Get the free Approval of executive director loan plan template

Show details

This sample form, a detailed Approval of Executive/Director Loan Plan document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is approval of executive director

The approval of executive director is a formal document that signifies the endorsement and authorization of a proposed action or project by the executive director of an organization.

pdfFiller scores top ratings on review platforms

Typing data into the system is 12 to 15 second delayed, this is a time waste. Like watching a TV interview when the words are not matching the lips.

Simple and quick.

SUPER GREAT

PDF Filler was ideal but I don't do much office work so cannot justify having it all year

great help

I am satisfied with its performance, but it should include a feature wherein we can past an image directly on the pdf doc.

Who needs approval of executive director?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to the Approval of Executive Director Form Form

How do understand the executive director approval process?

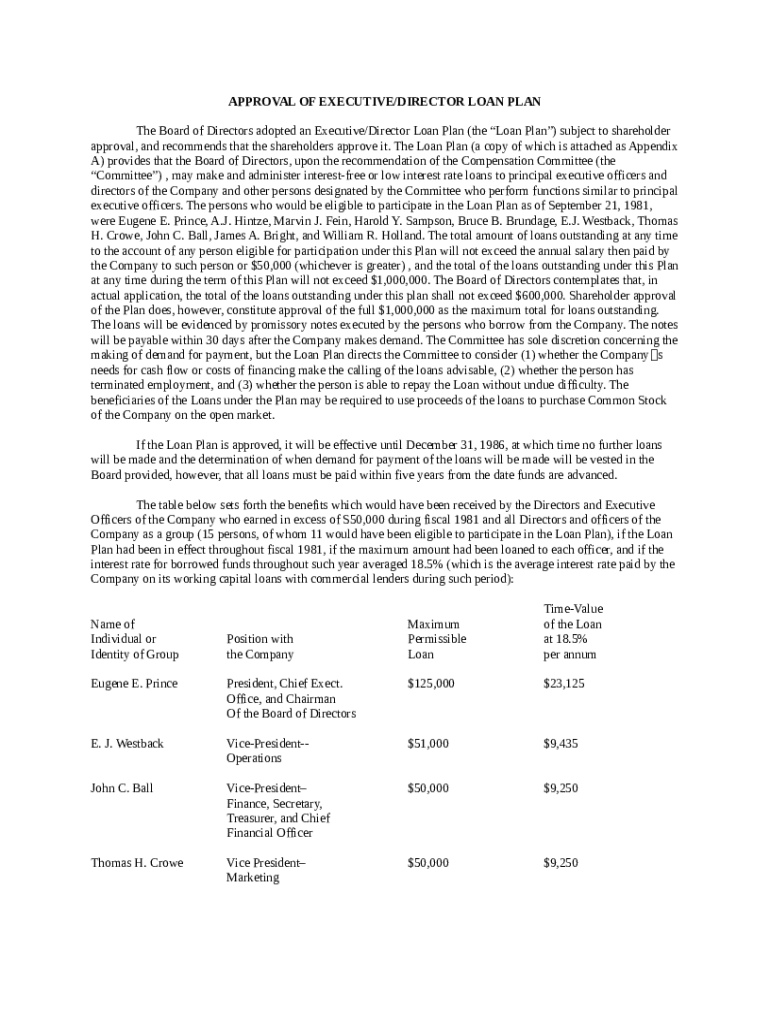

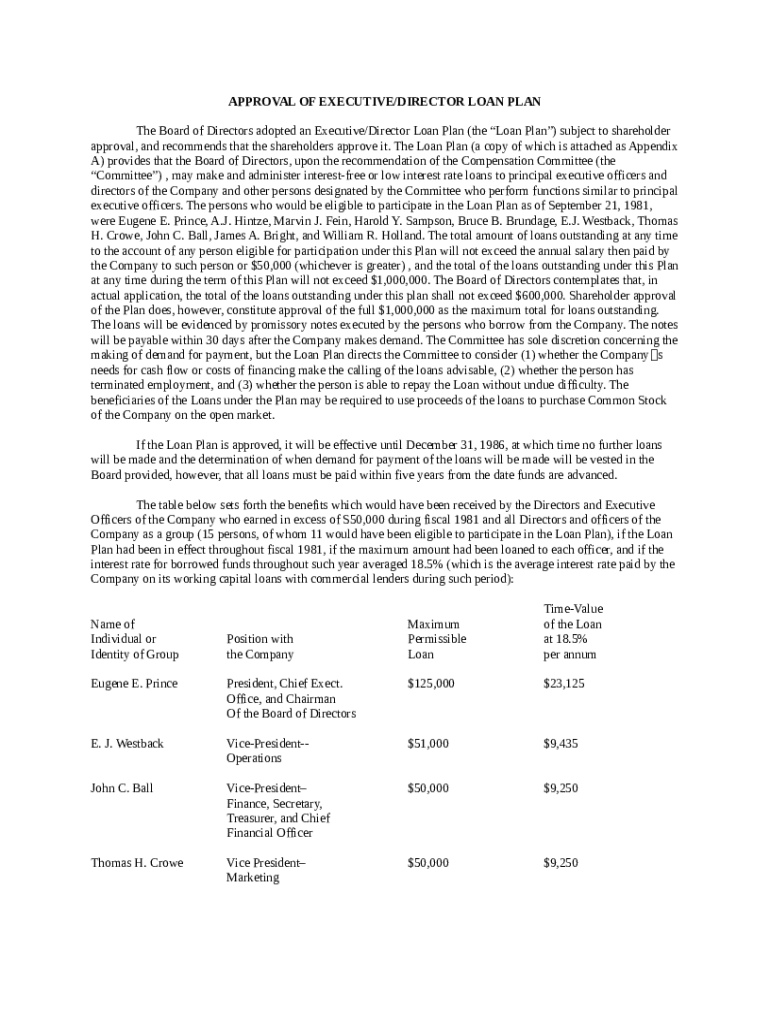

The approval of executive director form form is pivotal in ensuring the smooth functioning of loan plans implemented by organizations. It typically involves various stakeholders such as the Board of Directors, the Compensation Committee, and shareholders. Understanding the process is essential for robust governance.

-

This plan is designed to provide structured financial support to executives, facilitating their performance and alignment with organizational goals.

-

Engaging the Board of Directors, the Compensation Committee, and shareholders is crucial for creating a transparent and fair approval process that can enhance trust.

-

Shareholder approval is necessary to validate the loan plan and ensure that it aligns with the interests of the wider investment community.

What are the key components of the executive director loan plan?

A well-structured executive director loan plan comprises several vital components that dictate how funds are allocated and monitored.

-

This includes details regarding the nature of loans provided to executive directors, stipulating terms and repayment schedules.

-

Identifying who qualifies for the loan program prevents ambiguity and ensures only suitable candidates receive financial assistance.

-

Establishing strict limitations on loan amounts helps maintain financial integrity and mitigates risks associated with over-leveraging.

How do navigate the approval workflow?

Navigating the approval workflow for the executive director form form is essential for effective proposal submission and stakeholder engagement.

-

This involves preparing documentation, outlining desired loan terms, and presenting the case to the Compensation Committee.

-

The committee plays a crucial role in evaluating proposed loans, ensuring they are in the best interest of the company and its shareholders.

-

Effective communication with shareholders, including transparency on loan terms and expected outcomes, is crucial for gaining their trust and approval.

