Get the free Adoption of Restricted Stock Plan of RPM, Inc. template

Show details

This sample form, a detailed Adoption of Restricted Stock Plan, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is adoption of restricted stock

Adoption of restricted stock refers to a formal agreement outlining the conditions and restrictions associated with stock granted to employees or directors.

pdfFiller scores top ratings on review platforms

It's perfect. I'm able to input information and get the form to whomever in a matter of minutes.

It is great to sign documents without having to print and scan them.

great and very handy util. support in mobile and dasktop is awesome. ui needs to be simplified. if i have to diwnload a doc, i have to go thre four steps now..

Thank you for taking the time to resolve the issue I was having. I will say that your customer service is excellent!

I own several apartments and have to fill out forms when evicting tenants. This is so professional looking vs handwriting the forms.

Impressed with ability to import forms, and overall performance of program.

Who needs adoption of restricted stock?

Explore how professionals across industries use pdfFiller.

Understanding the Adoption of Restricted Stock Form

TL;DR: How to fill out a restricted stock form

To fill out a restricted stock form, you typically need to provide basic identification, specify the number of shares requested, and understand the terms related to vesting and forfeiture. Ensure you have the necessary approvals from your board or compensation committee, as this will streamline the granting process.

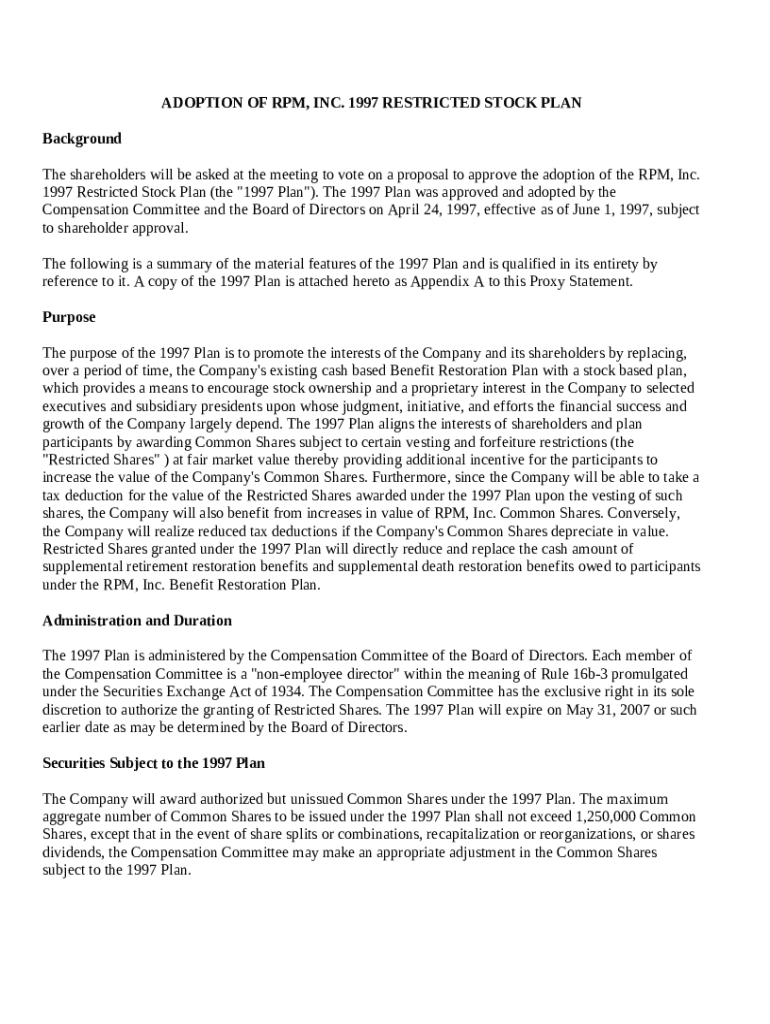

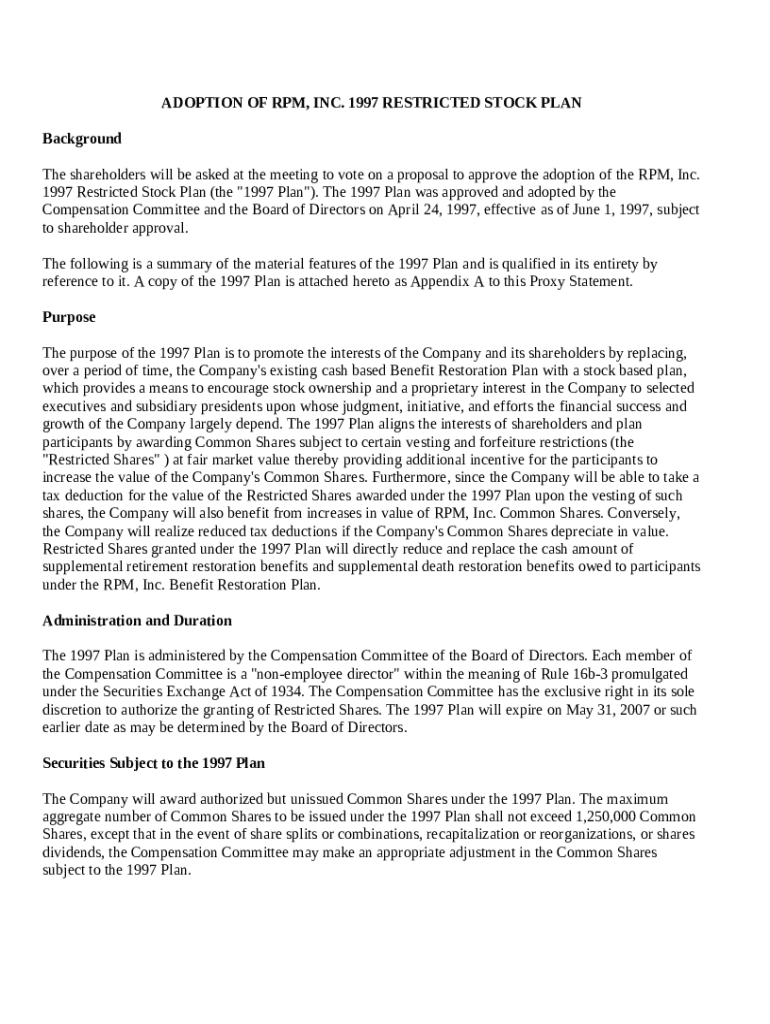

What is the background and approval process for adoption?

