Get the free Employee Stock Purchase Plan of American Annuity Group, Inc. template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is employee stock purchase plan

An employee stock purchase plan (ESPP) is a company program that allows employees to purchase company stock at a discounted rate, typically through payroll deductions.

pdfFiller scores top ratings on review platforms

Extremely helped my job at work and home! Great one!

I usually help my children to their school works (lent them to use it). And it helps to do paperless and no need to waste ink. We straightly read from the saved file. Excellent.

i like it a lot but i rather buy the software to install...

i like it a lot but i rather buy the software to install on my desktop since i only will use it like once or twice per year. but i loved it.

What a time saving document access and communication...

What a time saving document access and communication method. The ability to format it to meet the inner personal business need and send is fantastic! Great job and thank you to the Creator(s)

Super impressed by the level of support from these guys. They were on my problem within minutes and when it turned out I had the wrong level of subscription (I needed a lesser one) it was changed and updated straight-away - no questions asked. Really happy.

Easy to Use

Great experience and very user friendly, PDF Filler is a life saver. Thank you guys for a pleasant experience.

Who needs employee stock purchase plan?

Explore how professionals across industries use pdfFiller.

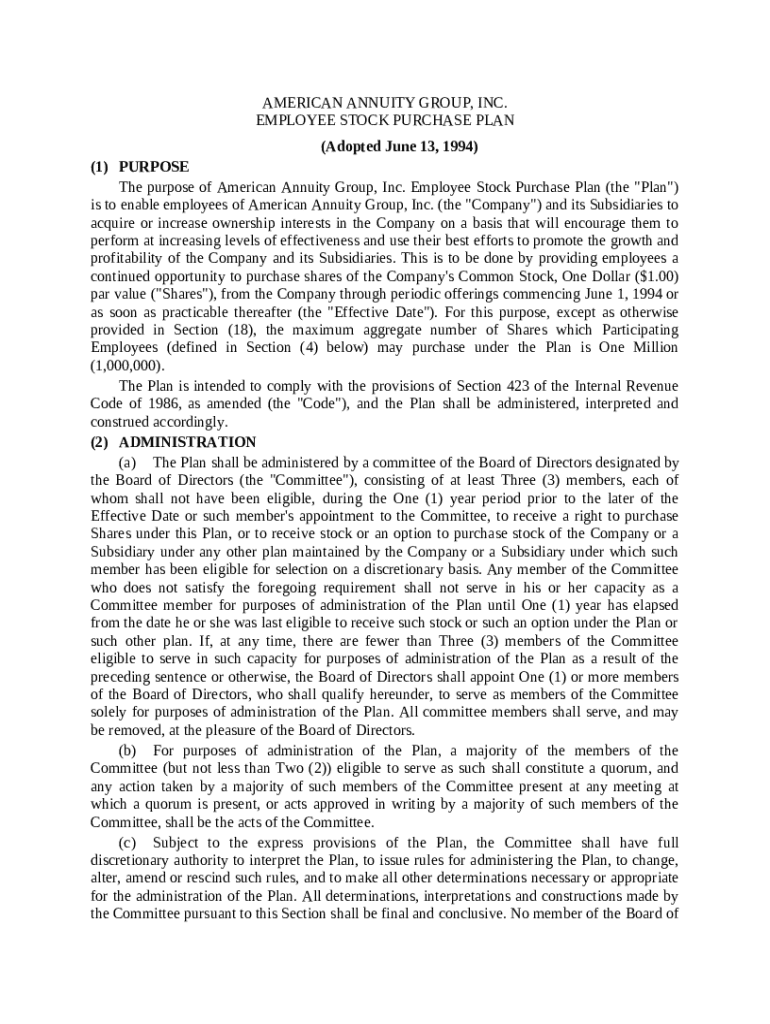

Comprehensive Guide to Employee Stock Purchase Plan Form

An employee stock purchase plan (ESPP) form allows employees to purchase company shares at a discount. This comprehensive guide explains the importance of the ESPP, how to fill out the form, and the various considerations and obligations involved.

What is an employee stock purchase plan (ESPP)?

An ESPP is a program that allows employees of a company to buy shares of the company's stock, often at a discounted price. The purpose of the ESPP is to incentivize employees and align their interests with those of the shareholders.

-

ESPPs enable employees to accumulate stock in their company, enhancing employee involvement and ownership.

-

Participating in an ESPP can lead to significant financial gains through discounted stock purchases, which can appreciate over time.

-

Typically, employees need to work for the company for a specified period before they can enroll, ensuring a commitment to the organization.

What are the key components of the employee stock purchase plan form?

