Get the free of Mortgage Deed of Trust and Variations template

Show details

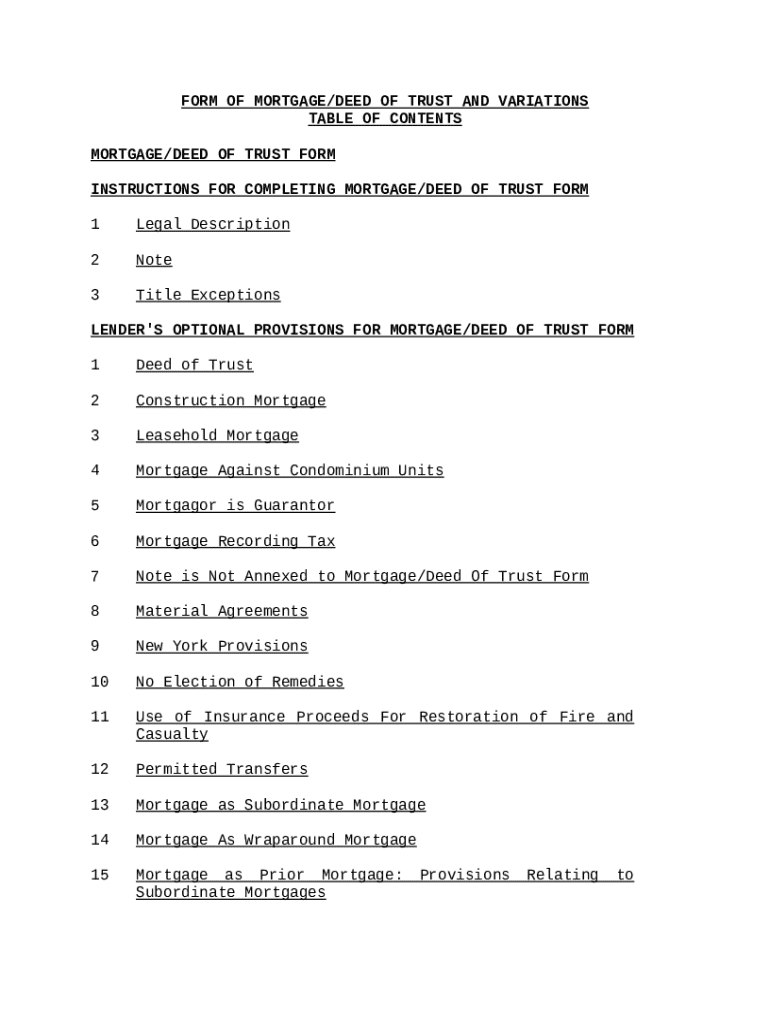

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is form of mortgage deed

A form of mortgage deed is a legal document that secures a loan on real property and outlines the terms of the mortgage agreement.

pdfFiller scores top ratings on review platforms

Great program - only difficulty I had was resizing signature.

Awesome! Very easy to use and navigate. Kudos to whomever developed this program!

Great. Just improve on the interrupting loading feature in the middle of completing a form.

As a person with very sloppy handwriting I love that PDFfiller allows me to fill out PDF files electronically!

No problems except not being able to zoom in and move page around for my poor vision

sent by sms, client went to link and couldn't sign they had to email it to themselves to sign. this is a waste of time

Who needs of mortgage deed of?

Explore how professionals across industries use pdfFiller.

Form of mortgage deed form guide

How does a mortgage deed work?

A mortgage deed is a legal document that secures a loan by pledging real estate as collateral. Its primary purpose is to outline the terms of a mortgage agreement and establish the lender's rights over the property. The importance of a mortgage deed cannot be overstated in real estate transactions, as it serves as a formal acknowledgment of the borrower's obligation to repay the loan.

When should use a mortgage deed?

-

When buying a new home, a mortgage deed is essential for securing the loan needed to complete the purchase.

-

If you refinance your existing loan, a new mortgage deed is often required to reflect the updated loan terms.

-

In cases where a property has already been mortgaged, a mortgage deed will need to be established for any additional borrowing.

What should include in a mortgage deed?

-

The names and addresses of both parties involved must be included to identify who is borrowing and lending.

-

A clear and concise legal description of the property being mortgaged is crucial for identifying the asset.

-

Include all pertinent details such as the loan amount, interest rate, and repayment schedule.

How do fill out a mortgage deed?

Filling out a mortgage deed requires careful attention to detail. Start with the borrower and lender's information, followed by a comprehensive property description. Next, clearly specify the loan details, paying special attention to any optional provisions you wish to include, such as late fees. Using tools like pdfFiller can greatly streamline this process by offering templates and interactive editing features.

-

Ensure everything is accurate and complete to prevent legal issues down the line.

-

Double-check names, amounts, and dates to avoid errors that could affect the validity of the deed.

What optional provisions can include?

Optional provisions in a mortgage deed can vary based on the lender's policies and the borrower's needs. These might include clauses for late charges, prepayment penalties, or cross-default provisions. Tailoring these provisions effectively can help you gain additional security or flexibility in your loan arrangement.

