Get the free Instructions for Completing Mortgage Deed of Trust template

Show details

"Instructions for Completing Mortgage Deed of Trust Form" is a American Lawyer Media form. The following form is for instructions for completing mortgage deed of trust.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is instructions for completing mortgage

Instructions for completing mortgage provide guidance on how to fill out mortgage application forms accurately and completely.

pdfFiller scores top ratings on review platforms

PDF Filler is a very useful and user - friendly tool, I recommend it!

its made things so easy for my business which requires alot of form filling

Great program! Love it! Totally worth every penny paid for subscription. This should be a must-have in any business that handle a lot of documents. Thank you.

Perfect for professionally filling out documents

I love this program, it makes my job so much easie

I cannot believe how wonderful this website is!! I can edit any PDF, fill out forms, send from the website and they even have an option to mail it for me! Definitely exceeded my expectations and I've never seen any other website or app like this. I KNOW I will be renewing this every year, especially how affordable it is!

Who needs instructions for completing mortgage?

Explore how professionals across industries use pdfFiller.

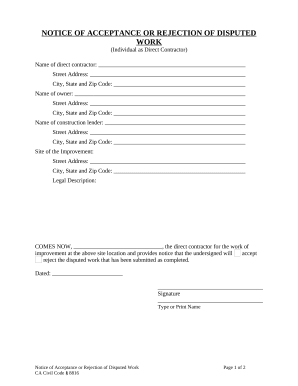

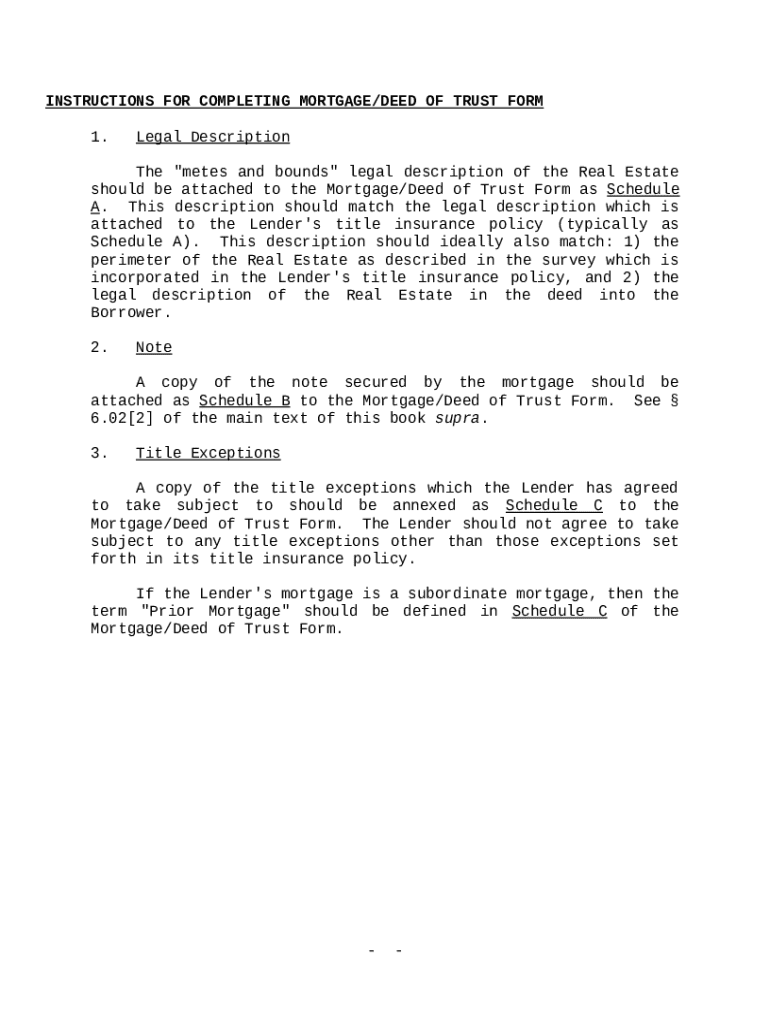

Comprehensive guide to completing the mortgage deed of trust form

How does the mortgage deed of trust form function?

