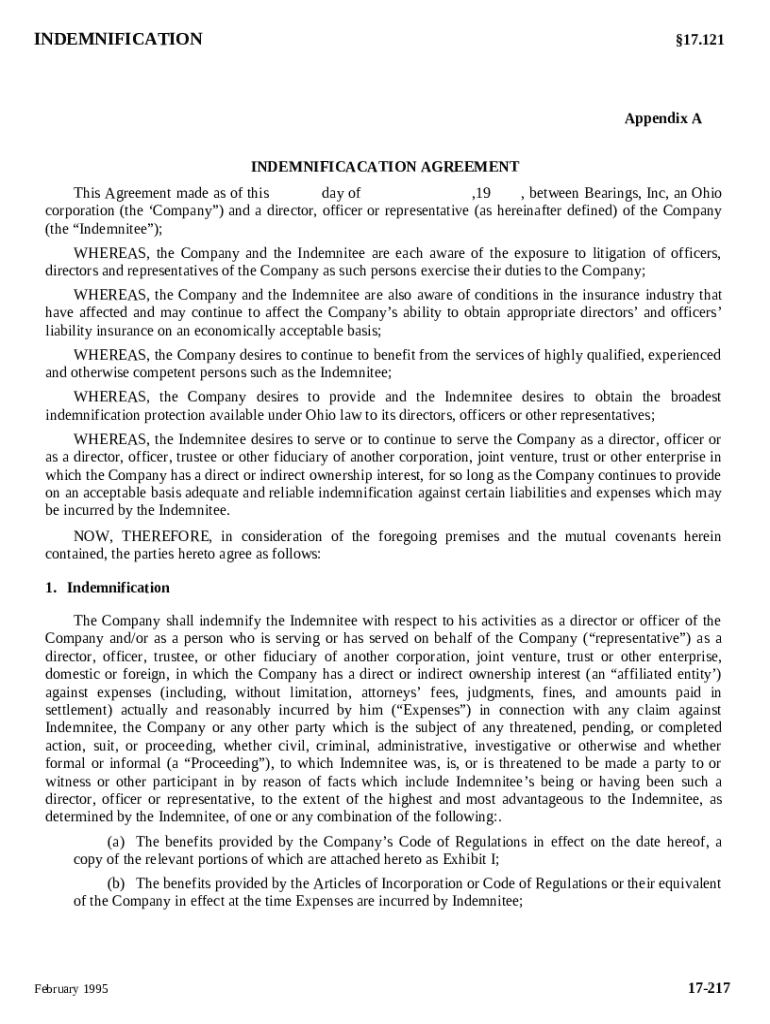

Get the free Indemnification Agreement establishing Escrow Reserve template

Show details

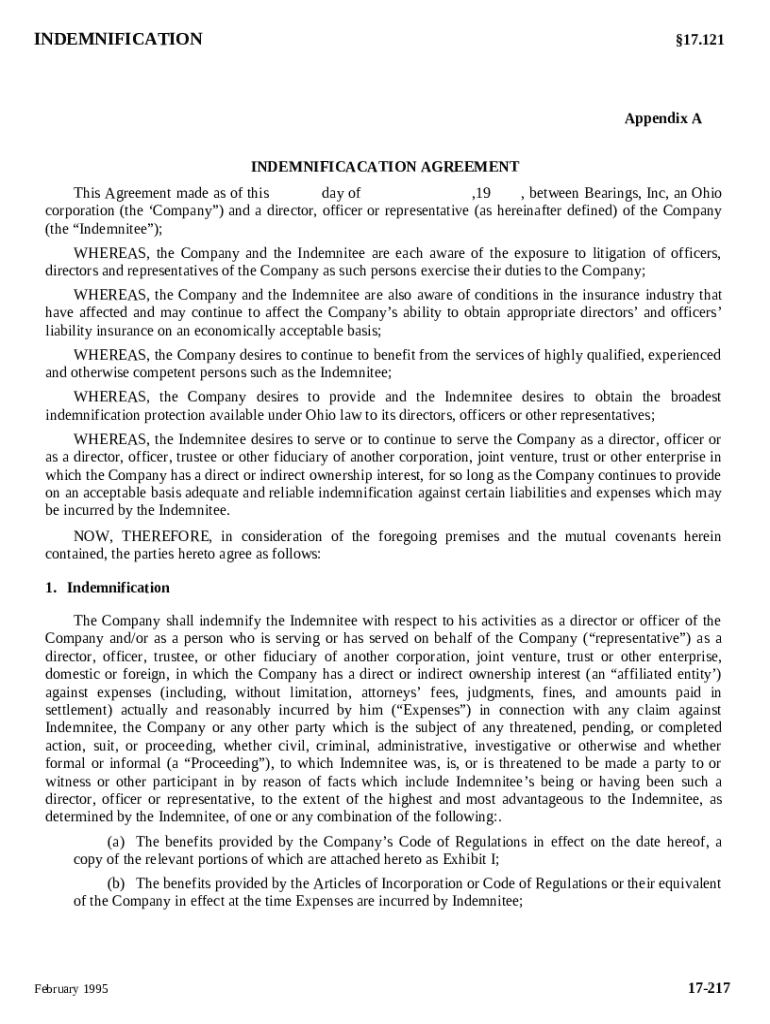

17-217 17-217 . . . Indemnification Agreement providing that (i) in event of change in control, corporation shall establish Escrow Reserve of $2,000,000 as security for its obligations under Indemnification

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indemnification agreement establishing escrow

An indemnification agreement establishing escrow is a legal document that outlines the terms under which one party is protected from losses due to the actions or failures of another party while funds or assets are held in escrow.

pdfFiller scores top ratings on review platforms

This is a great product and it…

This is a great product and it definitely has my approval and recommendation

Not as user-friendly as I might have…

Not as user-friendly as I might have liked.

Awesome program - try it! You will see what I mean.

Awesome program. I love it!After using this program for a bit I now realize it is more than awesome. This program has helped me with forms and signatures and has pretty much streamlined this part of my job. I really love it!!!!!

First time user

First time user. Awesome product. Thanks!!!!!!!!!!!!!!

Yes Very satisfied

Yes, my experience was very good and straightforward. I got everything done that I needed to do. Thank you

Works fast and easy

Works fast and easy, great service!I had signed up very briefly to edit some pdfs for work. The program worked smoothly, but then I foolishly forgot to end my membership, and was billed for a years' worth of their service, which I did not need. Their customer support was top-notch and had my problem resolved in just a few minutes. I'd recommend them for anyone looking for a company that is responsive to their customers.

