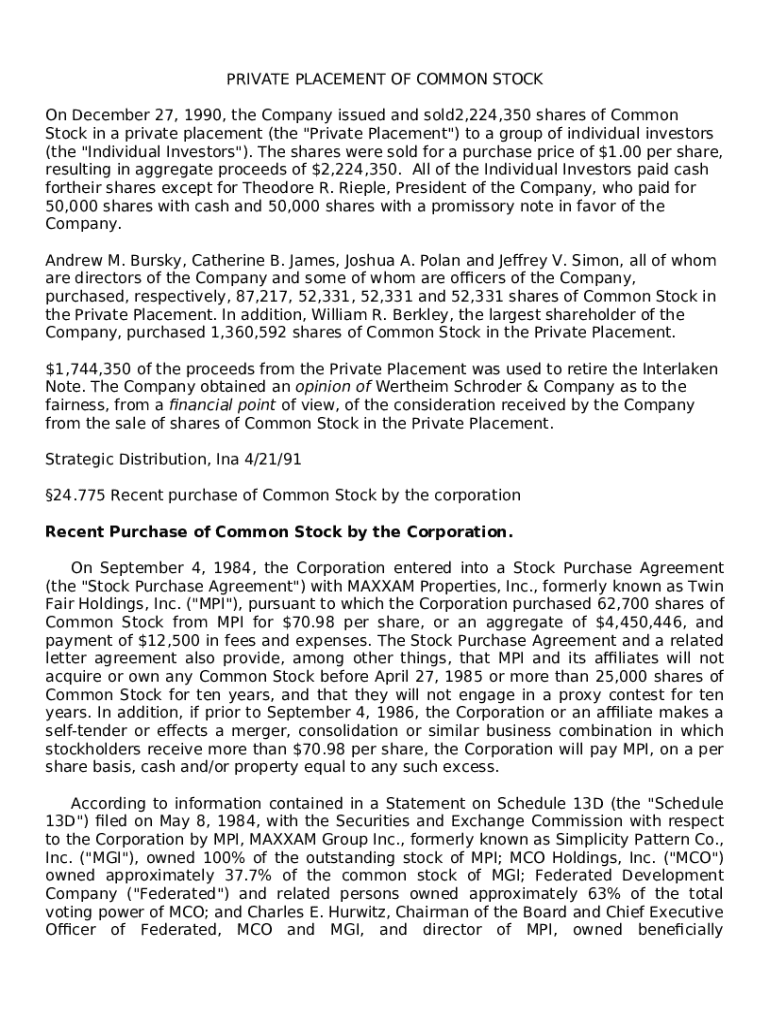

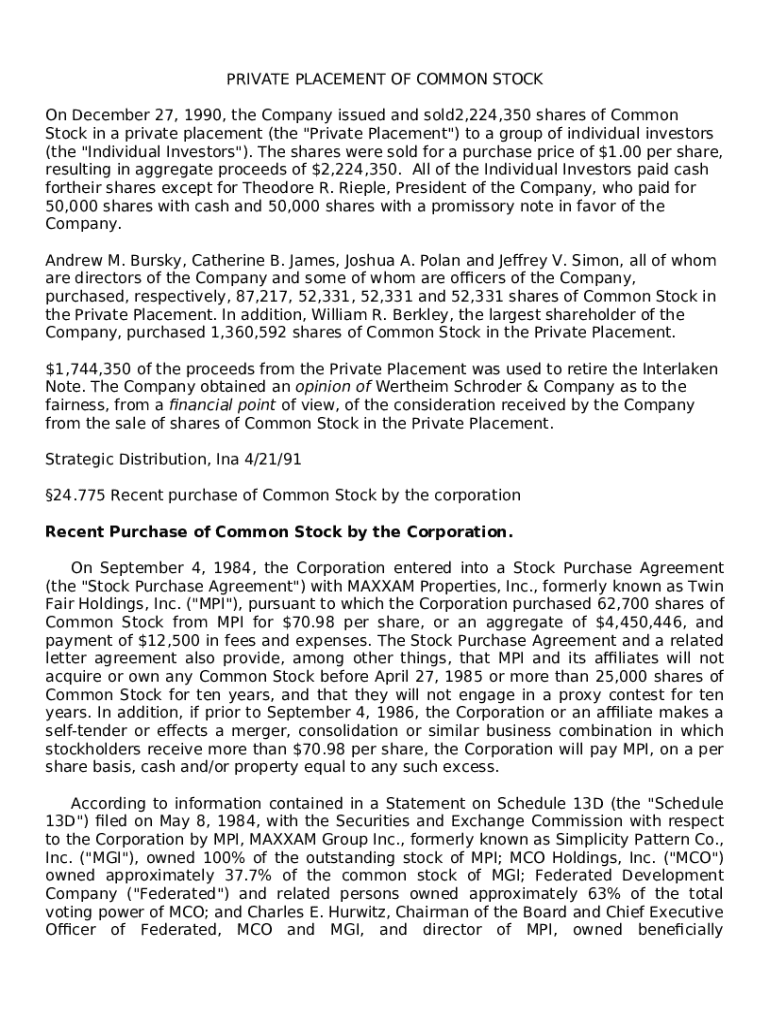

Get the free Private placement of Common Stock template

Show details

This sample form, a detailed Private Placement of Common Stock document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is private placement of common

Private placement of common refers to the sale of common shares to a select group of investors rather than through a public offering.

pdfFiller scores top ratings on review platforms

i like it i would recommend this to someone else..

I've had some problems with the application but overall it meets my business needs.

Easy to use and very useful in today's business world

This is a great tool (and I design systems similar to this). However, I'm just not sure I will use it enough in order to justify the annual price.

I have just started using this program but so far I am happy with it. It is great for completing documents that have been scanned in.

This was the best PDF editor site I have seen thus far! It was so smooth and easy to use, as well as had multiple options to easily save and transfer the document without needing to convert everything back and forth!

Who needs private placement of common?

Explore how professionals across industries use pdfFiller.

Private Placement of Common Form Form Guide

How does the private placement of common stock work?

The private placement of common stock is a method for issuing securities directly to a select group of investors without publicly offering them. This approach differs significantly from public offerings where stocks are made available to the general public. One of the main advantages of private placements is that they typically require less regulatory compliance, making the fundraising process quicker and more efficient.

What are the key components of a private placement?

-

Private placements often attract institutional investors, accredited investors, and high-net-worth individuals who can provide substantial capital without the complexities of a public offer.