The Mortgage Deed of Trust form is a vital document in securing a mortgage. It establishes the legal relationship between the borrower and lender, detailing the terms under which the property will serve as collateral for the loan. Understanding this form is essential to navigating the mortgage application process smoothly.

What is the purpose of the mortgage deed of trust?

-

This form ensures that the lender has recourse through a legal claim on the property in case of borrower default.

-

The Borrower, who is the homeowner, and the Lender, typically a bank or mortgage company, are the primary parties in the transaction.

-

While both serve to secure loans, a deed of trust involves a third party, the trustee, who holds the title until the loan is paid off.

How do you complete the mortgage deed of trust form?

Completing the mortgage deed of trust form involves meticulous attention to detail. Start by gathering all necessary documentation to support your application, such as identification and comprehensive property details.

-

Collect identification, legal descriptions of the property, and any other necessary paperwork.

-

This involves filling in the legal description of the property, ensuring matching details with additional documents.

-

Attach the Borrower’s Note that includes the terms of the loan, which must be signed and dated.

-

Outline any title exceptions that may affect the property’s title to ensure clarity.

-

Consider optional provisions that may allow lenders to convert mortgages to deeds of trust.

What are the specific sections of the mortgage deed of trust?

-

This section should accurately include legal descriptions that correspond to the property records.

-

This must secure the Borrower’s Note, including a correctly dated copy.

-

Title exceptions can be critical in determining what encumbrances may affect the property; accurate representation is necessary.

-

Some lenders may need to adjust terms from a mortgage to a deed of trust, requiring careful attention to descriptions.

What are the best practices and common mistakes to avoid?

Precision is key when completing mortgage applications. All details must be accurate to prevent delays or complications during the approval process.

-

Every detail must be double-checked for correctness, especially legal and personal information.

-

Ensure consistent terminology throughout the forms to avoid confusion.

-

Errors in legal descriptions can have serious implications, potentially leading to title disputes.

-

Working with a lender or attorney can ensure adherence to legal requirements and eliminate mistakes.

How can pdfFiller assist in managing mortgage documents?

pdfFiller provides an efficient platform for managing your mortgage documents online. Users can upload, edit, sign, and share forms effortlessly, enhancing collaboration and security.

-

Users can upload the Mortgage Deed of Trust Form and make necessary edits quickly.

-

Utilize eSign capabilities to securely sign documents without needing to print them.

-

Share your documents with stakeholders easily, opening avenues for real-time collaboration.

-

Store and manage your mortgage forms securely on pdfFiller’s cloud platform.

What local compliance and regulations must be followed?

Local regulations regarding mortgage deeds can significantly impact the application process. Understanding these laws is crucial for ensuring compliance and avoiding legal complications.

-

Different states have specific laws governing mortgage deeds of trust, which can include unique documentation and procedural requirements.

-

It’s vital to verify all documentation against local laws to prevent legal issues.

-

Utilize local resources such as legal websites or government offices to confirm your compliance status.

How to fill out the instructions for completing mortgage

-

1.Access the PDF of the mortgage application on pdfFiller.

-

2.Read through all the sections to familiarize yourself with the requirements.

-

3.Begin with personal information: fill in your full name, address, social security number, and contact details.

-

4.Proceed to employment information: include your current employer's name, address, and your position, as well as your income details.

-

5.Fill out financial information: detail your assets like bank accounts, investments, and any outstanding debts.

-

6.Provide property details: include the address of the property you are purchasing or refinancing, the intended use of the property, and the purchase price.

-

7.Review all information entered to ensure accuracy and completeness.

-

8.Utilize any available features on pdfFiller to check for errors or missing information.

-

9.Sign the document electronically if required, or follow instructions for printing and submitting your application.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.