Get the free Phantom Stock Plan of Hercules, Inc. template

Show details

This sample form, a detailed Phantom Stock Plan document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is phantom stock plan of

A phantom stock plan is a type of employee benefit plan that awards employees the benefits of stock ownership without granting actual shares.

pdfFiller scores top ratings on review platforms

good

Ver easy to use !!!!!!!!!!!!!!!

It was so much easier than other tools for PDF editing. Proper UX and the content was downloaded as previewed. Thank you.

Well, PDF filler is a game-changer in completing files and documents at a fast speed!! Life is much more convenient and hassle-free. It's really one of my favorite apps in the store!!!

I found it very easy to work with

It allowed me to change not only the text but the pictures and their layout as well. It also saved it my files and it was easy to get to.

Who needs phantom stock plan of?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Phantom Stock Plans on pdfFiller

How does a phantom stock plan work?

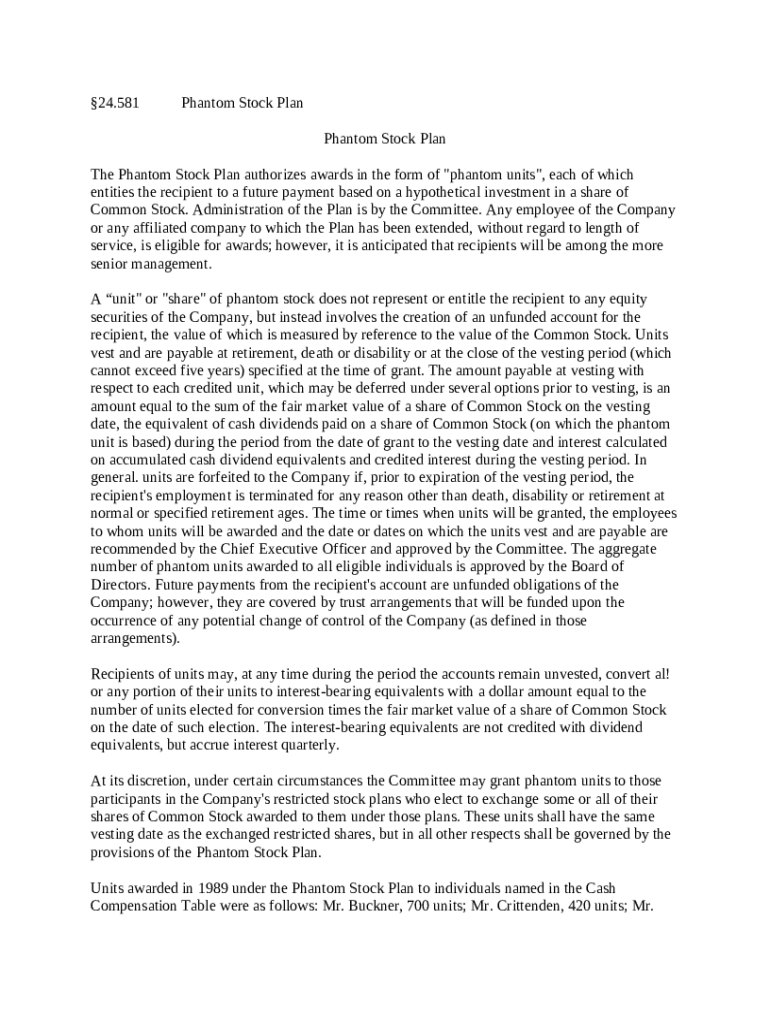

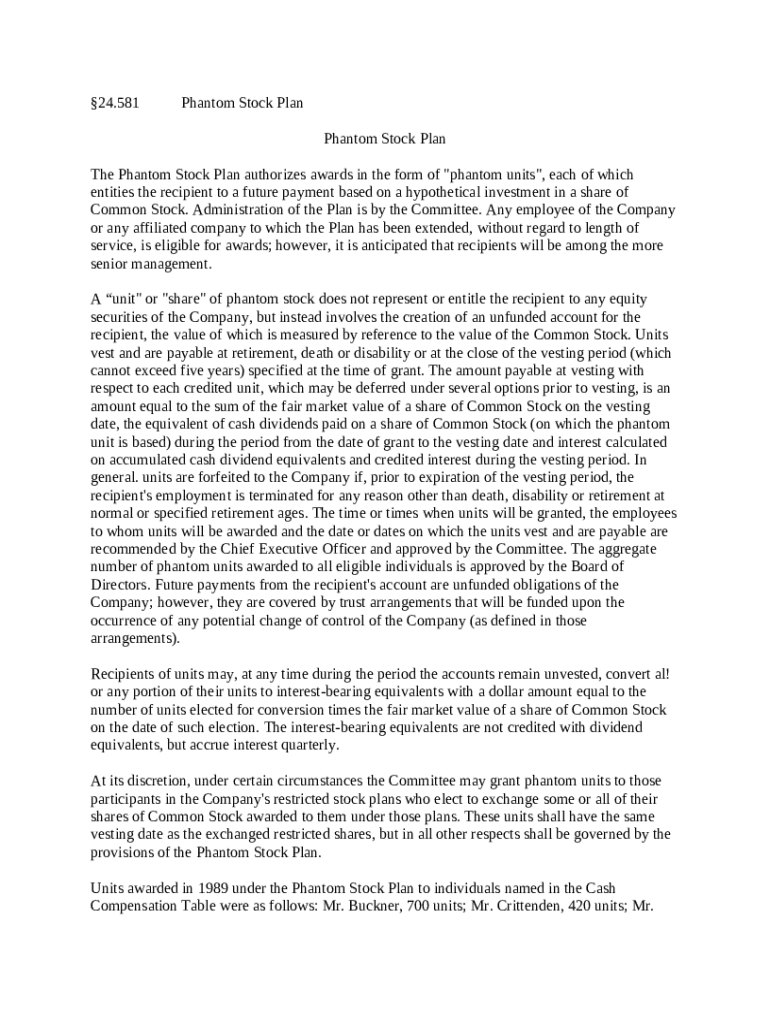

A phantom stock plan is a form of employee compensation that provides selected employees with a cash bonus based on the company's stock performance, without giving them actual stock. This innovative strategy motivates employees to contribute to the company's success while ensuring the company retains ownership and control. Understanding the distinct difference between phantom stocks and real stock options is critical for both employers and employees.

What are the key features of phantom stock plans?

-

Typically, eligibility for phantom stock awards is granted to key employees, executives, or those whose performance directly influences the company's success.

-

Vesting periods define the time frame during which an employee must remain with the company to earn their phantom stock. Commonly, these can range from 1-5 years based on company-specific guidelines.

-

Payments upon vesting are calculated based on the fair market value of the company’s stock at the time of payment, plus any dividends that may have been declared.

How are phantom stock plans administered?

The administration of phantom stock plans requires a dedicated committee to oversee their implementation and compliance. Responsibilities include evaluating performance metrics, granting phantom stock units, and ensuring transparent reporting practices to maintain trust with employees.

What is the process for granting phantom stock awards?

-

Employees interested in applying for phantom stock should follow a structured approach, often involving an application form and a review from the administration committee.

-

It’s essential for employees to be aware of the critical timelines for their submissions to ensure they do not miss out on available stock awards.

-

