Get the free Executor's Deed of Distribution template

Show details

On the conclusion of the administration of an estate, it is often useful for the Executor to execute a deed to the beneficiaries under a will. This form addresses that situation.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

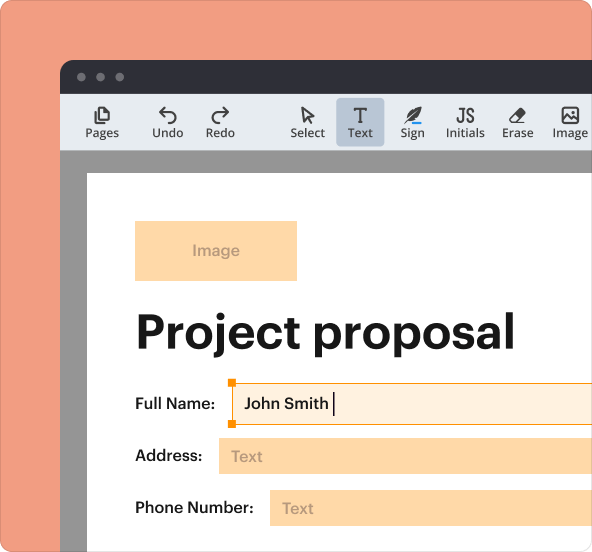

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is executors deed of distribution

The executors deed of distribution is a legal document used to transfer ownership of property from the estate of a deceased person to beneficiaries as designated in the will.

pdfFiller scores top ratings on review platforms

love it

Great

PDFfiller helped me prepair and print my COVID-19 vaccination papers for my clients

been using it for sometime and it does everything I need it to do

good

tutto ok!

Who needs executors deed of distribution?

Explore how professionals across industries use pdfFiller.

A Complete Guide to the Executor's Deed of Distribution Form

What is the Executor's Deed of Distribution?

The Executor's Deed of Distribution serves as a legal document that transfers assets from the executor of an estate to the designated beneficiaries. It is a crucial part of settling an estate as it outlines how the assets are distributed according to the deceased's wishes.

-

The purpose of the Executor's Deed of Distribution is to provide formal documentation of asset distribution, reinforcing the legality of the process.

-

This deed is typically required after a will has been probated, and assets need to be formally transferred to beneficiaries.

-

It helps clarify rights to assets and prevents future disputes among heirs and distributees.

What are the key components of the Executor's Deed of Distribution?

Understanding the main components of this deed enhances clarity and compliance. Each section serves a specific legal function, ensuring the proper transfer of assets.

-

The jurisdiction must be clearly specified, as state laws govern estate distribution.

-

Local regulations may also apply, impacting how the deed must be executed and filed.

-

This refers to the executor or personal representative managing the estate.

-

These are the beneficiaries or heirs receiving the assets.

-

This marks the official date the distribution is acknowledged and effective.

How do you fill out the Executor's Deed of Distribution form?

Filling out the form accurately is critical in avoiding disputes or future legal issues. A step-by-step approach ensures compliance and fidelity to the original will.

-

Begin with the identification of the executor and all beneficiaries, accurately fill out asset details, and ensure the document is signed appropriately.

-

Avoiding inaccuracies in names or asset descriptions can prevent complications in asset distribution.

-

Ensure all distributions precisely mirror what is laid out in the decedent’s Last Will and Testament to uphold legal validity.

How does asset distribution work?

The distribution of assets under the Executor's Deed of Distribution must align with the deceased’s intentions, which can be specified within the will. Understanding how to approach this can eliminate confusion and prevent legal ramifications.

-

Devisees are individuals named in the will to receive specific assets; recognizing their rights is essential for proper execution.

-

Assigning shares or percentages to each grantee should be clear to avoid any misunderstandings regarding distribution.

-

Improper distribution can lead to legal challenges if discrepancies arise concerning the desires outlined in the will.

What are the legal requirements and compliance factors?

Each state has specific legal requirements that must be adhered to while executing an Executor's Deed of Distribution. Understanding these requirements helps ensure compliant filing.

-

Research your state’s statutes to ascertain unique mandates for executing and filing the deed.

-

Failing to follow legal processes may result in delays or potential legal action against the executor.

-

The Probate Court often oversees the distribution process to ensure regulatory compliance and justice for all heirs.

How can pdfFiller assist with the Executor's Deed of Distribution?

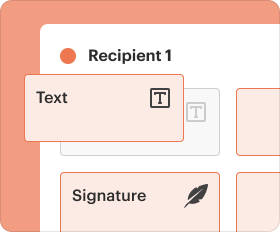

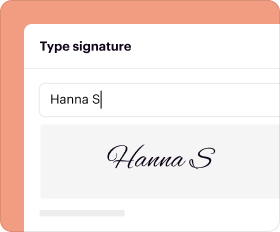

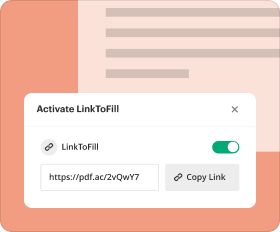

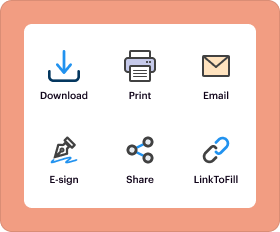

pdfFiller provides a suite of tools that simplifies the management of the Executor's Deed of Distribution form. Leveraging this platform enhances efficiency in the document handling process.

-

Users can easily edit and eSign the Executor's Deed of Distribution form all within pdfFiller, ensuring quick turnaround.

-

The platform allows for seamless collaboration with other stakeholders, such as other executors or heirs.

-

Completed forms are securely stored in the cloud for easy retrieval and management, ensuring document safety.

What additional information do executors need regarding estate administration?

Managing an estate encompasses various forms and responsibilities; understanding other necessary documents can streamline the process. Executors must arm themselves with knowledge of best practices to formally execute their duties.

-

Related forms, such as inventory lists and receipts, are essential for thorough estate management.

-

Maintaining clear communication with beneficiaries and adhering to timelines can enhance executor effectiveness.

-

Stay informed about local laws to ensure that all actions align with jurisdictional requirements.

How to fill out the executors deed of distribution

-

1.Begin by obtaining a blank executors deed of distribution form from pdfFiller.

-

2.Open the form in pdfFiller’s editor after uploading or choosing it from the library.

-

3.Fill in the decedent's full name, date of death, and relevant estate details in the designated fields.

-

4.Enter the names and details of all beneficiaries receiving assets from the estate.

-

5.Specify the assets being distributed, ensuring to include any descriptions or identifiers necessary.

-

6.Confirm the allocation of assets among beneficiaries matches the will or trust documents.

-

7.Review the completed form for accuracy, checking all entries and signatures required.

-

8.Add your name and signature as the executor in the designated area at the end of the document.

-

9.Once filled, save the document and download it or send it for notarization if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.