Who needs indemnification agreement establishing escrow?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the indemnification agreement establishing escrow form

Learning how to fill out an indemnification agreement establishing escrow form involves understanding its components and requirements in detail. This process empowers individuals and businesses to create a well-structured agreement that protects interests involved in transactions.

What is an indemnification agreement?

An indemnification agreement is a legal document where one party agrees to compensate another for certain losses or damages. The primary purpose is to allocate risk and provide protection against potential liabilities. It is crucial for negotiations in various contractual landscapes, as they clarify the roles of each party involved.

-

Indemnification agreements aim to provide clarity on the responsibilities and liabilities of each party.

-

Typically, the two key parties are the indemnifying party (the one providing indemnity) and the indemnitee (the one receiving protection).

-

Situations like contract breaches, legal claims, or employment disputes often trigger the need for indemnification.

What are the legal foundations of indemnification in Ohio?

Ohio law provides specific guidelines governing indemnification agreements, which is critical for ensuring all parties understand their legal rights. The legal frameworks help protect both individuals and companies when dealing with risks and liabilities.

-

Ohio has established regulations that define the scope and validity of indemnification agreements.

-

These laws often include provisions that safeguard against unfair indemnity clauses or unreasonable liabilities.

-

Understanding these laws helps businesses make informed decisions when drafting or entering into indemnification agreements.

