Get the free Restricted Stock Plan of RPM, Inc. template

Show details

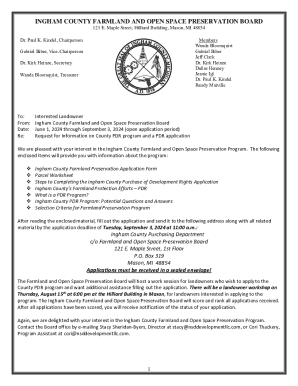

18-200A 18-200A . . . Restricted Stock Plan under which (a) Compensation Committee determines those employees of corporation and subsidiaries who are eligible to receive awards of Restricted Shares,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is restricted stock plan of

A restricted stock plan is a program that allows employees to receive company stock as part of their compensation, subject to certain restrictions.

pdfFiller scores top ratings on review platforms

PDF filler has been a huge help with our secondary paper billing purposes

so far so good

GREAT

Family Tree Project

This is my first experience with an Online system. After overcoming initial issues. I now am very pleased, except you 15 limit on merge. Plus some limitations on writing MS Publisher files.

A very good product, however, I don't have a need for it on an ongoing basis.

Excellent!

Who needs restricted stock plan of?

Explore how professionals across industries use pdfFiller.

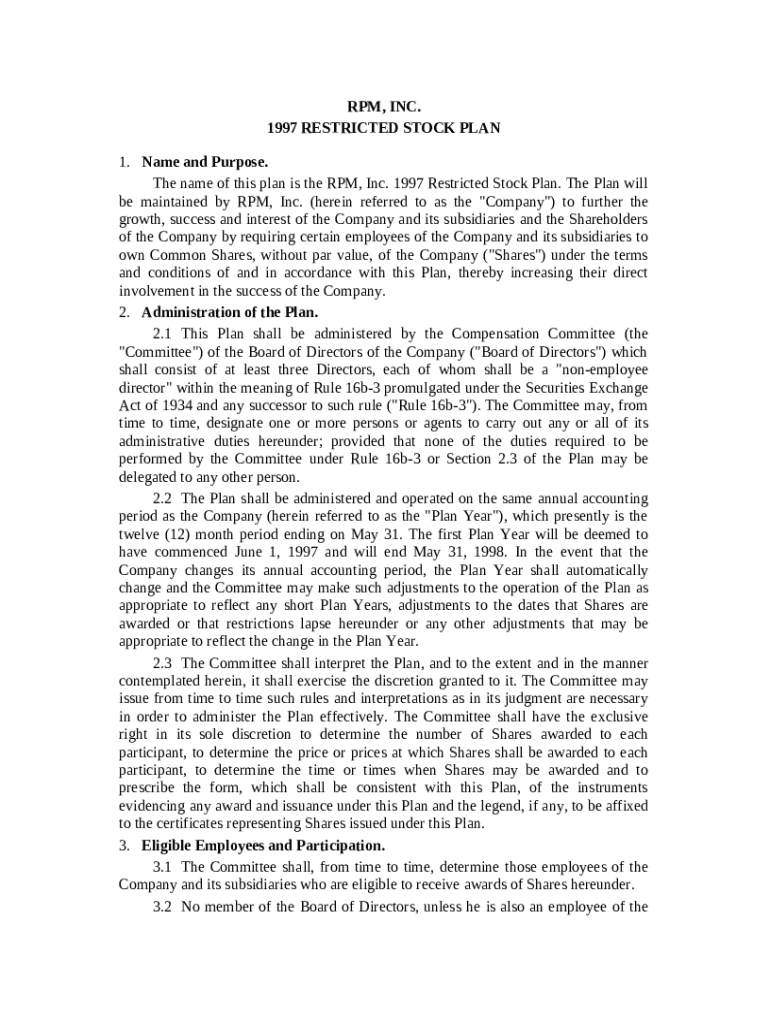

Comprehensive Guide to the Restricted Stock Plan of RPM Inc

How to fill out a restricted stock plan form?

Filling out a restricted stock plan form involves several important steps. First, ensure you have all required personal and employment information at hand. Next, follow the instructions outlined in the form sections, providing accurate details, editing if necessary, and ensuring digital signatures are applied where required for completion.

What is a restricted stock plan?

