Get the free Stock Purchase Plan with exhibit of Bancorporation template

Show details

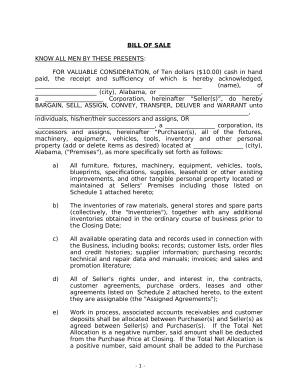

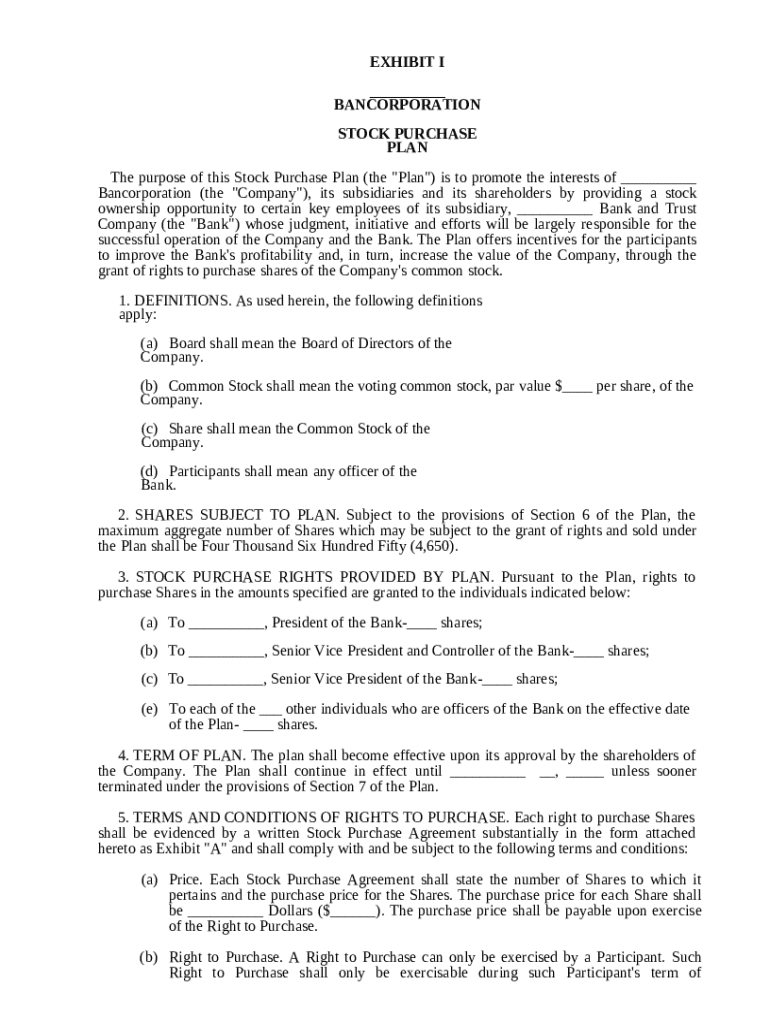

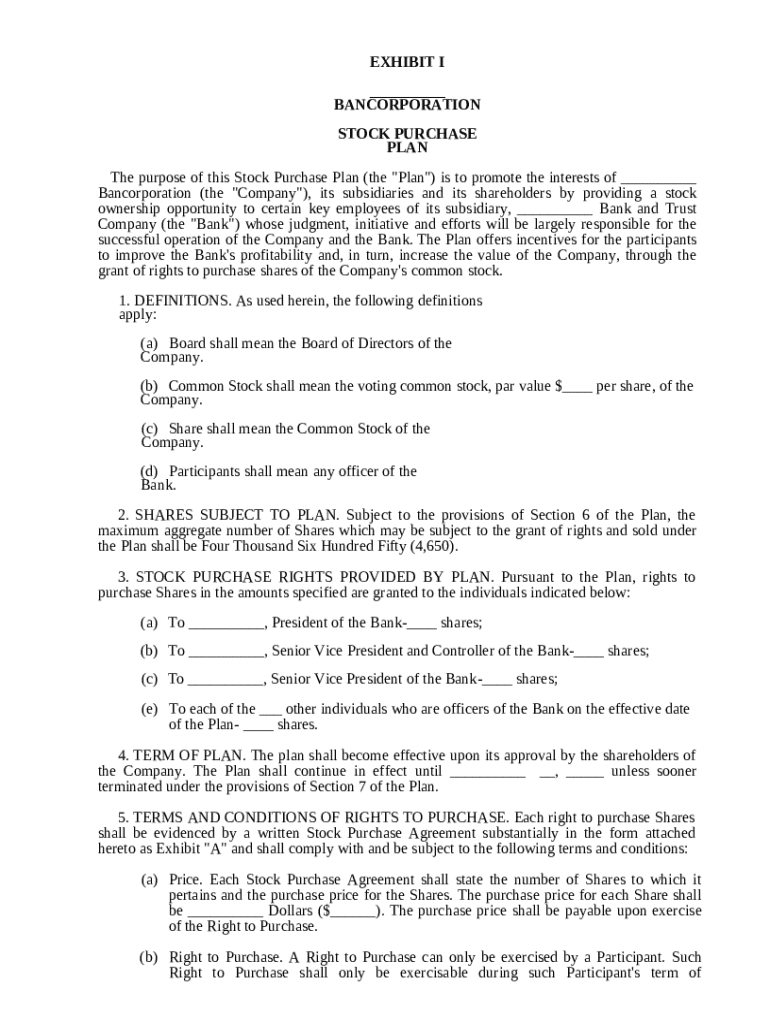

19-222F 19-222F . . . Stock Purchase Plan under which named officers of corporation are granted right to purchase different specific amounts of common stock at $200 per share (approximate price at

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is stock purchase plan with

A stock purchase plan is a company-sponsored program that allows employees to buy shares of the company's stock at a discounted price.

pdfFiller scores top ratings on review platforms

Adding a pic was hassle before now its…

Adding a pic was hassle before now its very simple. Thank you!!!

Great product!

Great product, recommend to others!

I was easily able to edit a Social…

I was easily able to edit a Social Security document and save to send to them.

it is great

it is great. It is very user friendly. It does exactly what I need it to do.

Great customer service

Great customer service! Extremely fast to reply and solved my problem right away.I would recommend this company.

This was so convenient

This was so convenient. It was quick and easy to register and begin filling out forms. This helped me out in a crunch to get my 1099 forms completed.

Who needs stock purchase plan with?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to stock purchase plans with form

How does a stock purchase plan work?

