Get the free Indemnification Agreement between Corporation and Its Directors and Non-Director Off...

Show details

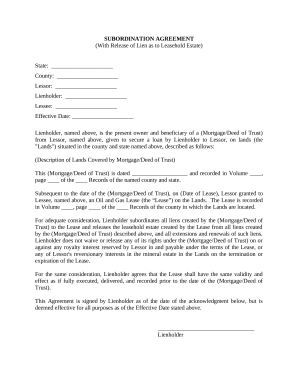

17-102E 17-102E . . . Indemnification Agreements between corporation and its directors and non-director officers at level of Vice President and above. The proposal states that Board anticipates that,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indemnification agreement between corporation

An indemnification agreement between a corporation is a legal document that outlines the terms under which the corporation agrees to protect its directors, officers, or employees from legal liabilities or claims arising from their actions on behalf of the company.

pdfFiller scores top ratings on review platforms

I had issues with making changes and…

I had issues with making changes and saving my documents. I reached out to Support and the help I received was excellent. The Support listened to my issue and tried to understand the problem. She persisted with suggestions until a solution was found and the programme worked. i appreciate how hard she tried to fix my issue.

PDF filler provides to type in text on a unfillable form.

Quick and Easy!!

great

I am still figuring it out

I had to send an important medical document on short notice and needed to fill a pdf document that was not fillable. I quickly did a search on the internet and found the pdfFilter. To my surprise, it was effortless to do, and was able to send the document in a timely manner.

Who needs indemnification agreement between corporation?

Explore how professionals across industries use pdfFiller.

Indemnification agreement between corporation: A comprehensive guide

What is an indemnification agreement and why is it important?

An indemnification agreement is a contract that provides protection to a corporation's directors and officers against certain actions or liabilities incurred while performing their duties. Its fundamental purpose is risk management, ensuring that individuals serving in these positions are covered against legal expenses. This agreement is crucial for corporate governance as it establishes clear terms that support decision-making without fear of personal financial exposure.

-

Define indemnification: It involves compensating for harm or loss, thereby shielding officials from personal financial liability.

-

Support corporate governance: These agreements enhance trust among directors and officers, allowing them to act in the best interest of the company.

-

Legal foundations: Indemnification is rooted in corporate law, varying by jurisdiction, making it essential to understand local regulations.

Why do corporations utilize indemnification agreements?

Corporations often use indemnification agreements to attract and retain talented directors and officers. This is particularly important in competitive markets where skilled leaders demand protection against potential legal repercussions resulting from their decisions. In addition to safeguarding personal assets, these agreements provide corporations with a mechanism to address risks that might not be fully covered under liability insurance policies.

-

Retention of talent: The agreement assures leaders that they are protected, encouraging them to make bold and necessary business decisions.

-

Legal cost coverage: Indemnification agreements help mitigate the financial burden of legal costs related to claims against directors and officers.

-

Insurance limitations: They help bridge the gap between insurance coverage and real-world liabilities, especially in complex cases.

