Last updated on Feb 17, 2026

Get the free Management Agreement between Advisers Managers Trust and Neuberger and Berman Manage...

Show details

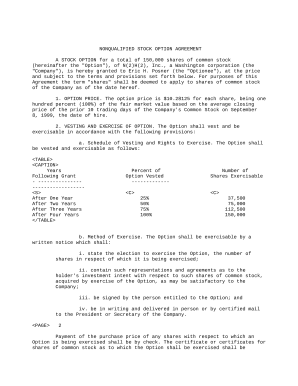

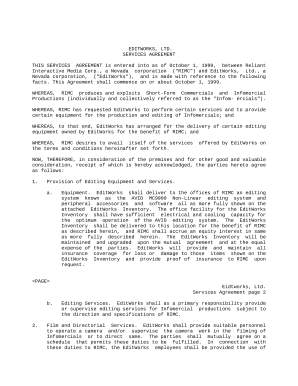

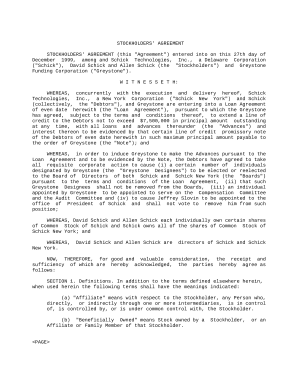

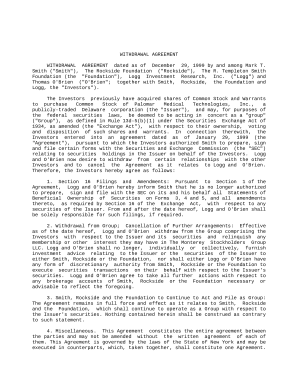

This sample form, a detailed Management Agreement document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is management agreement between advisers

A management agreement between advisers is a formal contract that outlines the roles, responsibilities, and compensation between financial advisers and their clients.

pdfFiller scores top ratings on review platforms

Excellent

EXCELLENT

Chatted online to cancel and refund $96 that I was charged and I got a pretty friendly guy named Peter! He was sweet and fast! If I needed this particular application again, I would definitely reuse them!!!

This is my first time dealing with PDFFILLER! There were some issues and they quickly assisted in resolving the areas in question . I would recommend them to business professionals and someone like me that has a periodic need for administrative documents.

Their customer service is great! Joyce helped me out and was super helpful and considerate! Best customer service experience I’ve had. Thanks for the quick response!

Chatted online to cancel and refund $96 that I was charged and I got a pretty friendly guy named Peter! He was sweet and fast! If I needed this particular application again, I would definitely reuse them!!!

Who needs management agreement between advisers?

Explore how professionals across industries use pdfFiller.

How to fill out a management agreement between advisers form: A Comprehensive Guide

Understanding the management agreement between advisers

A management agreement between advisers is a formal contract that outlines the responsibilities and expectations of all parties involved in an investment management engagement. These agreements serve as the foundation for a professional relationship, ensuring that both advisers and clients are aligned in their financial objectives.

-

Management agreements clarify roles, set objectives, and define the scope of services provided by advisers.

-

Standard components include investment objectives, fees, duration, and termination clauses.

-

Understanding the distinctions between discretionary and non-discretionary management agreements is essential for selecting the appropriate type.

What parties are involved in a management agreement?

Key parties involved in a management agreement include investment managers, advisers, and clients. Each party holds specific roles, contributing to the harmonious functioning of the investment strategy.

-

Managers Trust is responsible for overseeing compliance and ensures that investments adhere to the client's goals.

-

This entity typically acts as a fund manager, executing investment strategies on behalf of clients.

-

The manager has the authority to make investment decisions based on the terms outlined in the agreement.

What are the key provisions of the management agreement?

Key provisions outline vital functions, expectations, and deliverables tied to the management agreement. They ensure clarity in operations and legal obligations.

-

This section describes the services provided, such as asset allocation and market analysis.

-

Responsibilities include regularly updating the client on portfolio performance and investment strategies.

-

The manager must analyze market trends and economic indicators to inform investment decisions.

How to set investment objectives and policies?

Establishing clear investment objectives is crucial for directing the investment strategy. This foundational step lays the groundwork for how the fund will operate.

-

Objectives must be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART).

-

This refers to ongoing monitoring and reassessment of the investment strategy to ensure it aligns with market conditions.

-

Investment decisions should adhere to pre-defined policies to maintain a consistent approach.

How to fulfill agreement obligations?

Fulfilling obligations typically involves systematic processes for investment management, ensuring adherence to the agreement terms.

-

Involves researching securities, analyzing performance metrics, and executing trades to align with objectives.

-

Firms should establish clear protocols for decision-making that reflects the agreement's intent.

-

Success in portfolio management requires attention to diversification, risk management, and regular performance evaluations.

What steps are involved in filling out the management agreement form?

Filling out a management agreement form requires careful attention to detail to ensure all necessary fields are accurately completed.

-

Utilize pdfFiller's features for a streamlined document completion process, including template assistance.

-

Follow detailed guidelines provided by the platform to ensure completeness and accuracy.

-

Be mindful of overlooking signatures and dates to prevent potential delays in the agreement process.

How to manage changes and amendments?

Managing amendments is vital for maintaining an up-to-date agreement that reflects current needs and legal requirements.

-

Adherence to addendums ensures that changes are documented clearly and legally binding.

-

Outline specific steps for reviewing and amending the contract to match evolving circumstances.

-

Effective communication is key, ensuring all parties are aware of changes in a timely manner.

What are best practices for document management?

Utilizing best practices in document management enhances efficiency and collaboration among all parties involved.

-

Leverage pdfFiller's collaboration tools for seamless communication and updates on document status.

-

eSign capabilities simplify signature gathering, reducing turnaround time and increasing convenience.

-

Employ systematic filing and labeling methods for easy retrieval of completed forms.

What are the compliance and regulatory considerations?

Understanding compliance ensures that management agreements meet legal standards and protects both advisers and clients.

-

Familiarity with the Investment Company Act is crucial for understanding regulatory obligations.

-

Regular reviews help avoid penalties and ensure that practices are up to date with current regulations.

-

Identifying potential risks such as non-compliance can minimize legal exposure and enhance operational integrity.

What are regional considerations in management agreements?

Region-specific laws and regulations can significantly influence the design and enforcement of a management agreement.

-

New York's legal framework has unique characteristics that impact compliance requirements for investment advisers.

-

Advisers must stay informed about local statutes to navigate obligations effectively.

-

Past disputes can provide insights and best practices for avoiding similar issues in the future.

How to fill out the management agreement between advisers

-

1.Open your PDFfiller account and upload the management agreement template.

-

2.Begin by entering the names of the parties involved at the top of the document; this usually includes the adviser and the client.

-

3.Next, specify the scope of services to be provided by the adviser. This section should detail the responsibilities and obligations of the adviser.

-

4.Then, outline the compensation structure, including fees, payment schedules, and any performance-based incentives if applicable.

-

5.Fill in the duration of the agreement, including start and end dates, and conditions for renewal or termination.

-

6.Review all sections carefully to ensure accuracy and completeness, making any necessary adjustments.

-

7.Finally, have both parties sign the document electronically to officially execute the agreement, ensuring it is saved properly in your PDFfiller account.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.