How do you draft an indemnification agreement?

Drafting an effective indemnification agreement requires careful consideration of essential components that must be included. This ensures the agreement is tailored to the specific needs of the parties involved.

-

Clearly define the indemnity scope, limits, and conditions to ensure that parties know their responsibilities.

-

Key clauses might include the scope of indemnity and conditions for extended indemnification.

-

Utilizing tools like pdfFiller makes it easier to tailor documents to fit individual circumstances.

What are the best practices for executing the agreement?

Best practices for executing an indemnification agreement revolve around accuracy and secure processing. Employing electronic signature tools can streamline this process.

-

Ensure all fields are correctly filled out to prevent disputes over misinterpretation.

-

This platform facilitates electronic signatures and document management, enhancing collaboration.

-

Share and edit agreement drafts with team members to achieve consensus before finalizing.

What special considerations apply in different industries?

Each industry may have unique factors that influence the drafting and execution of indemnification agreements. High-risk sectors such as finance and healthcare often include specific provisions to mitigate risks.

-

Consider how industry norms and regulations impact indemnification agreements.

-

High-stakes industries may require more detailed indemnity clauses to address potential liabilities.

-

Remain aware of local regulations to ensure agreements align with legal requirements.

What common clauses should you understand in indemnification agreements?

Indemnification agreements have several key clauses that define the terms and limits of indemnity. Understanding these clauses helps in negotiations and execution.

-

These clauses lay out the conditions under which indemnification will be granted and are central to the agreement.

-

Recognizing common limitations ensures that both parties know the boundaries of liability.

-

Mutual agreements enhance trust and define the expectations clearly between parties.

How do you manage and update indemnification agreements over time?

Regularly reviewing indemnification agreements is essential to ensure they remain accurate and relevant. Changes in laws or business circumstances may necessitate updates.

-

Conducting periodic reviews helps identify any outdated terms that may expose parties to unnecessary risk.

-

Changes in regulation or business operations serve as cues for revising the agreements.

-

This tool helps track changes and manage document versions effectively.

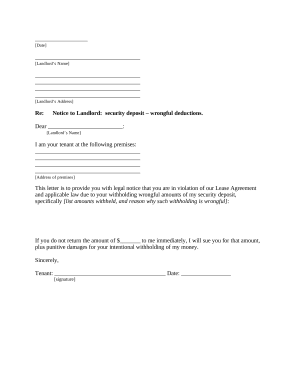

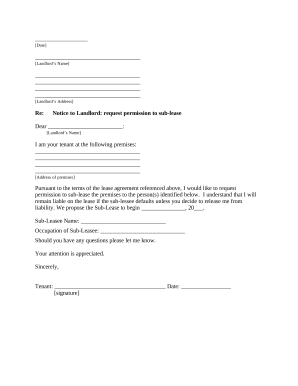

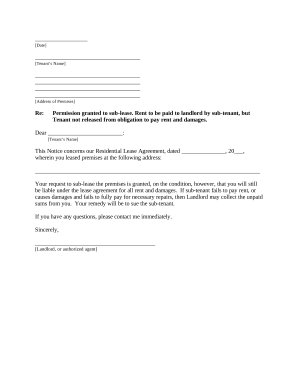

How to fill out the indemnification agreement establishing escrow

-

1.Access pdfFiller and log into your account, or create one if you don’t have an account.

-

2.Search for the ‘indemnification agreement establishing escrow’ template in the document section.

-

3.Once you locate the template, click on it to open and start filling.

-

4.Begin by entering the names of the parties involved in the agreement in the designated fields.

-

5.Provide the details of the escrow arrangement, including the amount of money or assets being held.

-

6.Clearly specify the reasons for indemnification and any conditions that must be met for the agreement to be enforced.

-

7.Fill in any necessary dates and additional clauses that pertain to the specific agreement.

-

8.Review all entered information to ensure correctness and clarity before finalizing.

-

9.Once satisfied, save the document or export it as needed, selecting the appropriate format for your purposes.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.