A stock purchase plan allows employees to buy shares of their company's stock at a discounted price, usually through payroll deductions. With these plans, employees can benefit from potential stock price increases while companies can enhance employee retention and motivation. Understanding how to fill out a stock purchase plan form is crucial for participation.

Understanding stock purchase plans

Stock purchase plans, or employee stock purchase plans (ESPPs), are designed to give employees an opportunity to become part owners of the company they work for. They play a crucial role in employee satisfaction and company loyalty.

-

Stock purchase plans provide employees the chance to buy shares at favorable terms, which can be a valuable addition to their overall compensation.

-

Employees enjoy discounted stock purchases, while companies can foster stronger loyalty by aligning employee interests with corporate performance.

-

These plans can lead to higher employee performance, ultimately driving profitability as employees work harder to increase the company's value.

What are the key definitions in stock purchase planning?

Understanding the terminology associated with stock purchase plans is essential for all stakeholders involved. Key terms help demystify the process and clarify roles and responsibilities.

-

Familiarizing oneself with terms such as 'stock options,' 'common stock,' and 'participants' can prevent misunderstandings.

-

Shares refer to the units of ownership in a company, while participants are the eligible employees who can buy these shares.

-

The board is responsible for approving the plan and ensuring it complies with legal standards and shareholder interests.

