Get the free Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, I...

Show details

This sample form, a detailed Executive/Director Loan Plan w/copy of Promissory Note document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is executive director loan plan

An executive director loan plan is a structured agreement outlining the terms under which an executive director may borrow funds from the organization they manage.

pdfFiller scores top ratings on review platforms

there is always little things to make thing easier to use - so just tips would be good

The application works great and the customer service is very good.

Easy to use, just wish I didn't have to dodge the pop-up balloons every time I needed to enter text.

love the features! some of the usability is cumbersome

So far, the program performs as promised.

Lots of "new" ways to create and edit documents of multiple formats...

Who needs executive director loan plan?

Explore how professionals across industries use pdfFiller.

Executive Director Loan Plan Form Guide on pdfFiller

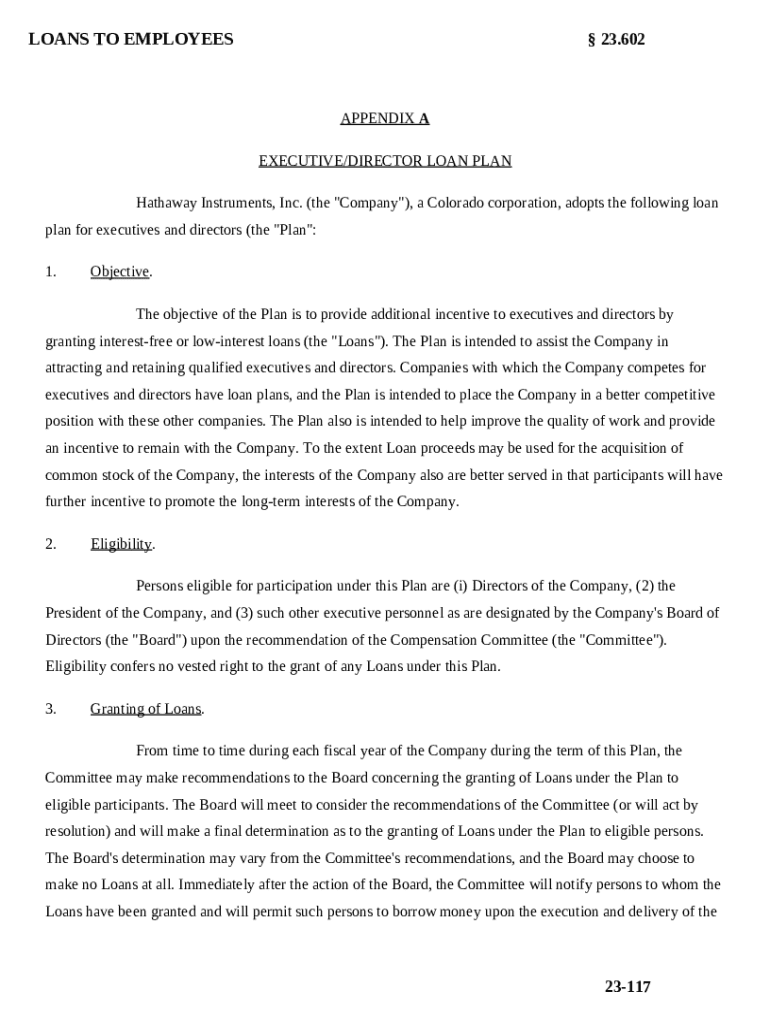

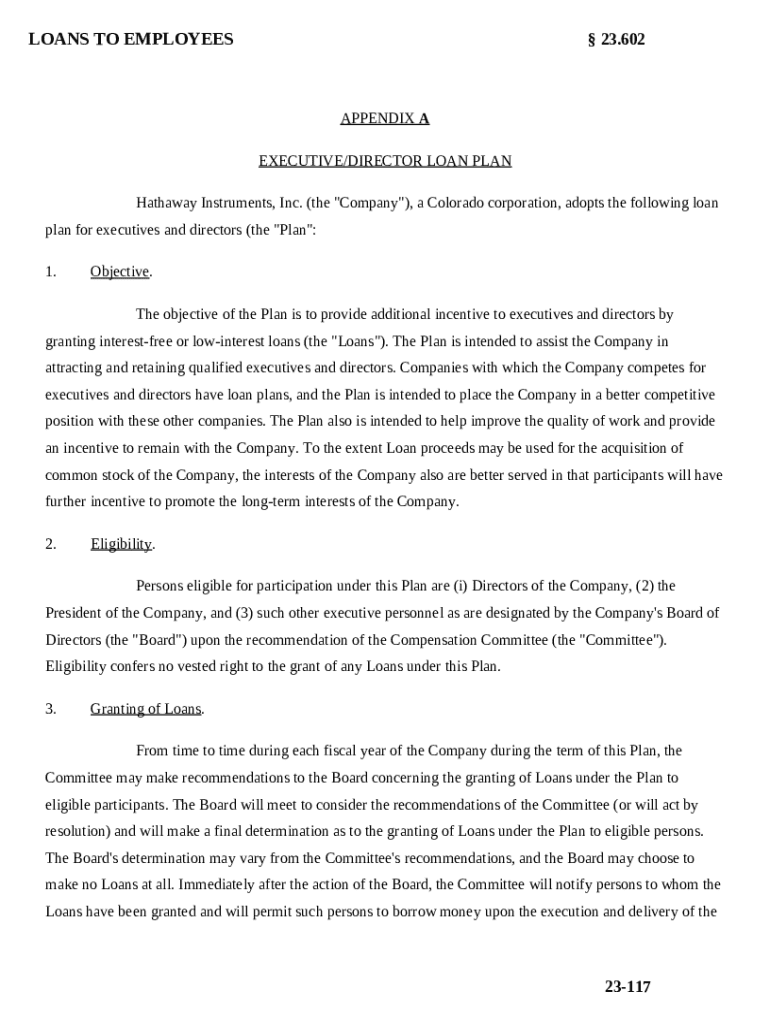

How does the Executive Director Loan Plan function?

