Get the free Credit Letter to Close Account template

Show details

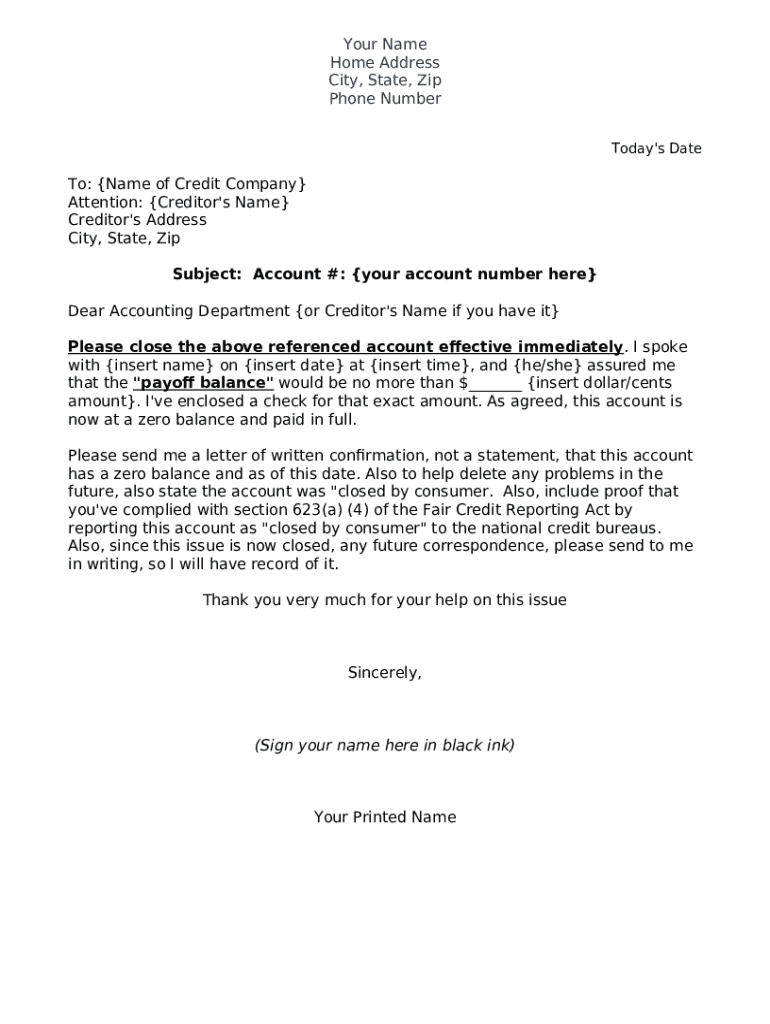

Credit Letter to Close Account

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is credit letter to close

A credit letter to close is a formal document indicating the finalization of credit terms for a borrower, confirming that they have satisfied all requirements to close a transaction.

pdfFiller scores top ratings on review platforms

I had trouble logging in to my account

I had trouble logging in to my account. It was a small issue but I sent a text message and got a reply soon after. The Customer Service at pdffiller is very responsive. I have been a customer (for creating insurance forms for my medical practice) for three years and it is an excellent service. It is user-friendly and intuitive and simple to use. I highly recommend pdffiller.

Things were easy

SO EASY TO USE pdfFiller ROCKS!

I really like pdfFiller. It is super easy to use and 9 out of 10 times has every feature I need. I would recommend it to anyone that needs a quick edit of a document.

easy to use

easy to use didnt have any issues at all using this site

very helpful

Great!!

Great! Love the expirience!

Who needs credit letter to close?

Explore how professionals across industries use pdfFiller.

Guide to Creating a Credit Letter to Close a Form

How to write a credit letter to close an account?

Writing a credit letter to close a form requires a clear understanding of why you're closing the account and what elements need to be included. This guide will assist you in crafting a formal closure letter that meets your needs.

-

Be clear about your motives such as minimizing your debt risk or improving your credit score.

-

Creditors have specific legal responsibilities when you close an account.

-

Obtain a written statement from your creditor to confirm closure.

What are the essential components of a credit closure letter?

A clearly structured credit closure letter includes specific components vital for identification and processing. Each piece holds importance for ensuring your request is handled promptly.

-

Including the correct date is crucial for your records.

-

You must specify the exact credit company and direct it to the appropriate department.

-

Make sure to provide your account number for easy reference.

How do you write the body of the credit closure letter?

A well-composed letter effectively communicates your intent for closure. It’s important to maintain a formal tone and structure as you make your request.

-

Choose between a generic greeting or one that addresses a specific person.

-

Use concise language to state your request plainly.

-

If applicable, mention any previous dialogue with a specific employee to aid in processing.

-

Ask for a formal closure confirmation to ensure your request has been processed.

What specific language should you include in your letter?

The language you use within your letter can determine how effectively your request is executed. Here are a few recommendations for phrasing.

-

Employ standard phrases that clearly request account closure.

-

If applicable, specify the agreed-upon balance and attach your payment.

-

Request compliance proof related to the Fair Credit Reporting Act.

How can pdfFiller help you create your credit closure letter?

Using pdfFiller can significantly simplify the process of creating your credit closure letter. With its range of tools, you have the flexibility to personalize your documents with ease.

-

Easily navigate to edit your templates on pdfFiller.

-

This allows for quick signing and enhances collaboration on documents.

-

Once completed, save your letter and share it directly through the platform.

What are the best practices for sending your credit closure letter?

Choosing how you send your closure letter can affect the overall efficiency of your process. Below are some best practices to consider.

-

Evaluate the pros and cons of each method for your situation.

-

Ensure that your creditor acknowledges receipt of your letter.

-

Maintain copies of all correspondence for future reference.

What steps should you take after submitting the closure letter?

Monitoring your closure request is crucial, especially after submission. It ensures that you don’t overlook any crucial responses.

-

Know the timeline for potential replies from your creditor.

-

Have a plan of action in case the creditor does not reply.

-

If issues arise, know how to contact credit reporting agencies.

What additional tips should you consider?

It's essential to consider potential pitfalls when closing a credit account. Apply these strategies to avoid common mistakes.

-

Check your letter for errors before sending it.

-

Be aware how closing accounts can affect your credit score.

-

Utilize available resources for any questions regarding closure.

How to fill out the credit letter to close

-

1.Open the credit letter template on pdfFiller.

-

2.Begin by entering the date at the top of the letter.

-

3.Fill in the borrower's full name and address in the designated fields.

-

4.Add the lender's name and contact information next in the corresponding section.

-

5.Clearly state the amount of credit being extended in the body of the letter.

-

6.Include specific details regarding the terms of the credit, such as interest rates and repayment schedule.

-

7.Review the entire document for completeness and accuracy, making any necessary adjustments.

-

8.Once all information is entered, save your work in the appropriate format.

-

9.If required, print the letter and obtain necessary signatures.

-

10.Finally, submit the completed letter according to your transaction guidelines.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.