Get the free Operating Deficit Guaranty: Targeted Affordable Housing Properties With Preservation...

Show details

This is a sample of an Operating Deficit Guaranty: Targeted Affordable Housing Properties With Preservation Rehabilitation. The agreement may be customized to suit your needs.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is operating deficit guaranty targeted

An operating deficit guaranty targeted is a financial instrument designed to ensure that a specific entity or project can meet its operating expenses during a predetermined period despite potential revenue shortfalls.

pdfFiller scores top ratings on review platforms

Very easy to use. I think the monthly subscription fee should come down a little bit but other then that I am happy.

VERY CONVINIENT

Works perfectly well. Good for filling pdf files and signing of forms.

Its amazing

I am very much satisfied

It's beneficial, especially with PDF document settings.

Who needs operating deficit guaranty targeted?

Explore how professionals across industries use pdfFiller.

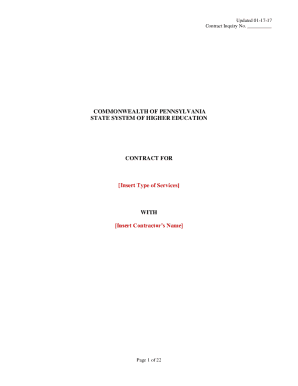

Comprehensive Guide on Operating Deficit Guaranty Targeted Form

What is the operating deficit guaranty?

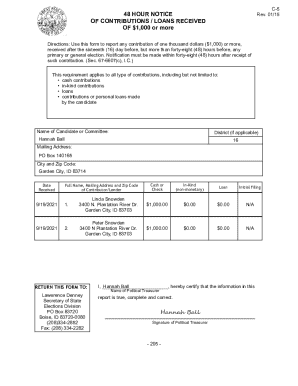

The operating deficit guaranty is a financial instrument designed to protect lenders by ensuring that a borrowing entity can cover operating deficits in targeted affordable housing properties. Essentially, it helps maintain financial stability during difficult periods, making it essential in multifamily housing financing. Key players involved include the guarantor, who provides the assurance; the borrower, who is the entity seeking the loan; and the lender, who offers the funds.

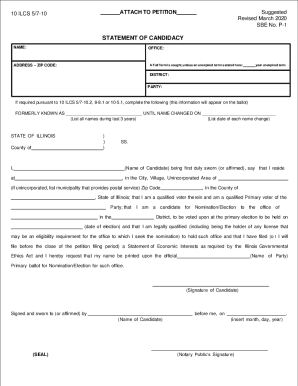

What are the prerequisites for executing the guaranty?

-

This agreement establishes the terms of the loan, outlining the responsibilities and conditions for both borrowers and lenders.

-

Certain financial conditions must be met for a guaranty to be valid, which can include assets or creditworthiness evaluations.

-

The guarantor must be transparent about their financial status to facilitate a thorough assessment by the lender.

How do fill out the operating deficit guaranty form?

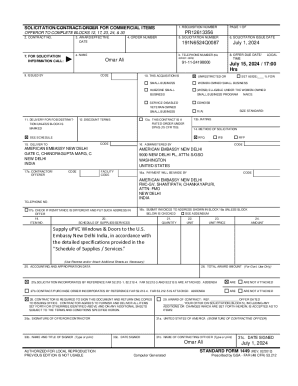

Filling out the operating deficit guaranty form doesn't have to be complicated. Start by carefully entering essential information such as the loan number and property name. Pay special attention to the financial details to ensure accuracy, as mistakes can lead to significant delays or issues.

-

Utilize platforms like pdfFiller, which offers interactive tools that aid in the completion of forms.

-

Follow step-by-step instructions for each field to minimize errors and ensure the document's validity.

What are the critical components of the guaranty agreement?

-

Important clauses in the agreement include recitals, agreements, and defined terms of indebtedness.

-

It is crucial to comprehend all loan documents, as they lay out the terms and conditions of the financial arrangement.

-

The guarantor has specific obligations to the lender, including meeting defined terms and conditions.

How to manage your operating deficit guaranty documents safely?

Practicing safe document management is vital. Storing PDFs securely and utilizing eSigning functionalities enhances the process, allowing for easy access and collaboration among teams. Using platforms like pdfFiller can streamline document management, making the sharing and signing process secure and efficient.

-

Store all your documents in a centralized location with appropriate access controls.

-

Utilize eSigning features to quickly sign documents and share them with relevant parties securely.

What are the compliance and regulatory considerations?

-

Different states may have varying regulations concerning operating deficit guaranties that must be adhered to.

-

Failing to comply can lead to significant repercussions, including financial penalties and voided agreements.

-

Utilize pdfFiller to ensure your documents meet regulatory standards and maintain security.

What resources are available for further support?

-

Connect to general FAQs related to loan agreements and guaranties for further clarification.

-

Have access to contact information for legal professionals specializing in guaranty agreements.

-

Engage with webinars and tutorials available on pdfFiller to enhance your document management abilities.

How to fill out the operating deficit guaranty targeted

-

1.Download the operating deficit guaranty targeted form from pdfFiller.

-

2.Open the form in pdfFiller’s editor.

-

3.Begin by entering your contact information in the designated fields, including your name, organization, and address.

-

4.Fill in the details of the project or organization requiring the guaranty, specifying the name, address, and purpose.

-

5.Indicate the target amount of the operating deficit that you are seeking to cover.

-

6.Provide a thorough explanation of the financial situation or challenges that led to the deficit, including budgeting details.

-

7.Sign and date the document in the appropriate areas, ensuring that any required witnesses or notary sections are completed if necessary.

-

8.Review all information for accuracy and completeness before submitting.

-

9.Once reviewed, download or print the filled form directly from pdfFiller, or submit it electronically if applicable.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.