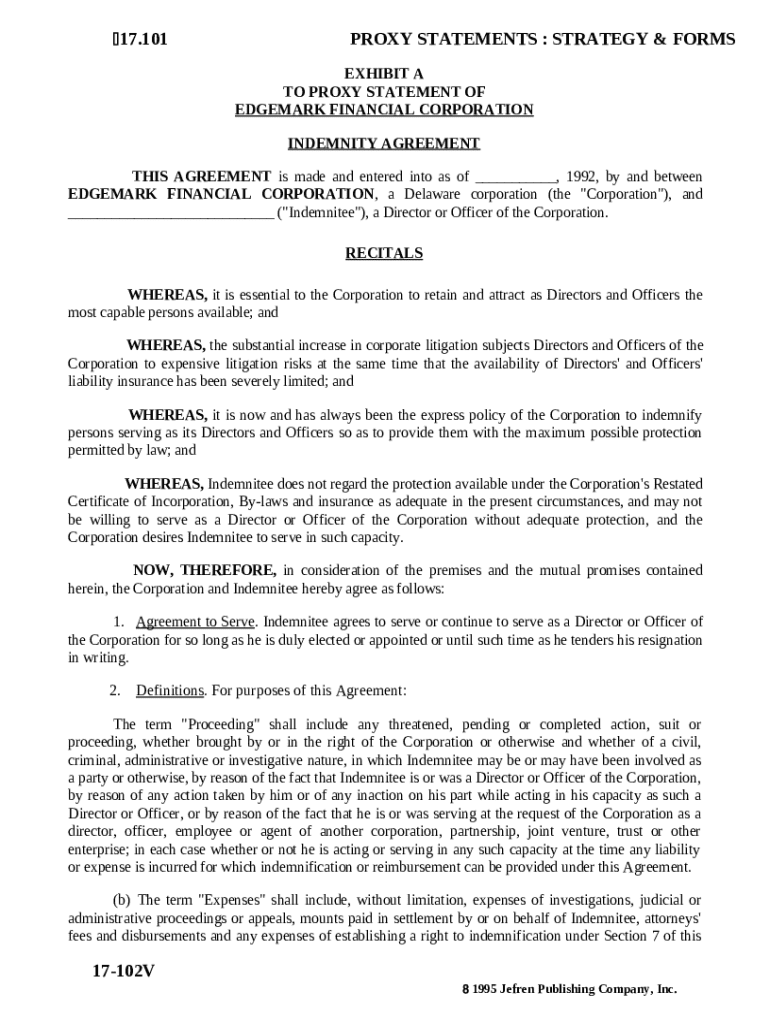

What key components should be included in an indemnification agreement?

A well-structured indemnification agreement should comprehensively cover several essential elements to ensure clarity and enforceability. Each section of the agreement must be tailored to delineate the responsibilities and protections offered to the indemnitee, typically the corporation’s officers and directors.

-

Parties definition: Clearly define who the 'Indemnitee' is and the corporation’s role.

-

Recitals: State the necessity and intent behind the agreement to reinforce its purpose.

-

Agreement to serve: A clause ensuring the continuing protection of individuals while they serve in their offices.

-

Definitions: Include definitions for key legal terms to avoid ambiguity and misinterpretations.

How do you fill out the indemnification agreement form?

Filling out the indemnification agreement form requires careful attention to detail and accurate information. Individuals must ensure that all required fields are complete and that any additional documentation needed—such as proof of identity or corporate governance documents—are included.

-

Step-by-step guidance: Follow the structured format of the form to ensure all necessary sections are addressed.

-

Accurate information: Double-check the details related to the Corporation and the Indemnitee to prevent errors that could lead to issues later.

-

Interactive tools: Utilize platforms like pdfFiller, which provide features for completing and editing forms seamlessly.

-

Compliance notes: Understand local laws and regulations that might impact the indemnification provisions outlined in the agreement.

What are best practices for corporate boards regarding indemnification agreements?

Corporate boards should regularly review and update indemnification agreements to ensure they comply with evolving laws and best practices. Maintaining alignment with corporate policies and transparency with shareholders fosters accountability and trust. Moreover, boards should seek legal counsel to ensure all aspects of the indemnification process are covered effectively.

-

Regular reviews: Conduct periodic assessments of the agreement's relevance and completeness.

-

Alignment with policies: Ensure agreements are in line with corporate bylaws and ethical practices.

-

Transparency: Engage with shareholders to provide insight into indemnification agreements and their purpose.

What common pitfalls and legal considerations should you be aware of?

While indemnification agreements are crucial for protection, there are common pitfalls that corporations should avoid. Challenges can arise regarding the enforceability of indemnification clauses due to vague language or lack of compliance with state laws. Additionally, studying past case law related to indemnification disputes can provide insights into potential issues that may surface.

-

Enforceability challenges: Vague wording could result in courts declaring clauses unenforceable.

-

State laws review: Understanding varying corporate regulations is critical to prevent non-compliance.

-

Case studies: Analyze previous indemnification disputes to identify weaknesses in your agreements.

What are the considerations for signing and managing indemnification agreements?

Signing indemnification agreements can be streamlined with the use of electronic signing options, which provide a secure and efficient way to execute these documents. Moreover, best practices for document management—such as version control and storing agreements in a secure, centralized location—can aid in maintaining oversight over these critical contracts.

-

Electronic signing: Use platforms like pdfFiller to facilitate secure and efficient signing processes.

-

Document management: Maintain organized storage for all agreements to ensure easy access and tracking.

-

Collaboration tools: Use collaborative software for tracking changes and updates to the agreements in real-time.

How to fill out the indemnification agreement between corporation

-

1.Begin by obtaining the indemnification agreement template from pdfFiller.

-

2.Open the template in your pdfFiller account.

-

3.Identify the sections that require specific information: corporation name, indemnified individual(s), and any specific terms or limitations.

-

4.Fill in the corporation's legal name in the appropriate field.

-

5.List the individuals being indemnified, such as directors and officers, ensuring you include their full names and titles.

-

6.Detail any specific conditions that apply, such as the types of liabilities covered (e.g., legal fees, settlements).

-

7.If applicable, include limits on the indemnification, such as maximum amounts covered or specific scenarios not included.

-

8.Review the filled document for accuracy and completeness.

-

9.Use the save feature in pdfFiller to retain your changes.

-

10.If necessary, share the document for electronic signature through pdfFiller's sharing options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.