Get the free Tax Preparer: Disclosure and Service Agreement template

Show details

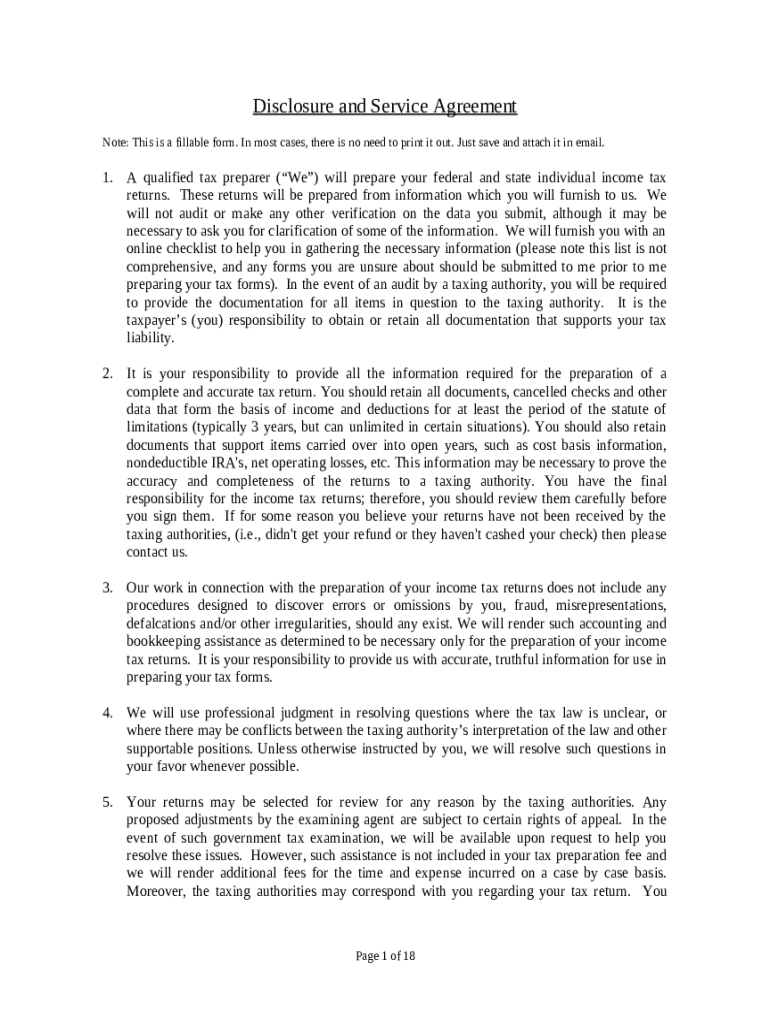

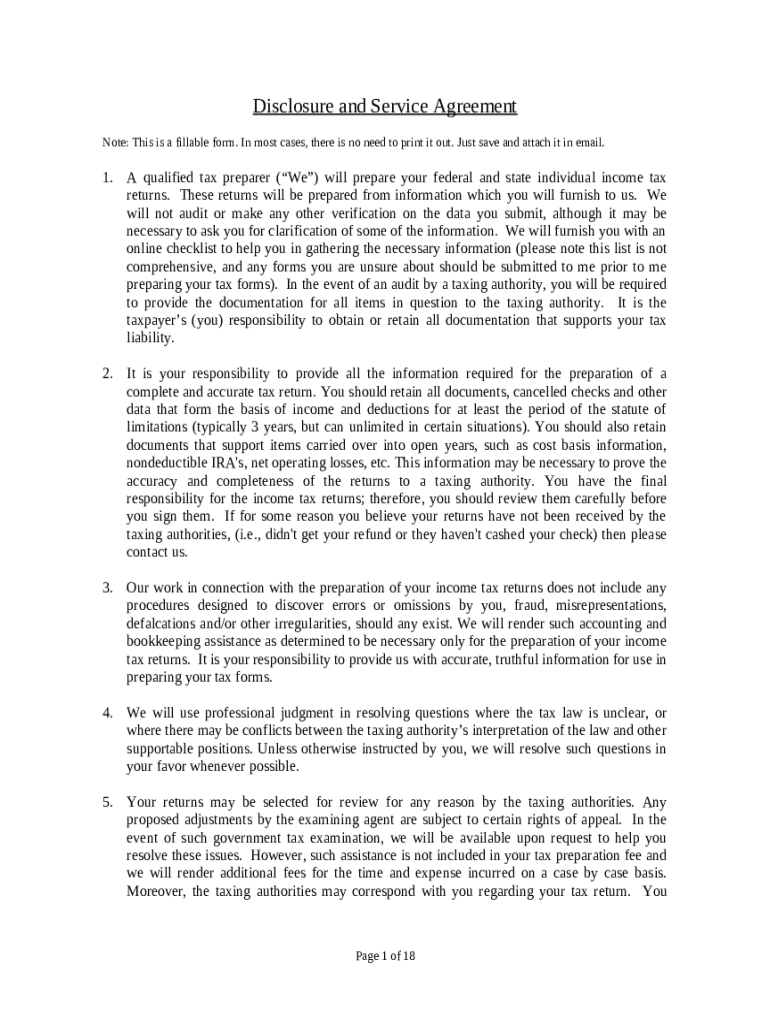

Disclosure and Service Agreement used by a Tax Preparer when taking on new clients. Includes Questionnaire and Fees outline.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is tax preparer disclosure and