A restricted stock plan is a type of employee compensation program where shares are granted at no upfront cost, but with certain restrictions. These plans provide significant benefits for employees and companies by enhancing retention and aligning employee interests with the company’s long-term growth. Employees benefit from potential stock value appreciation, while companies can promote loyalty.

-

Employees can gain shared ownership and grow their wealth as the company performs well.

-

Companies can attract and retain top talent, reducing turnover and fostering a motivated workforce.

What are the key components of RPM Inc's restricted stock plan?

The RPM Inc Restricted Stock Plan consists of several key components that define its structure and implementation. The primary purpose is to incentivize employees who meet specific eligibility criteria, ensuring that only those most likely to contribute to the company’s goals can participate.

-

The plan is designed to reward employees by granting them shares as performance incentives.

-

Typically includes requirements such as employment status and tenure with the company.

-

Details on the type of shares granted, focusing on those with no par value, ensuring ease of share transfer and ownership.

How is the administration of the plan structured?

The administration of the RPM Inc Restricted Stock Plan is overseen by a Compensation Committee, which is structured to ensure fair and compliant management of employee stock benefits. The Committee is bound by statutory rules such as Rule 501, which regulates how stock awards are defined and distributed.

-

Comprises members with relevant expertise in compensation and benefits, ensuring ethical handling of stock awards.

-

Must adhere to regulatory requirements during the administration of stock plans, including accurate reporting.

-

The Committee can delegate certain administrative tasks to qualified personnel to streamline the process.

What is the significance of the plan year timing and adjustments?

Understanding the significance of the 'Plan Year' is crucial for both employees and the company. It defines the timeframe for the administration of the plan, including when stock awards are granted and the performance periods evaluated.

-

The 'Plan Year' is the accounting period defined for the restricted stock plan, indicating when performance metrics are assessed.

-

Typically outlined in the plan rules, ensuring employees know when to expect their first allocation.

-

Details how changes in the company's accounting period can lead to modifications in plan timing and assessments.

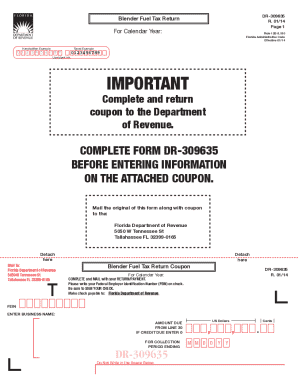

What are the tax implications and compliance considerations?

The tax implications of participating in a restricted stock plan can be significant and vary based on the individual’s situation. IRS rules govern how and when taxes are owed on stock awards, making it vital for employees to stay informed about these aspects.

-

Participants may need to file specific IRS forms to report stock ownership and sales appropriately.

-

Employees must familiarize themselves with IRS guidelines to avoid penalties or misunderstandings about their tax obligations.

-

There may be common compliance challenges, but being proactive can help mitigate these issues.

How can navigate the RPM Inc restricted stock plan form?

Filling out the RPM Inc Restricted Stock Plan form can be simplified with clear guidance. Users can utilize digital tools like pdfFiller for ease of editing, signing, and submission.

-

Follow outlined instructions carefully and ensure all information is accurate to avoid delays.

-

Using tools like pdfFiller helps streamline the process, ensuring that you can fill in, edit, and sign documents digitally.

-

Efficiently manage documents and keep track of stock ownership through dedicated software, enhancing personal record-keeping.

What are the best practices for maximizing value from stock plans?

Maximizing the benefits from a restricted stock plan requires strategic approaches from employees. By understanding key elements, such as vesting periods, participants can make informed decisions regarding their stock options.

-

Establish a clear financial plan that aligns with company performance and personal financial goals.

-

Vesting schedules determine when employees can sell shares; knowing this timeline is crucial for financial planning.

-

Leverage document management features to ensure compliance and quick access to grant documents when making decisions.

How to fill out the restricted stock plan of

-

1.Open the restricted stock plan of document on pdfFiller.

-

2.Review the document to understand the sections that require information.

-

3.Fill out the basic information section, including the name of the company and date.

-

4.Enter details about the stock grant, including the number of shares and value per share.

-

5.Provide the recipient's information, including their name and position in the company.

-

6.Indicate the vesting schedule, stating how long the employee must remain with the company before receiving the stock.

-

7.Complete any additional sections that may require signatures from management or HR.

-

8.Review the filled document for completeness and accuracy.

-

9.Save the completed document and share it with all relevant parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.