-

Terms such as 'placement agent', 'subscription agreement', and 'purchase price' are commonly used and have distinct legal and financial implications within private placements.

-

Both issuers and investors must navigate legal frameworks, including securities regulations and contractual obligations to ensure compliance and safeguard investor interests.

What are the filing requirements for private placements in your region?

When engaging in private placements, compliance with local regulatory frameworks is essential. Generally, investors and issuers must prepare and submit specific documentation, including private placement memorandums and Form D filings, to the relevant securities authority. Each jurisdiction may impose different deadlines and requirements, making it vital to stay informed.

Why is due diligence critical in private placements?

-

Conducting thorough due diligence helps investors assess financial and operational risks associated with potential investments in private placements.

-

A due diligence checklist might include items such as reviewing financial statements, understanding the business model, and assessing management quality.

-

Professional financial advisors can play a crucial role in guiding investors through the due diligence process, ensuring that every aspect of the investment is scrutinized.

What financial considerations should you keep in mind?

Investors should carefully evaluate the sale price per share of stock during a private placement. Understanding alternative payment methods, such as cash or promissory notes, also plays a crucial role in the investment decision-making process. Ultimately, using the proceeds effectively—be it for retiring debt or reinvestment—can significantly impact the company's growth and investor returns.

How can pdfFiller assist in managing your private placement documents?

-

pdfFiller allows users to easily edit and fill out necessary forms required for private placements, streamlining the documentation process.

