Get the free Authorization to purchase corporation's outstanding common stock template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is authorization to purchase corporations

An authorization to purchase corporations is a legal document that grants an individual or entity the power to execute a purchase transaction involving a corporation.

pdfFiller scores top ratings on review platforms

Only place I could find and easily fill out forms thanks

I needed this program so badly for medicare billing!

An amazing tool that is a must have for any business owner.

Overall, the experience was good. The program provided was interactive and fairly easy.

Good, solid product - works as advertised

It sure makes it easier to fill out complex forms

Who needs authorization to purchase corporations?

Explore how professionals across industries use pdfFiller.

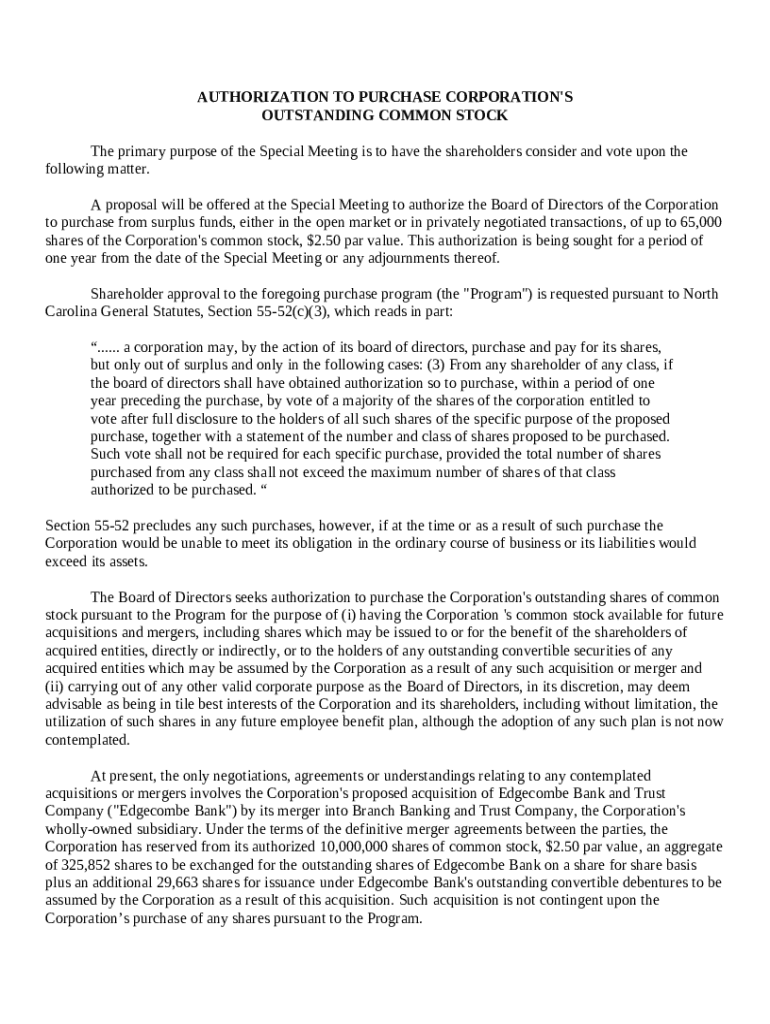

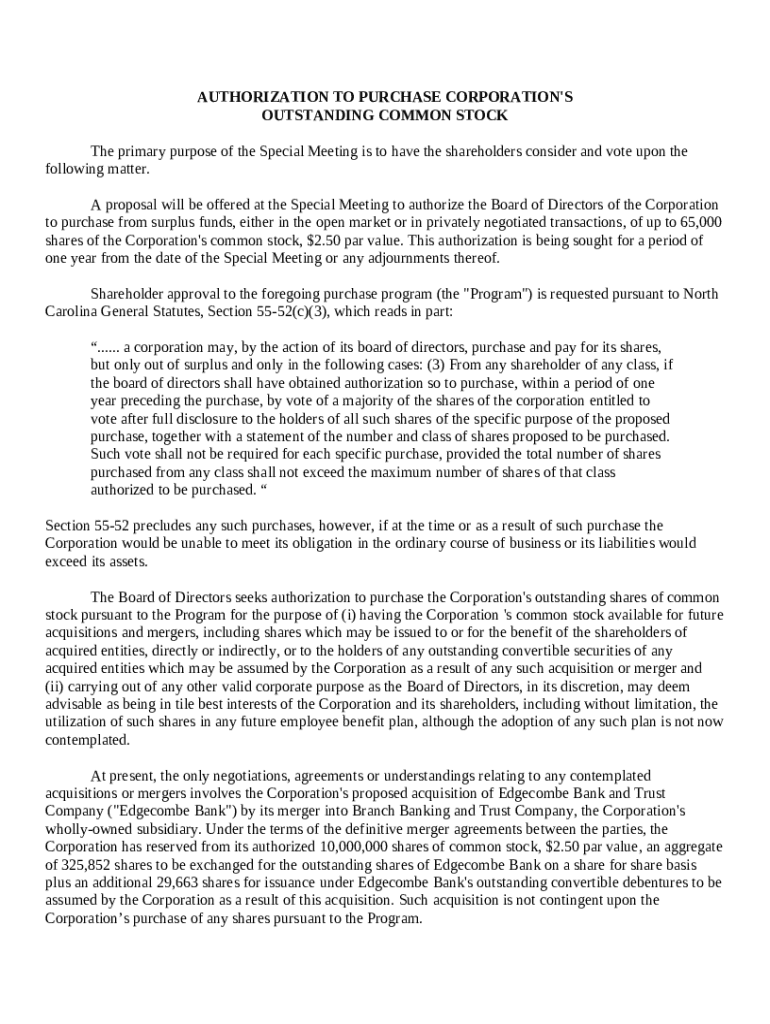

Comprehensive Guide to Authorization to Purchase Corporation's Outstanding Common Stock

