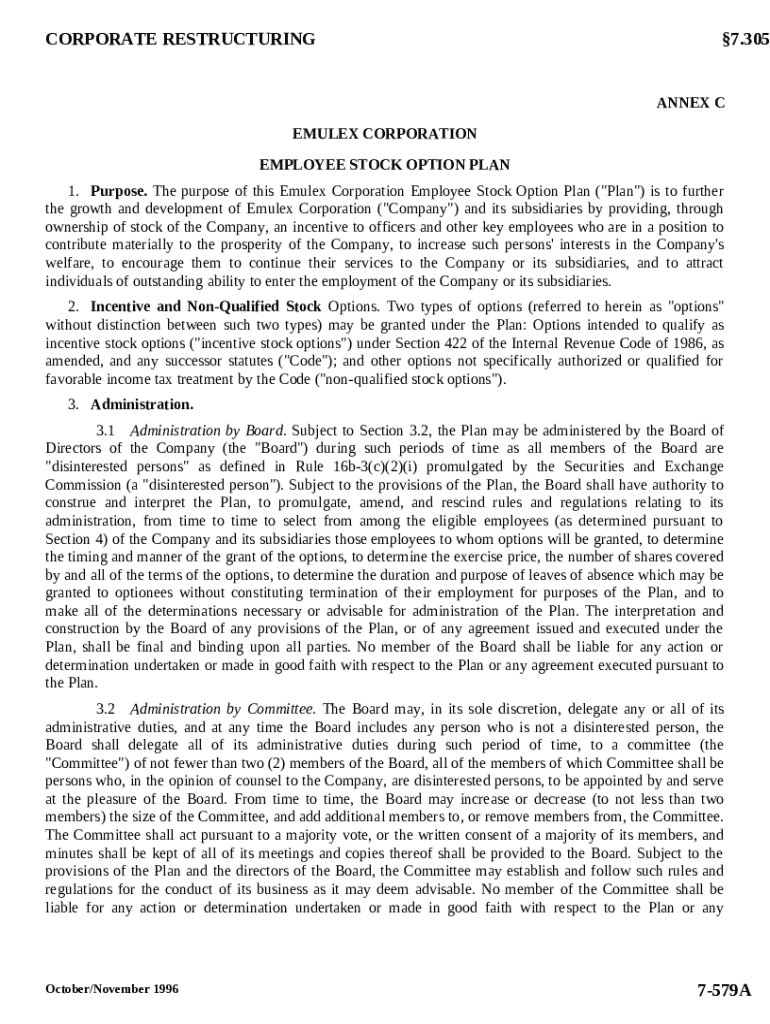

Get the free Employee Stock Option Plan of Emulex Corp. template

Show details

This sample form, a detailed Employee Stock Option Plan document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is employee stock option plan

An employee stock option plan (ESOP) is a program that provides employees with the opportunity to purchase shares in the company, often at a predetermined price.

pdfFiller scores top ratings on review platforms

It doesn't always save my drawn signatures and it doesn't fax. Other than that it's great.

I really liked it, and may use in the future!

PDF filler has worked for our business through out the year and would highly recommend it. We mostly use it for fax purposes, but for us that alone is worth what we pay per year.

Im a home care nurse and I deal with alot of forms and this make my job a whole lot easier! i luv it.

I wish I could keep my files more organized in folders

30 days free trial is very generous. I would like to see the result after conversion to .docx Secondly I'll be glad if can subscribe for a shorter period

Who needs employee stock option plan?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to employee stock option plans

How do employee stock option plans work?

Employee stock option plans (ESOPs) are a benefits program that allows employees to purchase company stock at a predetermined price. This can serve as a motivational tool, aligning employees' interests with the success of the company. Companies often structure these plans to encourage long-term employment, contributing to both employee retention and growth.

-

Employee stock option plans (ESOPs) are contracts that provide employees the right to purchase stock options at a set price.

-

ESOPs can lead to increased motivation as employees have a direct financial stake in the company’s performance.

-

There are key benefits in implementing ESOPs, including attracting talent and improving overall company morale.

What is the foundational purpose of employee stock option plans?

The foundational purpose of employee stock option plans lies in incentivizing performance and retention. By offering shares, companies motivate employees to work towards collective success, thus aligning individual performance with company goals.

-

Stock options encourage employees to deliver high performance, knowing their contribution impacts their financial gain.

-

An appealing ESOP can serve as a strong incentive for talented professionals, differentiating a company in competitive job markets.

-

Stock ownership aligns employee priorities with the company’s overall success, fostering collaboration and innovation.

What types of stock options are available?

There are primarily two types of stock options: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Both types have distinct characteristics and tax implications, making it crucial for companies to choose the right option based on their organizational goals.

-

ISOs offer favorable tax treatment, qualifying for capital gains taxes rather than ordinary income if specific conditions are met.

-

NSOs do not qualify for the same tax benefits but are more flexible and accessible to a broader range of employees.

-

Understanding the tax implications between ISOs and NSOs is vital for effective employee financial planning.

How to effectively administer your employee stock option plan?

Administering an ESOP involves defined roles and responsibilities, criteria for employee eligibility, and a clear mechanism for granting options. Proper administration ensures that employees understand their benefits and that the company complies with relevant regulations.

-

Administrative roles should be clearly defined to facilitate efficient processing of stock options.

-

A structured criteria for eligibility helps to maintain fairness and transparency in option distributions.

-

The timing and mechanism for granting options must be clear and communicated effectively to all eligible employees.

What are the steps for filling out the employee stock option plan form?

Completing the employee stock option plan form accurately is essential for both employees and HR departments. The following detailed instructions make this process straightforward.

-

Begin by gathering all necessary information and understanding the options being granted.

-

Pay attention to common errors, such as incorrect valuations or incomplete data entries.

-

Interactive tools, such as those provided by pdfFiller, can help streamline form submission and mitigate errors.

What legal considerations and compliance issues exist?

Legal compliance is crucial when implementing employee stock option plans. Companies must adhere to IRS guidelines and be aware of any state-specific regulations that may apply in their region.

-

Understanding the regulatory environment helps ensure that the ESOP is set up correctly and avoids legal pitfalls.

-

The IRS provides specific rules regarding taxation and reporting that must be followed.

-

Companies must familiarize themselves with state-specific laws that can affect the administration of ESOPs.

What resources are available for managing stock options effectively?

Various tools and resources exist to help manage employee stock options effectively. Utilizing these resources can streamline administration and improve employee engagement.

-

Innovative tools available from platforms like pdfFiller can help manage and track employee stock options.

-

Common questions regarding stock options can offer insights and clarity for both employers and employees.

-

Access links to stock option templates, which can aid in creating compliant and effective ESOP documentation.

How to fill out the employee stock option plan

-

1.Log in to pdfFiller and upload the employee stock option plan PDF document.

-

2.Review the form to understand the required fields, which may include employee information, option terms, and vesting schedules.

-

3.Begin filling in the employee details, such as name, position, and employment start date, in the designated sections.

-

4.Input the specifics of the stock options, including the total number of options, exercise price, and vesting period as per company policy.

-

5.Ensure to provide any additional information required, such as the grant date and expiration date for the options.

-

6.Review all filled sections for accuracy and completeness before finalizing the document.

-

7.Save the filled-out form in pdfFiller, and if needed, use the e-signature feature for approval by the necessary parties.

-

8.Finally, download or share the completed ESOP document with relevant stakeholders.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.