-

With pdfFiller's eSignature capabilities, users can finalize documents quickly, enhancing the efficiency of the contract execution process.

-

The platform facilitates team collaboration, ensuring that all stakeholders can approve documents in a secure and organized environment.

What questions should you prepare when interviewing strategic investors?

-

It's vital to focus on alignment in values, growth strategies, and investment philosophies when discussing with potential investors.

-

Utilize pdfFiller to create tailored communication templates that can streamline your interactions with investors, ensuring all critical points are covered.

-

Understanding each investor's goals and how they align with your business objectives can help forge stronger partnerships and ensure a successful placement.

What are the responsibilities after a private placement?

-

Investors and issuers must remain aware of ongoing compliance requirements, including regular reporting of financial performance and operations.

-

There are various resources available for tracking compliance and reporting obligations, which can ease the administrative burden.

-

Post-placement, maintaining good investor relations is crucial for ensuring investor confidence and support for future capital raising efforts.

What can we learn from successful private placements?

-

Reviewing successful private placements can uncover best practices and strategies that resulted in positive outcomes for those companies.

-

Market leaders often leave insights that can guide new issuers in avoiding common pitfalls and recognizing growth opportunities.

-

Understanding frequent challenges faced by others can help investors make informed decisions and structure better deals.

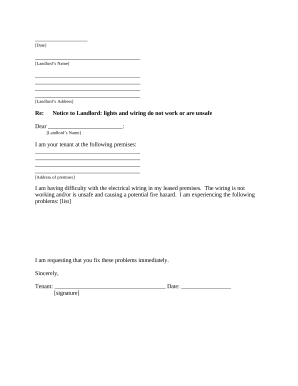

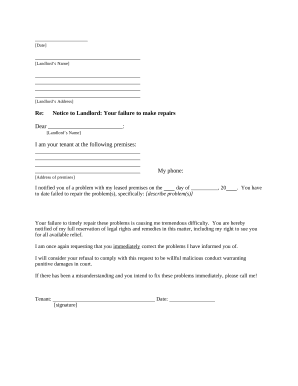

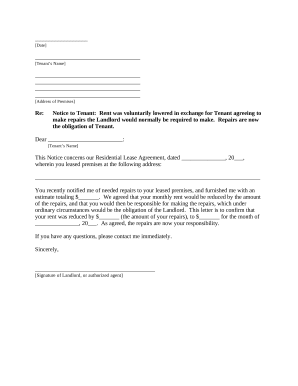

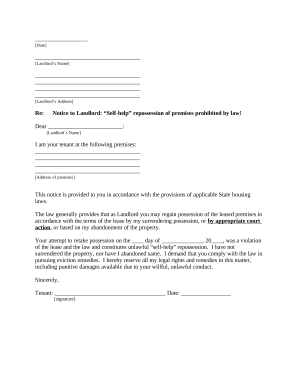

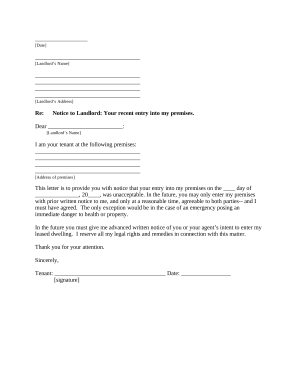

How to fill out the private placement of common

-

1.Open the private placement of common form on pdfFiller.

-

2.Begin by entering the issuing company's legal name in the designated field.

-

3.Fill in the details of the offering, including the number of shares being sold and the price per share.

-

4.Provide information about the investors involved, including their names and contact details.

-

5.Include any applicable financial terms, such as dividends and voting rights associated with the shares.

-

6.Attach any required supporting documents, such as financial statements or business plans, if necessary.

-

7.Review the filled form for accuracy and completeness, ensuring all fields are correctly filled.

-

8.E-sign the document using the provided signature tool on pdfFiller.

-

9.Save the completed document and download it for your records or for distribution to investors.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.