Get the free of Accounting Index template

Show details

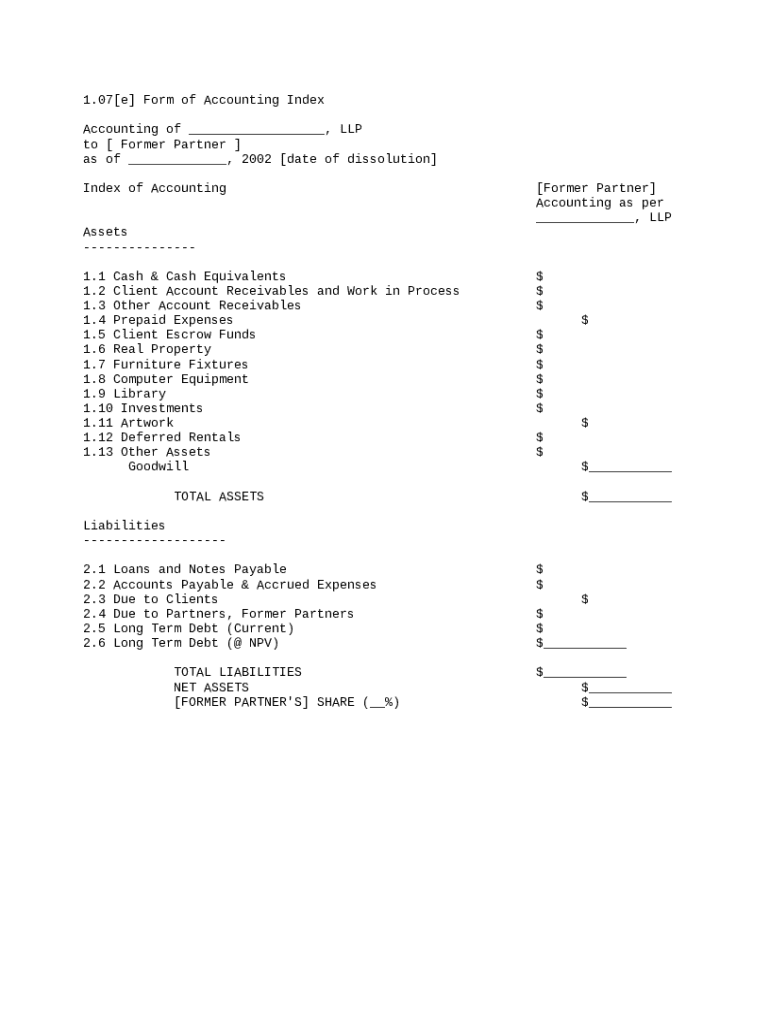

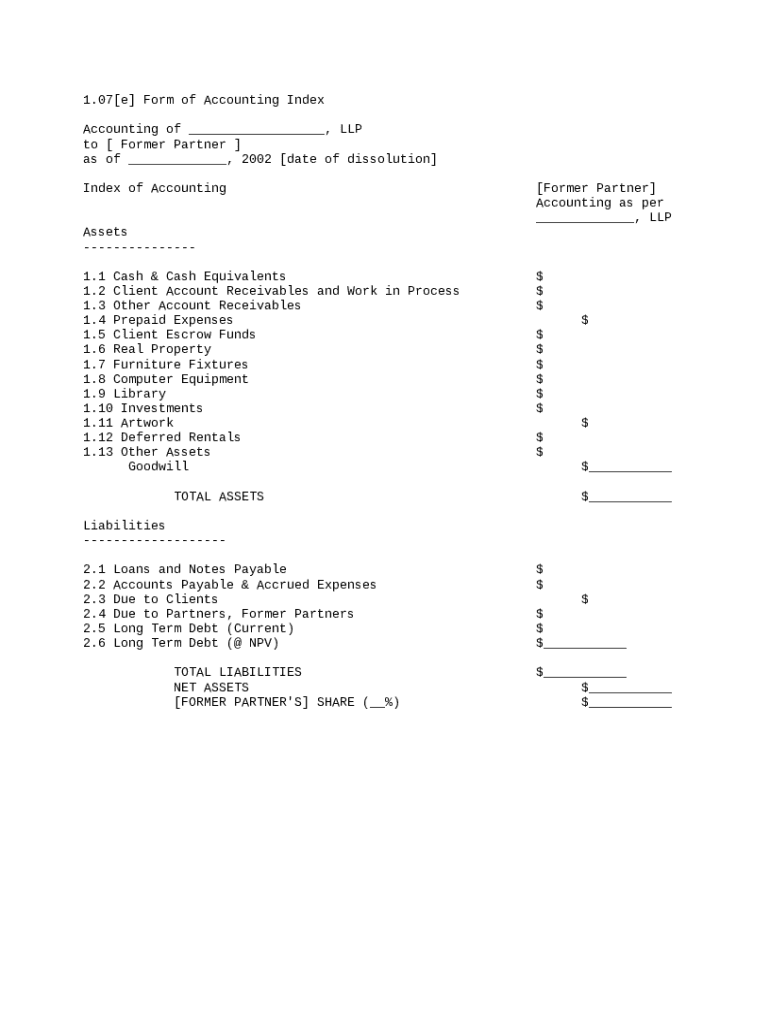

This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is form of accounting index

The form of accounting index is a document that categorizes and summarizes accounting entries for easy reference and analysis.

pdfFiller scores top ratings on review platforms

easy to use, easy to maneuver!

