Get the free Proposed employees' loan and guaranty benefit plan template

Show details

This sample form, a detailed Proposed Employees' Loan and Guaranty Benefit Plan document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is proposed employees loan and

A proposed employees loan is a document outlining the terms, conditions, and amount of a loan offered to employees by an employer.

pdfFiller scores top ratings on review platforms

I used this program for one item in the past and just discovered today I can use it for many other types of forms such as Income Tax etc. Very easy to use, thank you. Wendell Juhl

the fill in didn't give me enough words for the address and zip

started in 5 seconds, worked in 10 seconds - just very good tool

It was very easy to use and was user friendly for using the icons to understand what I was doing. Process was a little slow, but I think that was my computer!

est site I have ever come across...Amazing experience

Have only used it for one document so far so good

Who needs proposed employees loan and?

Explore how professionals across industries use pdfFiller.

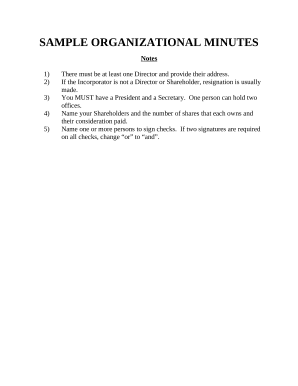

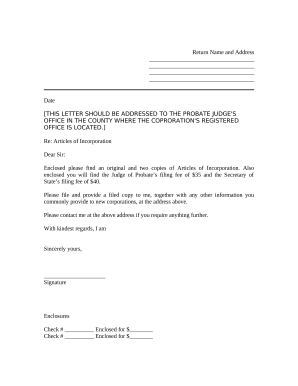

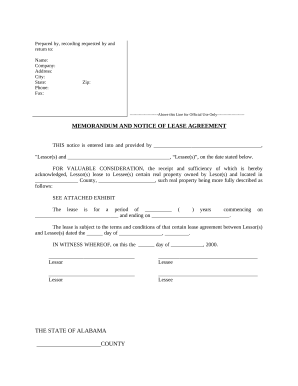

Proposed Employees Loan and Form Guide

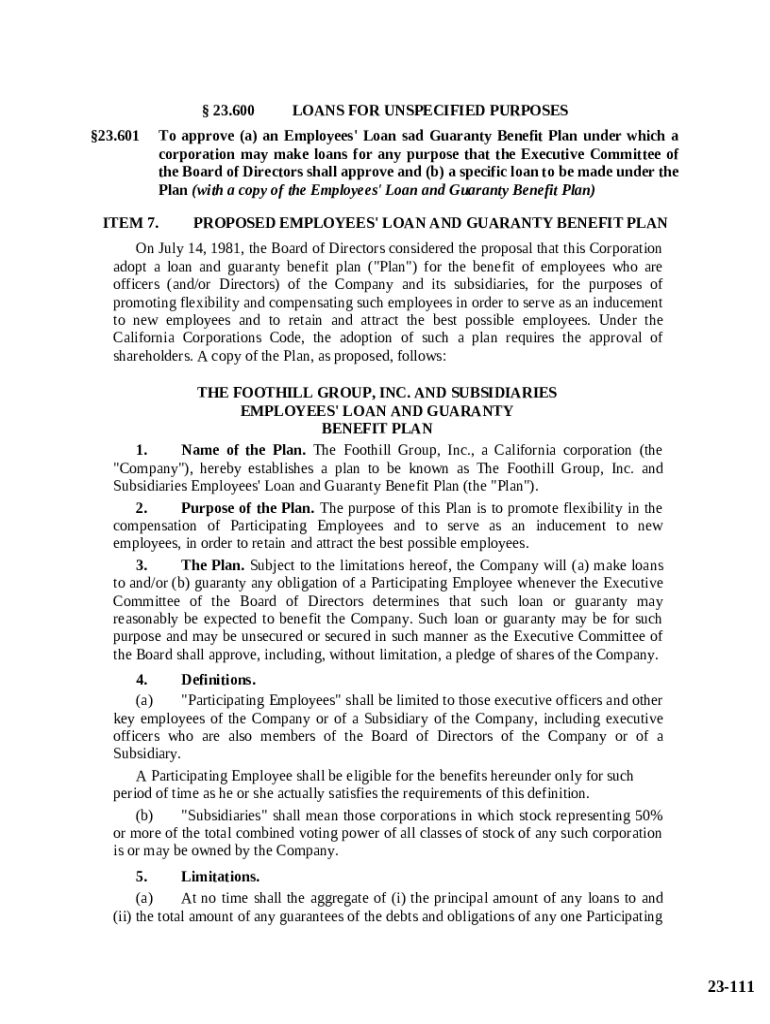

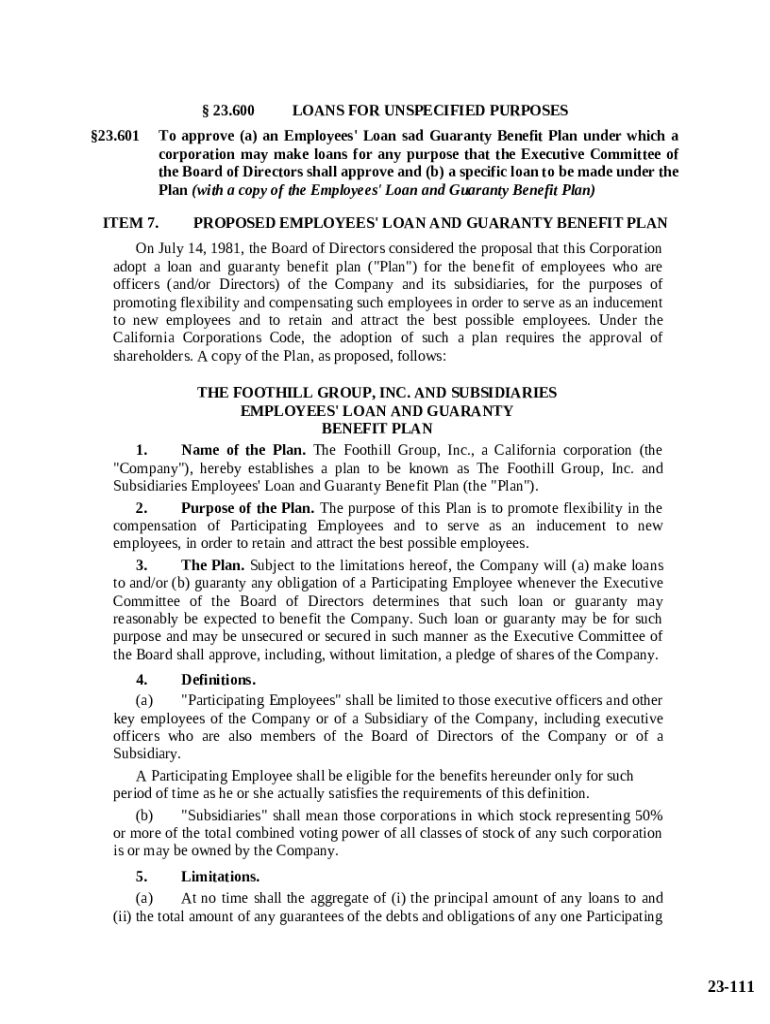

What is the Employees' Loan and Guaranty Benefit Plan?

The Employees' Loan and Guaranty Benefit Plan is designed to provide eligible employees with financial assistance through loans, while enhancing the company's ability to attract and retain talent. This plan serves as a flexible compensation tool, allowing employees to access funds based on their needs, which can lead to increased workplace satisfaction and loyalty.

Who is eligible for the Employees' Loan and Guaranty Benefit Plan?

Eligibility for this plan typically includes employees who have been with the company for a specified duration and have a sound credit history. This ensures that the loans are granted to employees who have demonstrated reliability and responsibility.

How does this plan enhance flexibility and attract talent?

The plan promotes flexibility in compensation by allowing loans that can cater to various employee needs, from emergency expenses to educational pursuits. This adaptability makes the company more appealing to prospective talent, showcasing a commitment to employee welfare and financial stability.

What are the key features of the Loan and Guaranty Benefit Plan?

This plan includes several key features designed to meet diverse employee needs. Here are the primary aspects:

-

Various loans are provided, including personal, educational, and home improvement loans, each catering to specific employee needs.

-

The company may have certain obligations to back these loans, ensuring financial security for employees.

-

Loans require the approval of the Executive Committee, which reviews all applications to maintain strict lending criteria.

What steps are involved in implementing the Employees' Loan and Guaranty Benefit Plan?

Implementing this plan involves a structured process to ensure legality and alignment with company objectives. Key steps include:

-

The Board of Directors must approve the plan, emphasizing its significance for company operations.

-

Mandatory shareholder approval is required under the California Corporations Code, reinforcing transparency.

-

Proper documentation of the plan's adoption is essential for compliance and operational clarity.

How to fill out the Employees' Loan Application Form?

Completing the Employees' Loan Application Form requires attention to detail to ensure all necessary information is accurately provided. The following elements are crucial:

-

Applicants must fill in standard personal information, including name, contact details, and employment status.

-

It's important to specify the intended use of the loan, as this can impact approval chances.

-

Applicants should clearly outline how they plan to repay the loan, demonstrating financial responsibility.

How to manage Employees' Loan documentation?

Proper management of loan documentation is critical for both the employee and the employer. Platforms like pdfFiller provide tools to edit forms, eSign, and collaborate securely on loan-related documents.

What are the benefits of the Employees' Loan and Guaranty Benefit Plan?

The plan holds numerous benefits, including enhancing employee loyalty, providing financial security, and fostering a positive workplace culture. Employees feel valued and supported, directly translating to better retention rates and job satisfaction.

Why compare the Employees' Loan Program to other options?

Understanding how this plan stacks up against traditional loan programs is essential for informed decision-making. This comparison can reveal unique advantages, including better terms, more flexibility, and tailored benefits for employees.

What is the conclusion regarding the Employees' Loan and Guaranty Benefit Plan?

In conclusion, the proposed Employees' Loan and Form process emphasizes the significant role of a flexible loan benefit plan in enhancing employee attraction and retention. Companies that adapt this plan not only support their workforce but also recognize the strategic benefits that come with it. The future demands responsiveness in policies to meet evolving employee needs.

How to fill out the proposed employees loan and

-

1.Begin by downloading the proposed employees loan template from pdfFiller.

-

2.Open the document and review the sections that need to be filled out.

-

3.Enter the date of the proposal at the top of the document.

-

4.Fill in the employee's full name, job title, and employee ID in the specified fields.

-

5.Provide detailed information about the loan amount requested and its intended use.

-

6.Specify the repayment terms, including the duration and interest rate, if applicable.

-

7.Include any collateral that may be required for securing the loan.

-

8.Have the employee sign and date the document to indicate acceptance of the terms.

-

9.Review all entered information for accuracy before submission.

-

10.Save the completed document and submit it to the designated HR representative or manager as instructed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.