The ESPP form contains essential sections that guide employees in providing the necessary information. Understanding these components is crucial for accurate completion.

-

The form usually includes sections for personal information, enrollment options, and stock allocation.

-

Employees must fill out specific fields such as their name, employee ID, and the number of shares they wish to purchase.

-

Many employees overlook reviewing their entries, leading to errors that can delay their application.

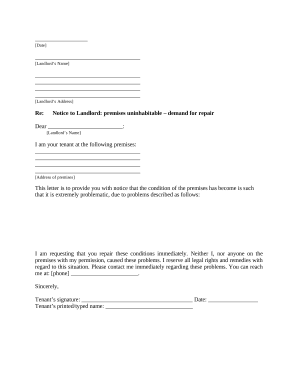

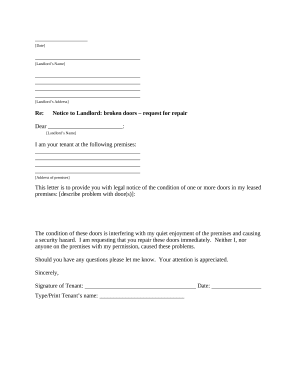

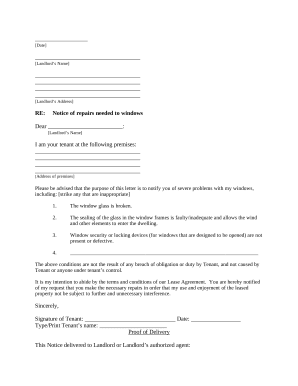

How to fill out the employee stock purchase plan form?

Filling out the ESPP form involves a systematic approach to ensure accuracy and completeness. Here’s a step-by-step guide.

-

Start by gathering your personal information and reviewing the eligibility criteria before beginning to fill out the form.

-

pdfFiller offers interactive tools that can simplify the completion process by auto-filling information where possible.

-

Double-check entries for correctness and ensure you meet all submission guidelines to avoid potential issues.

How to review and sign the employee stock purchase plan form?

After completing the ESPP form, a thorough review is necessary to ensure accuracy before submitting it. Signing the form correctly is also crucial.

-

Go through each section of the form to confirm the information is both accurate and complete.

-

pdfFiller's eSignature feature allows you to sign documents electronically, making the process streamlined and efficient.

-

You can collaborate with team members on pdfFiller, allowing for shared reviews and feedback before final submission.

What IRS forms are relevant to ESPP?

Several IRS forms are associated with the ESPP, and understanding these forms is crucial for compliance and tax purposes.

-

These forms are used for reporting stock options and the sale of shares under the ESPP.

-

These forms must be filed at specific times, usually during tax season, to ensure proper reporting of income.

-

Participation in an ESPP can impact your tax filings, making it essential to understand how these forms relate to your financial obligations.

What are the filing procedures for ESPP-related IRS forms?

Filing the necessary IRS forms can be streamlined with the right understanding and tools. Here’s a guide to help you navigate the process.

-

Complete the forms accurately and ensure all required documentation is attached before submission.

-

Be aware of filing deadlines specific to your region to avoid penalties for late filings.

-

pdfFiller can assist in generating and filing these forms to streamline your tax submission process.

What is the administration and compliance of the ESPP?

The administration of the ESPP involves overseeing the compliance with both IRS regulations and corporate policies.

-

A committee or designated team usually administers the ESPP, ensuring adherence to the plan's guidelines.

-

It is crucial for the administering body to comply with IRS requirements and internal company policies to maintain the ESPP's integrity.

-

Continual management of the program is necessary to address any changes in IRS rules or company conditions affecting employees.

What are the final steps after submitting your ESPP form?

After submitting your ESPP form, it’s important to understand the next steps and what to expect throughout the process.

-

You'll receive confirmations regarding your submission and updates on the process from your employer.

-

Utilize pdfFiller's features to track the status of your ESPP application for real-time updates.

-

Know the expected timelines for share allocation and ownership periods post-application to better manage your investment.

How to fill out the employee stock purchase plan

-

1.Visit your employer's ESPP portal or request the necessary PDF form.

-

2.Read the plan documents to understand eligibility and terms.

-

3.Fill in your personal details: name, employee ID, and contact information.

-

4.Specify the percentage of your paycheck you wish to contribute to the ESPP.

-

5.Select the stock price discount rate, if applicable, as per plan guidelines.

-

6.Review the participation period for stock purchases within the plan.

-

7.Sign and date the form to confirm your understanding and agreement to the terms.

-

8.Submit the completed PDF form as instructed, either electronically or via email.

-

9.Keep a copy of the signed form for your records and confirmation of your enrollment.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.