The Executive Director Loan Plan is designed to provide executives and directors with financial support through loans. Its primary purpose is to facilitate the acquisition of company stock or other investments that benefit the overall corporate structure. By implementing this plan, companies can attract and retain high-value talent by providing them financial assistance when they need it.

-

The Executive Director Loan Plan serves to offer financial resources to eligible executives and directors, enabling them to invest in the company or other financial activities.

-

This plan helps in retaining talented executives who may otherwise seek opportunities elsewhere, establishing loyalty and commitment among the team.

-

Facilitating loans improves the company’s overall financial health as it motivates executives to have a vested interest in the organization's success.

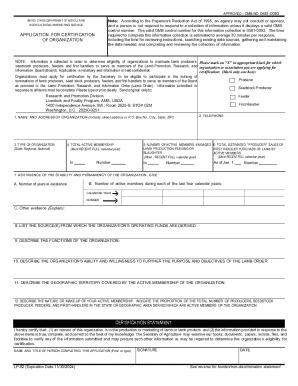

Who is eligible for the Executive Director Loan Plan?

Eligibility to participate in the Executive Director Loan Plan primarily revolves around specific roles within the company. Generally, it includes Company Directors, the President, and selected executives.

-

Participating personnel typically includes executives in leadership roles, ensuring that those with substantial influence are given access to the plan.

-

The Compensation Committee actively reviews candidates' credentials and makes recommendations for participation, ensuring a tailored approach.

-

Even if a person is deemed eligible, it is essential to note that eligibility does not automatically guarantee the approval of loan requests.

What is the loan granting process?

The loan granting process is generally governed by a timeline that aligns with the fiscal year of the company. Loan recommendations are made by the Committee, and the Board makes the final approval decisions.

-

The recommendation process operates on a set calendar, typically revolving around the company's fiscal year and accounting for budgetary constraints.

-

The Committee reviews loan proposals, ensuring they align with the company's strategic goals and interests before forwarding them to the Board.

-

The Board has the final say on whether loans are granted, ensuring that all decisions are made with the company's best interests in mind.

What types of loans are offered under the plan?

The Executive Director Loan Plan includes several loan options tailored to meet the unique needs of executives. Among these, interest-free and low-interest loans are prominent.

-

Interest-free loans are designed to enhance affordability, while low-interest loans provide cost-effective financing solutions.

-

Loan funds may be utilized for personal investments such as acquiring company stock, aligning the executive's financial success with the company's growth.

-

Such loans encourage executives to make decisions that not only benefit them personally but also promote the company’s welfare.

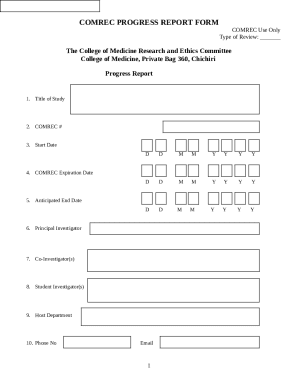

How to fill out the Executive Director Loan Plan form?

Filling out the executive director loan plan form is a straightforward process, but precision is crucial.

-

Begin by gathering all necessary borrower information and follow the guidelines provided in the form carefully to ensure correct completion.

-

Accuracy in detailing personal and financial information enhances your chances for positive loan considerations.

-

Utilize pdfFiller’s editing and signing tools to fill out, submit, and manage your application efficiently.

What are the important considerations and compliance notes?

Legal compliance is essential when participating in the Executive Director Loan Plan. Companies must adhere to relevant local laws and internal policies.

-

Review all regional legal parameters that govern executive loans to ensure compliance.

-

Understand and adhere to the internal guidelines as set forth by the Board to avoid discrepancies.

-

Utilize pdfFiller’s management tools to keep all documentation organized and keep records updated.

How can pdfFiller assist with document management?

pdfFiller stands out as an ideal platform for managing the Executive Director Loan Plan form and other documents. Its cloud-based capabilities streamline the entire process.

-

pdfFiller helps users manage PDF forms with ease, making it a valuable tool for electronic documentation.

-

The platform allows seamless eSigning and collaboration on loan forms, improving communication and reducing time management issues.

-

Being cloud-based, it allows access from anywhere, ensuring that teams can work efficiently regardless of location.

How to fill out the executive director loan plan

-

1.Begin by downloading the executive director loan plan template from pdfFiller.

-

2.Open the document in pdfFiller and familiarize yourself with the sections provided.

-

3.Enter the name of the nonprofit organization and the executive director in the designated fields.

-

4.Fill in the loan amount requested by the executive director and specify the purpose of the loan.

-

5.Detail the repayment terms, including interest rates, payment schedule, and duration of the loan.

-

6.Include any necessary collateral agreements or conditions tied to the loan.

-

7.Review the document for accuracy and completeness, ensuring all relevant information is included.

-

8.Once satisfied with the information, save the document in your pdfFiller account.

-

9.Share the completed executive director loan plan for review and approval by the organization's board or financial committee.

-

10.Finalize and print the document after obtaining necessary signatures, keeping a copy for organizational records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.