I love how effective it is and makes my job 10 times easier!

hkknhjkmhijukjgjhklhhjjjjmgnfhfhhkjhjkjkkjljhkhjgjhkjkjl

Easy and awesome !!

PdfFiller allowed to to complete an important document

A+++

Who needs of accounting index template?

Explore how professionals across industries use pdfFiller.

How to fill out a form of accounting index form: A comprehensive guide

Understanding the form of accounting index

A 'form of accounting index' is crucial in organizing financial documentation, serving as a summary that categorizes a company’s financial information. It assists accountants in presenting relevant data clearly and effectively, ensuring all necessary details are easily accessible during audits or reviews. Adherence to CPA (Certified Public Accountant) standards is essential for maintaining credibility and compliance in financial reporting.

-

It provides a structured framework for organizing financial data.

-

It enhances clarity and accessibility of financial records.

-

Aligning documentation with CPA standards ensures compliance and credibility.

What are the components of the accounting index?

Understanding the key components of the accounting index is essential for effective data management. This includes a detailed breakdown of assets, liabilities, and net assets that form the backbone of financial reports. Recognizing the significance of these elements helps businesses in evaluating their financial health.

-

Assets are categorized as current and fixed, providing insights into liquidity and long-term stability.

-

Liabilities encompass debts and obligations, affecting a company's net worth and operational capabilities.

-

Net assets reflect the company's total value, vital for evaluating financial performance.

How do you complete the form step-by-step?

Filling out the form of accounting index may seem daunting, but with a structured approach, it can be straightforward. Start by gathering all necessary information, ensuring you have accurate data for each section. Utilizing pdfFiller tools can simplify data entry and facilitate management throughout the process.

-

Ensure correct company name, registration details, and financial year.

-

Leverage the platform’s features to streamline filling and editing.

-

Double-check entries and use built-in calculators for financial accuracy.

What common errors should you avoid in your accounting index?

Mistakes in the accounting index form can lead to significant financial misunderstandings. It's crucial to know common errors to avoid, such as miscalculating figures or failing to update regular entries. Being mindful can save you time and resources in the long run.

-

Common missed items include incomplete asset listings and unverified calculations.

-

Errors can lead to inaccurate financial reporting, affecting decision-making.

-

Utilize revision history and error-checking tools for better accuracy.

How can interactive tools enhance your document management?

In today's digital age, leveraging technology for document management is essential. pdfFiller offers robust features that allow users to collaborate, share, and manage their accounting forms seamlessly. Utilizing these tools can significantly improve your team's efficiency and ensure proper documentation.

-

Features include customizable templates and easy data sharing.

-

Streamline teamwork with shared access to documents.

-

Ensure compliance and security with digital solutions for signing documents.

What are the regulatory compliance considerations?

Regulatory compliance is a fundamental pillar of any accounting practice. Understanding the specific regulations applicable to your region can avoid costly penalties. pdfFiller assists businesses by facilitating adherence to legal standards and ensuring ongoing updates regarding compliance needs.

-

Regulations vary by region and must be acknowledged to ensure compliance.

-

The platform provides tools that align documents with necessary regulations.

-

Regularly review region-specific laws to ensure all practices remain compliant.

How is the form used in different business scenarios?

The versatility of the accounting index form allows it to be adapted for various business scenarios. Whether it’s a small business or a large corporation, understanding the application of this form in different contexts is vital for financial clarity. Case studies can illustrate how different industries implement the form effectively.

-

Different industries have unique requirements, making adaptation necessary.

-

Examples from various sectors can highlight effective utilizations.

-

Team dynamics can influence how the index form is approached and completed.

What is the conclusion for mastering your accounting documentation?

Mastering the form of accounting index is key to ensuring accurate financial documentation. Utilizing pdfFiller tools not only simplifies the process but also enhances data integrity and compliance. By embedding the use of effective tools and continuous learning, users can streamline their accounting tasks with confidence.

How to fill out the of accounting index template

-

1.Open the form of accounting index template in pdfFiller.

-

2.Begin by entering the date at the top of the form to indicate when the accounting entries were made.

-

3.In the first column labeled 'Account Name', list the names of all accounts involved in your entries.

-

4.Move to the 'Account Code' column and provide the corresponding codes for each account, based on your chart of accounts.

-

5.In the next column, 'Description', write a brief explanation of each transaction that relates to the accounts listed.

-

6.Fill in the 'Debit' and 'Credit' columns with the respective amounts for each entry, ensuring that they accurately reflect your transactions.

-

7.If applicable, add any references or transaction numbers in the 'Reference' column for tracking purposes.

-

8.Review all entries for accuracy and completeness before finalizing the form.

-

9.Save your completed form of accounting index as a new document for future reference and reporting.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.