What should be documented in the loan agreement?

Documenting the loan agreement accurately ensures that all aspects of the loan are clear and legally binding.

-

Determine the specific details of the loan agreement, including principal, interest rates, and repayment schedules.

-

Ensure all loan agreements comply with local regulations and corporate policies to avoid legal disputes.

-

Setting a clear repayment timeline can help both the organization and the executive manage financial expectations efficiently.

How can evaluate executive director performance in context?

Evaluating executive director performance is essential to ensure their financial support translates into value for the organization.

-

Clearly define the metrics used for evaluating performance, aligning them with company goals.

-

Collect insights from multiple stakeholders to gain a holistic view of the executive's contributions.

-

Establish a direct correlation between the executive’s performance and the overarching objectives of the organization to aid accountability.

How do manage loans and maintain compliance?

Post-approval management of loans is as crucial as the initial approval process, requiring ongoing compliance checks and tracking.

-

Consistently track how and when loans are distributed to maintain clear records and accountability.

-

Regularly ensure that loan agreements adhere to established company policies to uphold integrity and legality.

-

Be proactive in identifying potential conflicts or issues arising from the loan process to mitigate risks in a timely manner.

What are common challenges and solutions in loan approval?

The loan approval process can present various challenges requiring strategic solutions for effective management.

-

Identifying issues like incomplete documentation or misconceptions among stakeholders can streamline the approval workflow.

-

Regular updates and transparent communication can foster trust and encourage shareholder involvement in the approval process.

-

pdfFiller provides interactive tools to simplify documentation, allowing for seamless editing and eSigning of necessary forms.

How to fill out the approval of executive director

-

1.Open the PDF file of the executive director approval form in pdfFiller.

-

2.Begin by entering the name of the executive director at the top of the form in the designated field.

-

3.Fill out the date when the approval is being submitted in the appropriate section.

-

4.Provide a brief description of the project or action requiring approval in the summary field.

-

5.Attach any necessary documentation or supporting files relevant to the project, if required.

-

6.Clearly state the benefits and any potential impact of the proposed action in the designated area.

-

7.Include all proposing team members' names and titles, along with their signatures in the sections provided.

-

8.Review all entered information for accuracy and completeness before submitting.

-

9.Once satisfied, click on the 'Submit' button to send the approval request to the executive director.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.