To complete an authorization to purchase corporations form, ensure that all necessary approvals and compliance steps are followed meticulously. This process is crucial for any corporation considering stock repurchases to maintain legal governance and shareholder transparency.

What is shareholder authorization, and why is it important?

Shareholder authorization refers to the process by which shareholders grant approval for certain corporate actions, such as purchasing outstanding common stock. This is significant in corporate governance as it ensures that shareholders have a voice in critical decisions that affect the company’s financial health and direction.

-

It is a formal process where shareholders vote to approve executive decisions, which may include stock repurchases.

-

In North Carolina, specific statutes govern the requirements for obtaining such approvals, ensuring legal compliance.

-

Without shareholder approval, companies may face legal challenges or operational restrictions if they proceed with stock purchases.

Why convene a Special Meeting?

Convening a Special Meeting is essential to discuss stock purchase decisions transparently. This provides a structured forum for shareholders to consider the implications and provide input on the proposal.

-

The meeting allows shareholders to discuss the reasons for the stock purchase and its potential impact on the company’s future.

-

It’s essential to assess the company’s financial position, market conditions, and shareholder sentiments before proceeding.

-

Consider utilizing surplus funds to purchase shares as a strategy to bolster stock price or enhance shareholder value.

What details should be included in the proposed purchase program?

A clearly outlined purchase program is fundamental for effective shareholder engagement and decision-making. This serves as the foundation for negotiations and approvals.

-

Detail the number and class of shares proposed for purchase to provide clarity to shareholders.

-

Set a time frame for the authorization period, typically one year, to outline validity and expectations.

-

Understand the maximum number of shares that can be purchased from each class, informing financial planning.

What role does the Board of Directors play?

The Board of Directors has a pivotal role in initiating purchase proposals and ensuring they align with the company’s strategic goals. Their involvement also ensures that the process adheres to legal standards.

-

The Board must analyze, recommend, and communicate stock purchase proposals effectively to shareholders.

-

It is critical for the Board to establish a clear procedure for obtaining and documenting shareholder votes to ensure transparency.

-

Transparency is key; full disclosure during the voting process helps build trust with shareholders.

What are the legal compliance and restrictions?

Understanding the legal landscape is essential prior to stock purchases. Companies must navigate through statutes to avoid potential legal pitfalls.

-

Section - c outlines specific regulations and compliance measures regarding stock purchases that corporations must follow.

-

There are situations where stock purchases may be restricted, and companies need to be aware of these to plan accordingly.

-

A company's financial health must be assessed to make informed decisions about proceeding with stock purchases.

How to fill out the authorization form?

Filling out the authorization form accurately is crucial for legal compliance. Utilize resources and tools effectively to ensure submission is seamless.

-

Detailed guidance on completing the authorization form can help streamline the process.

-

Double-check all entries for correctness to avoid any delays or complications in processing.

-

Employ pdfFiller’s features for easy editing and electronic signing to simplify document management.

How to collaborate with stakeholders effectively?

Effective collaboration is key to securing shareholder buy-in for stock purchase proposals. Engaging stakeholders can lead to enhanced trust and smoother execution.

-

It is vital to provide shareholders with comprehensive and accessible information ahead of the Special Meeting.

-

pdfFiller’s document management tools facilitate collaborative efforts, ensuring all parties stay informed.

-

Keep all stakeholders updated on the proposal, focusing on its potential implications and benefits.

What steps should be taken post-meeting?

Following shareholder approval, it is crucial to have structured next steps to ensure execution aligns with corporate governance standards.

-

Outline clear actions and timelines for executing the stock purchase as approved by shareholders.

-

Establish a system for tracking and reporting the results of the stock purchase proposal to shareholders.

-

Maintain compliance with governance standards, ensuring that future stock purchases adhere to established protocols.

How to fill out the authorization to purchase corporations

-

1.Begin by accessing the authorization form on pdfFiller.

-

2.Ensure that you have the necessary information about the corporation being purchased, including its legal name and registration details.

-

3.Fill out the section indicating the purchaser's details, such as name, address, and contact information.

-

4.Provide the reason for the purchase in the designated area, such as investment or acquisition.

-

5.Include the terms of the purchase, including payment method and timelines, to clarify the agreement.

-

6.If applicable, add any specific conditions or contingencies associated with the purchase.

-

7.Double-check all entered information for accuracy and completeness to avoid issues during processing.

-

8.Sign the document to affirm your authorization and ensure you have the legal right to execute the purchase.

-

9.Submit the completed form electronically through pdfFiller or print it out to send via traditional mail, depending on your preference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.