What are the key components of a stock purchase plan?

Every stock purchase plan includes vital components that dictate its operation, ensuring it aligns with both employee benefits and company regulations.

-

Eligibility requirements can vary but typically include full-time employment and a certain tenure with the company.

-

Companies may impose limits on how many shares employees can purchase in a given period to manage their financial exposure.

-

Participants must understand their responsibilities, such as timely enrollment and tax obligations regarding stock purchases.

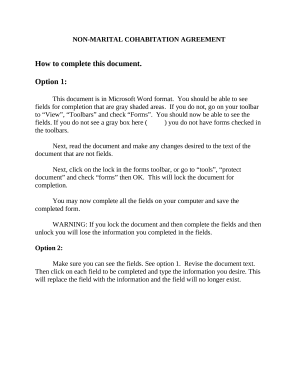

How do you fill out the stock purchase plan form on pdfFiller?

Filling out the stock purchase plan form can be a straightforward task when using pdfFiller, which simplifies document management and electronic workflows.

-

Begin by locating the form within the pdfFiller platform, which can be accessed from any device with an internet connection.

-

Pay attention to key sections like personal information and declaration of understanding the plan details.

-

Once completed, pdfFiller allows you to sign electronically and submit your form, streamlining the process effortlessly.

What types of employee stock purchase options exist?

Employee stock options come in various flavors, each with distinct implications for taxation and benefits. Understanding these differences can help in making informed decisions.

-

These plans include Employee Stock Purchase Plans (ESPPs), Restricted Stock Units (RSUs), Incentive Stock Options (ISOs), and Non-Qualified Stock Options (NSOs), each differing in tax treatment and employee rights.

-

Different stock options may have varying tax implications, affecting how and when employees pay taxes on gains.

-

Understanding these options allows employees to leverage the most advantageous scenario according to personal financial goals.

What are compliance and legal considerations in stock purchase plans?

Compliance with laws and regulations is critical to avoid penalties and ensure the plan's integrity. Knowledge of legal requirements helps maintain transparency and protects employee rights.

-

Several legal frameworks guide stock purchase plans, including SEC rules that protect investors.

-

Companies must adhere to certain filing requirements, ensuring that all necessary disclosures are made.

-

Employees are entitled to clear information regarding their rights and benefits within the stock purchase plan framework.

How does pdfFiller help with document management?

pdfFiller offers a comprehensive suite of tools for document management that is especially beneficial for managing stock purchase plans. Its intuitive interface enhances collaboration and efficiency.

-

Team members can collaborate on documents in real-time, making it easier to track changes and gather feedback.

-

By cloud-storing important documents, users can access their stock purchase plan forms from anywhere, anytime.

-

The platform allows for secure eSigning, and its tracking features ensure everyone is aware of updates.

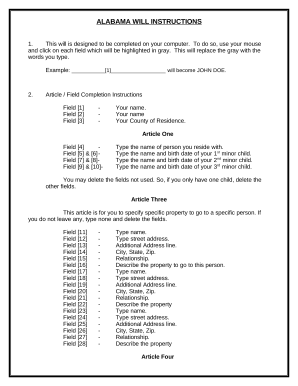

How to fill out the stock purchase plan with

-

1.Start by downloading the 'stock purchase plan with' document from your company's internal portal or from a secure link provided by HR.

-

2.Open the PDF file using pdfFiller or upload it if you are using the web app.

-

3.Begin by filling in the personal data section, including your full name, employee ID, and contact information as required.

-

4.Next, review the terms of the stock purchase plan, ensuring you understand your options and any associated risks.

-

5.In the selected options section, indicate the number of shares you wish to purchase and select your payment method if offered multiple choices.

-

6.Sign and date the document in the designated area to confirm your agreement with the plan's terms and conditions.

-

7.Before submitting, double-check all the filled-in information for accuracy and completeness.

-

8.Save a copy of the signed document for your records, and then submit it as instructed, either electronically through the platform or physically to your HR department.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.