Tax preparer disclosure and refers to the document that outlines the rights and responsibilities of tax preparers and clients regarding the preparation of tax returns.

pdfFiller scores top ratings on review platforms

This is an awesome app!

Very good service, easy to use.

PDF filler is awesome. Want to start using it more

Buenisima herramienta

excellent pdf file editing tools

Today it is much easier to work on pdf, no need for physics. pdf filler saves us paper

pdf filler is a great tool for editing pdf files online. with many features like add text, note, watermark, add image, spell checker etc. the software supports the largest platforms such as Dropbox, one drive, google drive which makes this software an essential tool for storing and classifying its documents

by its many features that the software brings together, a learning curve is essential. the software tends to become slow during sessions on very large documents.

good

Who needs tax preparer disclosure and?

Explore how professionals across industries use pdfFiller.

Navigating tax preparer disclosure and form form requirements

Understanding tax preparer disclosure requirements

Tax preparers have specific disclosure requirements mandated by Section 7216 of the Internal Revenue Code. This section emphasizes the importance of confidentiality in tax services, stipulating the legal obligations tax preparers have regarding client information. Ensuring these disclosures protect taxpayer privacy is critical for maintaining trust.

-

Tax preparation involves sharing sensitive financial information. It's crucial for tax preparers to keep that information secure to protect clients from identity theft.

-

Tax preparers must comply with IRS regulations regarding the handling of client data, including disclosure rules that outline when and how client information can be used.

What are the key elements of the disclosure and service agreement?

A well-structured disclosure and service agreement contains essential elements that frame the relationship between the tax preparer and client. These include a clear outline of the information needed from clients for tax returns, as well as the responsibilities of both parties regarding handling personal information.

-

Using digital documents simplifies the process, ensuring that the necessary information is captured accurately and securely.

-

Clients must understand what personal information they need to provide, which supports efficient tax preparation.

How can you prepare your tax returns with confidence?

Gathering the necessary documentation is critical to ensure accurate tax returns. Tax preparers often provide online checklists that help clients understand what to collect, streamlining the preparation process.

-

Collect all relevant financial documents, including W-2s, 1099s, and any other income statements before starting.

-

Online checklists offered by tax preparers can help ensure that no key documents are missed.

What are the responsibilities of taxpayers in retaining documentation?

Taxpayers have a duty to maintain thorough records of their financial transactions. Understanding the statute of limitations for keeping tax documents can safeguard individuals from potential disputes with taxing authorities.

-

Documents should be kept for at least three years following the tax filing date, but some may need to be retained longer.

-

Utilizing folders or digital cloud services can help keep tax records organized and easily accessible.

How should you navigate audits by taxing authorities?

Understanding the audit process can alleviate stress for taxpayers. Knowing what documentation is required and your rights during an audit can better prepare you for this experience.

-

Auditors will review your financial records and may require additional documentation for verification.

-

Taxpayers have the right to be treated fairly and can seek representation during an audit.

Why is reviewing your tax returns before submission important?

A thorough review of your tax returns can help identify and correct inaccuracies before they lead to penalties. Common pitfalls can be easily avoided with careful attention to detail.

-

When inconsistencies arise, addressing them prior to filing is crucial.

-

Mistakes such as miscalculations or incorrect Social Security numbers can significantly delay processing.

How can you eSign and manage your tax documents with pdfFiller?

Using pdfFiller offers an efficient way to edit and manage tax forms. Its collaboration features can streamline the process of tax preparation, making it easier to share and sign documents digitally.

-

pdfFiller provides options for making changes to tax documents before finalizing submissions.

-

The convenience of digital signing can expedite the preparation process while maintaining compliance with legal standards.

How to fill out the tax preparer disclosure and

-

1.Download the tax preparer disclosure document from the tax agency or relevant website.

-

2.Open the document using PDF software or upload it to pdfFiller.

-

3.Review the pre-filled information, ensuring it accurately reflects your situation.

-

4.Fill in your personal information, including your name, contact details, and Social Security number if required.

-

5.Provide your tax preparer's name and contact information.

-

6.Ensure all sections requiring acknowledgment, such as fee structures and services provided, are properly completed.

-

7.Review the entire document for accuracy and completeness.

-

8.Save the updated document on pdfFiller.

-

9.Print the final document or send it electronically to your tax preparer as needed.

-

10.Keep a copy for your records following submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.