Get the free Long Term Incentive Compensation Plan of A.M. Castle and Co. template

Show details

20-181 20-181 . . . Long Term Incentive Compensation Plan under which Human Resources Committee designates employees who will be participants in Plan and establishes Maximum Award Percentage with

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is long term incentive compensation

Long term incentive compensation refers to financial rewards meant to motivate and retain employees over a longer period, typically linked to the company's performance.

pdfFiller scores top ratings on review platforms

Great price and so user-friendly.

So easy to use. I'm so glad I found pdfFiller, it's perfect for my needs and for the price, it was a no brainer.

Great website easy to use

The filler helped me accomplished all my goals in filling out and printing the forms I needed

Great experience was everything I hoped it would be

EASY TO USE

Not satisfied

Who needs long term incentive compensation?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Long Term Incentive Compensation Form on pdfFiller

How to fill out a long term incentive compensation form?

Filling out a long term incentive compensation form involves collecting relevant performance data, understanding eligibility parameters, and accurately reflecting award structures based on organizational goals. Use pdfFiller to easily edit and manage the document. Begin by entering participant details and selecting appropriate incentive vehicles.

What is long term incentive compensation?

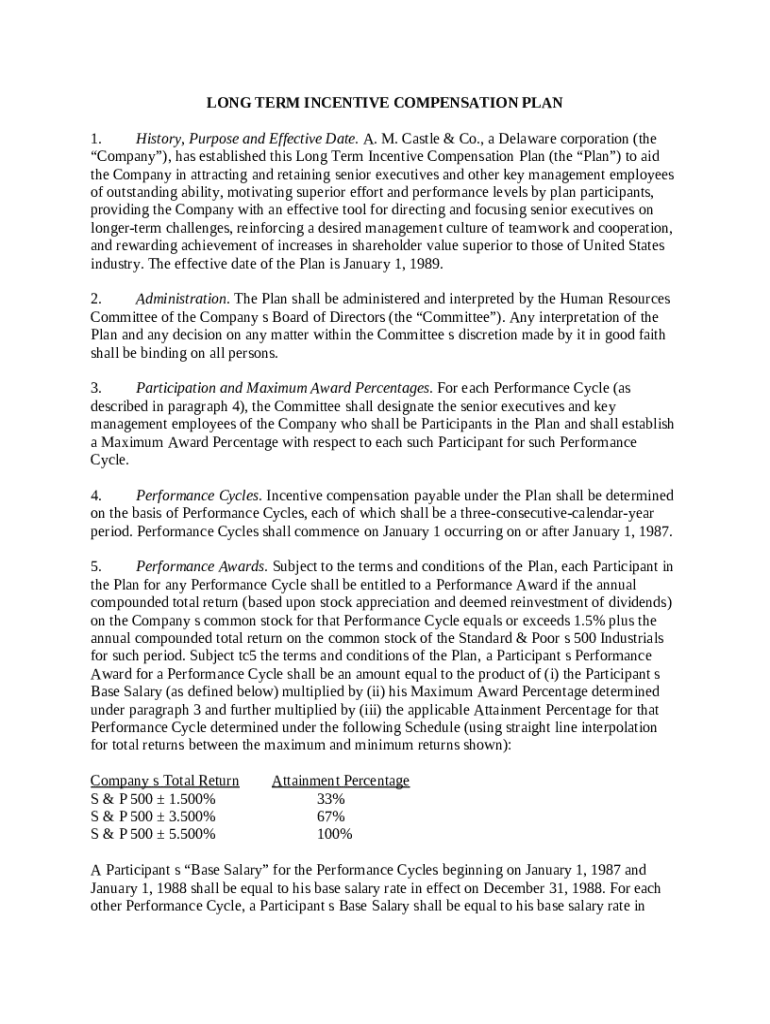

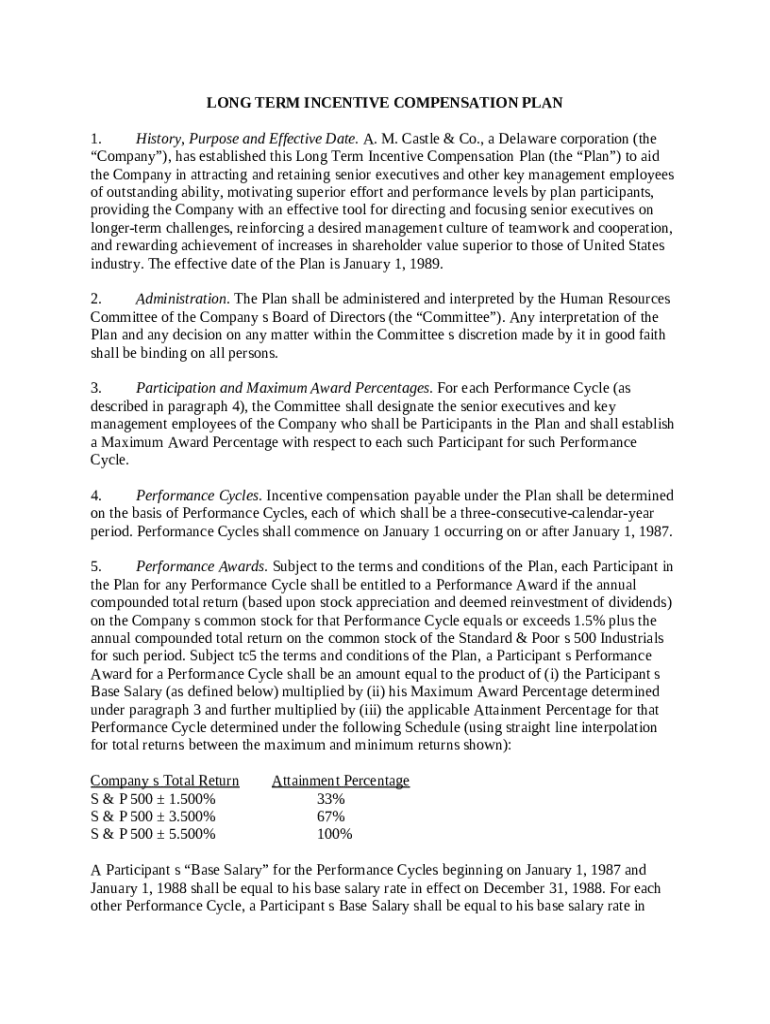

Long term incentive compensation (LTIC) is a crucial reward system designed to attract and retain senior executives. It motivates superior performance by aligning the interests of company leaders with those of shareholders. This form of compensation is intended to enhance employee loyalty and company competitiveness over an extended period.

What are the key components of a long term incentive compensation plan?

Effective long term incentive plans (LTIPs) encompass various components tailored to suit organizational objectives. These plans often include award vehicles such as stock options, restricted stock, and performance shares. Adjusting the mix of these elements can influence how effectively they motivate performance and drive shareholder value.

-

Gives employees the right to buy company stock at a predetermined price, incentivizing performance linked to stock appreciation.

-

Employees receive shares that are subject to vesting requirements, promoting loyalty and long-term alignment with company success.

-

Awards linked to specific performance targets, pushing employees toward achieving measurable company goals.

How are long term incentive plans administered?