pdfFiller provides a user-friendly platform to create and manage necessary documents effectively, simplifying the submission process.

What are the tax implications and regulations?

Individuals receiving phantom stock should be aware of the tax implications upon vesting and payment. The relevant tax laws can be complex, making compliance critical to avoid penalties. Optimizing tax outcomes requires proper planning and possibly the guidance of a tax professional.

How does employment status affect phantom stock awards?

-

Employees may forfeit their phantom stock if they leave the company before their vested stocks are paid out. Understanding this can guide employee decisions on their tenure.

-

Former employees who retire or become disabled may retain rights to phantom stock. However, specific eligibility terms will depend on the company's policies.

-

In certain situations, company policies can affect phantom stock rights, especially during reorganizations or layoffs, highlighting the need for employees to be familiar with the rules.

What are best practices for implementing a phantom stock plan?

-

When designing a phantom stock plan, it is crucial to align it with the business objectives to ensure it serves its intended purpose.

-

To enhance employee understanding, establishing effective communication strategies about the operation and benefits of phantom stock plans is essential.

-

Companies should consider their unique cultures when implementing phantom stock plans, ensuring that them fit within existing compensation frameworks.

How to create and manage phantom stock plan documents?

-

Organizations can utilize pdfFiller for drafting, filling out, and managing phantom stock agreements, ensuring all documentation is comprehensive and accessible.

-

With interactive tools like collaboration features and e-signatures, pdfFiller simplifies the process of document management, allowing multiple stakeholders to contribute effectively.

-

Maintaining accurate records and updates about the phantom stock plans is vital for compliance and future reference, which pdfFiller can facilitate seamlessly.

How to fill out the phantom stock plan of

-

1.Access the phantom stock plan document template on pdfFiller.

-

2.Begin by filling in the company name and date at the top of the document.

-

3.Specify the eligible employees in the designated section by entering their names and roles.

-

4.Outline the terms of the phantom stock awards, including the valuation method and vesting schedule.

-

5.Provide details for the payout structure, indicating how and when employees will receive their phantom stock benefits.

-

6.Include any applicable tax treatment information for both the company and employees.

-

7.If required, add signature fields for both the employer and employee representatives.

-

8.Review the filled-out document for accuracy and completeness.

-

9.Save the document and choose to either print or electronically send it to the relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.