The adoption of a restricted stock plan requires significant stakeholder engagement, particularly during shareholder meetings where votes on the RPM Inc Restricted Stock Plan are cast. The approval process typically involves both the Compensation Committee and the Board of Directors, who evaluate the plan's potential impact on the company and its shareholders.

-

An essential gathering where stakeholders learn about and vote on the adoption of the restricted stock plan.

-

A focused evaluation of how the stock plan aligns with the company's compensation philosophy and shareholder interests.

-

Key dates include the proposal submission, approval notifications, and plans for implementation.

What are the purpose and objectives of the restricted stock plan?

The primary goal of the restricted stock plan is to replace cash-based benefits with stock ownership, fostering a culture of ownership among employees. This approach aligns the interests of shareholders with those of plan participants by incentivizing executives to increase shareholder value.

-

Encourages employees to invest in the company's success, enhancing motivation and commitment.

-

Aims to unify the goals of executives and shareholders, resulting in a more cohesive company strategy.

-

Stimulates greater stock ownership among executives, thereby enhancing performance.

What are the key features of the RPM Inc restricted stock plan?

The RPM Inc Restricted Stock Plan encompasses several critical features that dictate how stock grants are awarded and managed. These features include specific details about the types of shares offered, the vesting schedule, and forfeiture restrictions that apply to the shares granted.

-

Details on whether shares are common or preferred, affecting their value and how they are treated in a financial sense.

-

Specifies the duration an employee must remain with the company before they own the shares outright.

-

Outlines scenarios in which the employee may lose their granted stock, such as termination or failure to meet performance milestones.

How are restricted stock grants processed?

Granting restricted stock involves a systematic approach that includes detailed documentation and compliance with regulatory requirements. Executives or team leaders must follow a series of steps to ensure that stock grants are processed accurately and legally.

-

Clear step-by-step instructions help ensure that no aspect is overlooked during the granting process.

-

Essential forms and approvals must be gathered before finalizing the stock grant.

-

Utilizing pdfFiller can streamline the entire management process of restricted stocks with interactive tools.

What is the impact on financial statements and taxes?

Employing restricted stock grants affects financial statements significantly, with accounting being required to recognize the expense associated with the shares granted. Tax implications can also create opportunities for both the company and recipients, where understanding these aspects is vital for compliance and strategic planning.

-

Restricted stock grants can increase reported expenses, potentially affecting profit margins.

-

Opportunities for deductions can arise from stock grants, benefiting both the company and participating employees.

-

Depreciation of common shares can pose risks to the perceived success of the stock grant initiative.

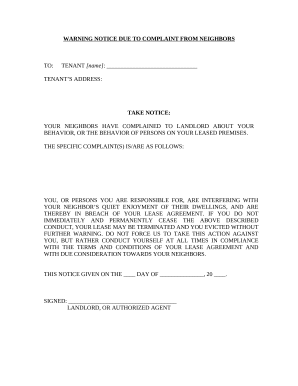

What are the compliance and documentation requirements?

Compliance is paramount in adopting a restricted stock plan, ensuring it adheres to regulatory and internal company standards. Necessary documentation aids in transparency and accountability while satisfying both shareholder and IRS requirements.

-

Understanding the legal frameworks that govern stock plans is crucial for successful implementation.

-

Documentation includes shareholder votes, IRS submissions, and internal approvals.

-

Utilizing tools like pdfFiller promotes efficiency and compliance in managing stock plan documentation.

How does innovative document management using pdfFiller enhance processes?

pdfFiller revolutionizes document management by offering interactive tools that facilitate the editing and signing of restricted stock forms. Its features support real-time collaboration, streamlining the process of managing complex stock plan documentation.

-

pdfFiller simplifies the process, allowing users to create and customize documents quickly.

-

Real-time collaboration tools aid teams in managing the necessary paperwork effectively.

-

pdfFiller helps maintain compliance through organized documentation and tracking of approvals.

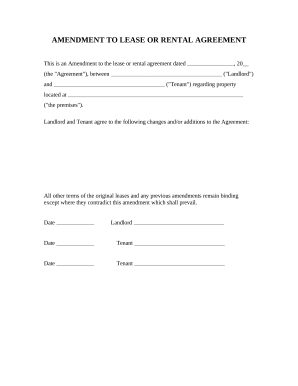

How to fill out the adoption of restricted stock

-

1.Begin by accessing the pdfFiller platform and log in to your account.

-

2.Locate the template for 'Adoption of Restricted Stock' in the document library or upload your own form if needed.

-

3.Fill in the basic information including the name of the company, address, and date at the top of the document.

-

4.Provide details about the restricted stock, including the number of shares being granted and any specific conditions or restrictions associated with the stock.

-

5.Fill in the names and roles of the individuals receiving the restricted stock, ensuring accuracy.

-

6.Include signature lines for both the issuing authority and the recipients to acknowledge the agreement.

-

7.Review all entries for accuracy to avoid errors that could cause issues later.

-

8.Once satisfied with the information, save your document and choose the option to print or share electronically as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.