The Human Resources Committee typically oversees the administration of long term incentive plans. This includes interpreting plan terms and making binding decisions regarding awards. The discretion of the committee can significantly impact how effectively the plan functions and how aligned it remains with strategic organizational goals.

Who is eligible for long term incentive compensation plans?

Eligibility criteria for participants in long term incentive compensation plans vary by organization but usually focus on key personnel and executives. Establishing maximum award percentages and evaluating individual performance cycles ensure fair and effective distribution of LTIC.

-

Often include senior management and other roles critical to the company's success.

-

Typically evaluated over three consecutive calendar years, aligning rewards with long-term goals.

How do performance cycles affect compensation determination?

Performance cycles are essential for determining compensation, usually set as three-consecutive-calendar-year periods. Evaluating criteria such as stock appreciation during these cycles informs the performance awards awarded to employees, compelling them to align their efforts with broader business objectives.

How can maximize earnings with long term incentive compensation?

Engaging participants effectively in long term incentive compensation plans can significantly maximize performance awards. Implementing proper incentive frameworks not only propels individual performance but also leads to enhanced company success and increased shareholder value.

What interactive tools does pdfFiller offer for LTIP documents?

pdfFiller provides comprehensive tools for editing and managing long term incentive compensation forms. This includes creating responsive documents, eSigning, and facilitating collaborative efforts within its cloud-based platform. Users can enjoy streamlined document management, making it easier to navigate LTIPs.

How to fill out the long term incentive compensation

-

1.Start by accessing your PDF filler account and locating the long term incentive compensation form.

-

2.Download the form if necessary, or open it directly in the editor.

-

3.Begin filling in the employee's details such as name, position, and identification number.

-

4.Specify the incentive type, whether it is stock options, restricted stock units, or performance shares.

-

5.Enter the grant date, vesting schedule, and any financial metrics if applicable.

-

6.Provide details regarding the performance goals tied to the compensation and their respective measurement periods.

-

7.Review the filled form for accuracy, ensuring all required fields are completed.

-

8.Save your completed document and follow any provided submission guidelines, such as sending to HR or management for approval.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.