-

Stipulating fees for late payments can encourage timely repayments from the borrower.

-

This clause ensures that if the borrower defaults on other obligations, it can lead to a default on the mortgage as well.

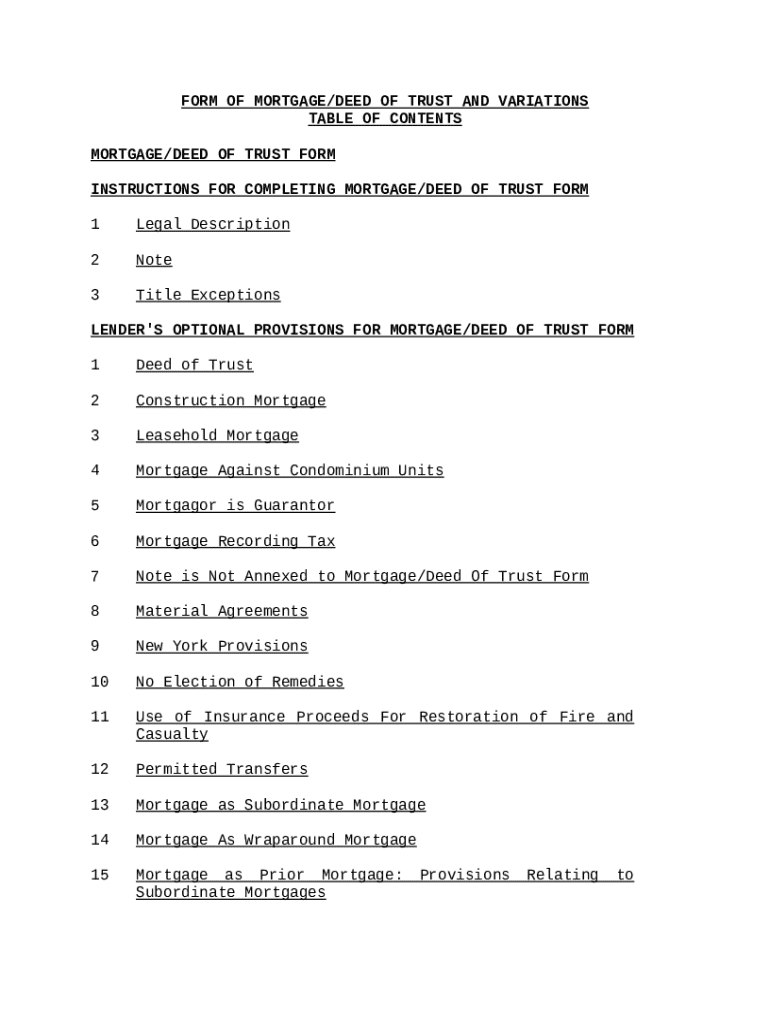

What are the variations of mortgage deeds?

-

Designed for properties that are yet to be built, these mortgages often have different structures and payment schedules.

-

These allow a new mortgage to encompass an existing mortgage, offering new financing options.

-

This type of mortgage is secondary to the primary mortgage, often with different terms and conditions.

What legal implications should be aware of?

Legal implications of a mortgage deed can significantly impact ownership rights. It’s important to understand regional compliance requirements and how they might differ. Additionally, being mindful of legal topics like judgment and fiduciary responsibilities can protect both parties.

-

The mortgage deed dictates what happens to ownership in the event of borrower default.

-

Ensure that your mortgage deed adheres to local laws to avoid disputes and legal issues.

What happens after mortgage payment and release?

Upon full repayment of a loan, the mortgage deed must be officially released to reflect that the debt has been settled. A structured payoff statement is critical in this process, confirming the total amount paid. Failure to comply with release processes can lead to complications, making it necessary to follow proper steps.

-

Ensure that proper documentation is recorded to prevent claims from lingering after the loan is settled.

-

Failure to secure a release can result in ongoing financial obligations or disputes about property ownership.

How can pdfFiller help with mortgage deeds?

pdfFiller makes it easy to edit, sign, and manage mortgage deeds seamlessly through its cloud-based platform. Users can access interactive tools for customizing mortgage deeds, ensuring that all forms are tailored to meet individual needs. Collaborative features also allow teams to review and finalize documents promptly, enhancing efficiency throughout the mortgage process.

How to fill out the of mortgage deed of

-

1.Access pdfFiller and log in to your account or create a new one.

-

2.Locate the 'form of mortgage deed' template in the library or upload your own document.

-

3.Begin by filling in the borrower's full name and contact information at the top of the form.

-

4.Next, enter the lender's name and address in the designated fields.

-

5.Provide the property details, including the address and legal description, ensuring accuracy.

-

6.Specify the loan amount and interest rate clearly in the respective sections.

-

7.Review any special provisions or clauses that might be included in the deed, adjusting as necessary.

-

8.Complete any required fields regarding the term of the mortgage and repayment schedule.

-

9.Read through the form to confirm all information is correct and complete.

-

10.Once satisfied, save your changes and download or print the completed mortgage deed for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.